$28.9M Chainlink Whale Dump Sparks Market Panic: LINK Battles to Hold $17

0

0

A major crypto whale has sparked renewed volatility in the Chainlink market. The investor offloaded 1.62 million LINK tokens worth about $28.9 million.

The widespread sell-off infused intense selling pressure on the Chainlink price, worsening its battle in an already sluggish crypto market. The knock on lent greater weakness, leaving LINK ’s recovery problem unresolved as bearish sentiment tightened across exchanges.

Market Weakness Deepens as Chainlink Price Faces Fresh Sell Pressure

The sale was at a delicate time for cryptocurrencies. Bitcoin and Ethereum were low in momentum, while altcoins were weak. According to CoinMarketCap, the Chainlink price fell 2.01% over the past week to $17.61. Trading volume decreased by 27.11 % to $864.98 million, which indicated a speculative rush toward the short term.

Also Read: Can Chainlink Overcome Its $23 Ceiling? Analysts Predict $27 Next

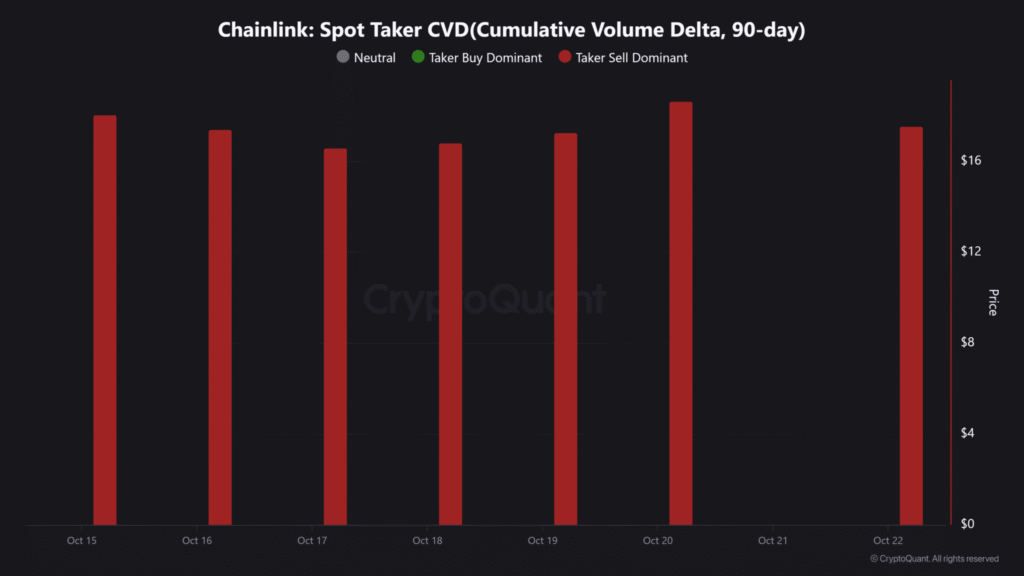

CryptoQuant data showed a bearish signal. The Spot Taker Cumulative Volume Delta (CVD) stayed negative from October 15 to 22. This means sellers were more aggressive than buyers all week. Red bars dominated the chart, proving that selling pressure remained heavy.

Chainlink Price Struggles to Regain Bullish Momentum

The Chainlink price has been under stress for weeks. LINK has failed to break the $20 mark despite several recovery attempts. Analysts say that the token needs strong buying momentum to shift sentiment. For now, LINK remains trapped between tight resistance and fragile support.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| October | $17.04 | $17.27 | $17.50 |

0.63%

|

| November | $19.06 | $19 | $18.93 |

8.9%

|

| December | $19.80 | $20.69 | $21.57 |

24%

|

LINK formed its second consecutive red daily candle and hovered near $16.50 support. It stayed below the 200-day exponential moving average (EMA) at $18.97. This technical setup shows a cautious market. The trend points down unless new buyers step in soon.

LINK Faces Critical Support as Downside Risks Intensify

Indicators in the market are pointing to the same weakness. The Average True Range (ATR) for Workhorse Group Inc. is set at 3.27, with the Price to Sales ratio for WKHS stock in the period of the last 12 months amounting to 1056.75. This is what we call very strong momentum – and for the bears, analysts anticipate a swift move to $15.50 if the Chainlink price drops below $17.

Conversely, a sustained move above $16.40 may create a short-term bounce. LINK by 23 % to the upside – toward $21.50, in case of successful defense of this zone. But if support doesn’t hold, the price may see a drop of 45 % toward $8.70. If that were to happen, it would be a repeat of previous breakdowns.

Whale Activity and Market Sentiment

Large holders often control LINK’s short-term direction. When whales sell in bulk, prices tend to slip quickly. The latest dump sent a warning signal across trading communities. Many fear that the whale move could trigger panic selling among retail investors.

The market sentiment remains cautious. Traders are not confident enough to push prices higher. Many now view every bounce as a chance to sell rather than a reason to buy. This pattern keeps the Chainlink price trapped in a bearish zone.

Derivatives and Exchange Data

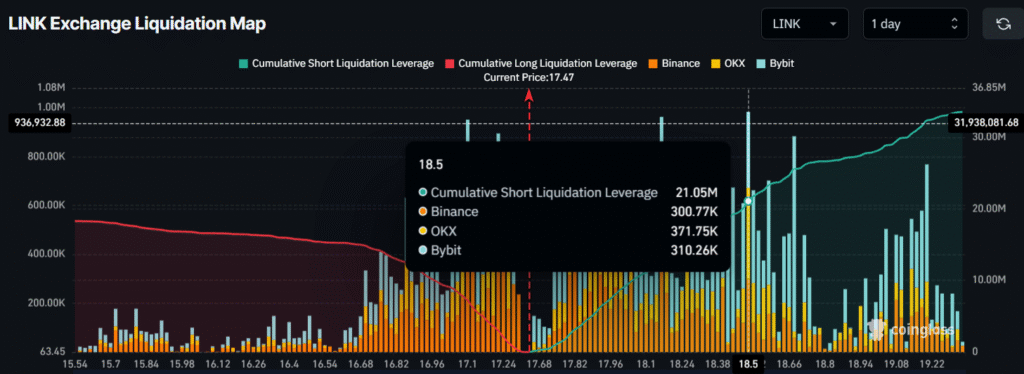

CoinGlass data highlights growing short interest. Around $18.50, short positions reached $21.05 million. Long positions near $17.10 totaled only $7.19 million. This imbalance shows that most traders expect further downside.

Exchanges like Binance, OKX, and Bybit reported high leverage on short trades. The heavy shorting activity suggests that the Chainlink price could stay below $18.50. Bulls need a clear breakout above that level to change the current outlook.

Broader Market Influence

The price of Chainlink does not move in isolation. Its direction tends to follow that of the wider crypto market. LINK usually tends to follow when Bitcoin is strong. When Bitcoin gets stuck, altcoin cryptos drop even more.

Macroeconomic news has an effect, too. Sentiment in crypto can change quickly, based on interest-rate expectations and regulatory headlines. Chainlink could profit if risk appetite returns to the markets. Alternatively, traders could stick with the safe-havens of relatively stable altcoins such as LINK.

Analysts Maintain Cautious Optimism for Chainlink Price Recovery

Analysts from The Birb Nest noted that LINK still looks “solid” after its recent recovery. But they warned that resistance at $20 remains the key barrier. For a real breakout, LINK must stay above $17 and close daily candles in green. Only then could it retest $22.70 and $26.

Analysts agree that the Chainlink price will stay range-bound unless whales stop selling. Sustained accumulation by long-term investors is crucial for any lasting recovery.

Conclusion

ChainLink price is at what can be best described as a make-or-break moment. A $28.9M whale sell-off adds bearish pressure. Technicals, on-chain data and derivatives all suggest traders are being cautious. LINK needs to sustain above $17 to avert further losses.

If buyers retake control of the $20 region, optimism could come back. Until then, traders remain wary. The following few sessions would set the tone for whether Chainlink breaks lower or rebounds.

Also Read: Chainlink (LINK) Price Prediction 2025: Whale Activity Signals $27 Breakout Ahead

Appendix: Glossary of Key Terms

Whale – A crypto investor or entity holding a large quantity of a token, capable of influencing market trends through sizable trades.

Support Level – A key price area where strong buying interest prevents further declines in an asset’s value.

Resistance Level – A price zone where selling pressure typically outweighs buying demand, often halting upward momentum.

Exponential Moving Average (EMA) – A technical indicator that tracks price trends by giving greater weight to recent data points.

Average Directional Index (ADX) – A tool that measures the strength of a market trend; readings above 25 indicate strong momentum.

Spot Taker Cumulative Volume Delta (CVD) – An on-chain metric showing the difference between market buy and sell volumes to reveal trader sentiment.

Short Position – A trading strategy where investors profit when an asset’s price declines, often used in bearish conditions.

Frequently Asked Questions Chainlink Price

1- Why did the Chainlink price drop?

A whale sold 1.62 million LINK, worth $28.9 million, adding strong selling pressure.

2- What are the key support levels?

Immediate support is at $16.50 and $15.50 if that fails.

3- What resistance levels should traders watch?

The $18.97 EMA and $20 mark are the main resistance zones for the Chainlink price.

4- Could the Chainlink price rebound soon?

A rebound is possible if LINK holds $17 and breaks above $20.

Read More: $28.9M Chainlink Whale Dump Sparks Market Panic: LINK Battles to Hold $17">$28.9M Chainlink Whale Dump Sparks Market Panic: LINK Battles to Hold $17

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.