Dogecoin Price Surges Past $0.17 as Triple Bottom Pattern Signals 130% Upside Potential

0

0

Dogecoin DOGE $0.18 24h volatility: 6.4% Market cap: $27.29 B Vol. 24h: $1.82 B traded at $0.1758 on Tuesday, July 9, consolidating above the $0.17 psychological resistance for a second session. This technical breakout comes after nearly two months of consolidation between $0.13 and $0.16.

Dogecoin price forecast | Source: TradingView

The daily DOGEUSDT chart outlines a Triple Bottom pattern, with recent lows registered in March, April, and June, establishing strong support between $0.13 to $0.15. The neckline resistance is positioned around $0.20, with a potential for a 130% rally if the $0.40 breakout target is validated.

The Relative Strength Index (RSI) sits at 53.43, indicating more room for upside before overbought conditions. More so, the widening Bollinger Bands signal increased volatility with DOGE price pressing against the upper limit at $0.176.

$130 Million Surge in DOGE Open Interest Confirms Bullish Reversal

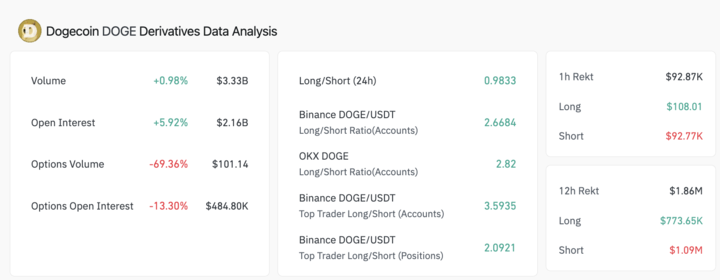

Recent Derivatives trading metrics further validate the bullish momentum behind Dogecoin price action. On July 9, Coinglass data shows that Dogecoin Open interest surged by 5.92% to $2.16 billion, reflecting approximately $130 million in fresh capital inflows within the last 24 hours.

This rapid capital inflow was accompanied by a rise in trading volume, which climbed to $3.33 billion, emphasizing the bullish rebound narrative.

Dogecoin Derivatives Market Data | Source: Coinglass

More so, Dogecoin Long/short ratios across major exchanges further reinforce the bullish narrative. On Binance, the ratio of long to short positions among accounts stands at 2.7, while OKX shows an even stronger bias with a ratio of 2.8.

Among top traders on Binance, the long/short ratio based on accounts has reached 3.6, and by open positions, it sits at 2.11. These figures reveal that both retail and high-volume traders are clearly leaning long, favoring another DOGE price leg-up in the coming sessions.

If Dogecoin can sustain a daily close above $0.18, bullish traders will likely attempt to reclaim the $0.20 neckline.

Conversely, failure to hold $0.17 support may drag prices back to the Bollinger midline near $0.164 or even lower, toward the $0.15 pivot.

BTC Bull Token Set to Ride the Meme Wave Alongside Dogecoin

As Dogecoin regains momentum, meme coin enthusiasts are also eyeing $BTCBULL, the leading presale token tied to Bitcoin performance.

BTC Bull Token allows holders to earn passive Bitcoin rewards as BTC advances toward $1 million, a narrative already attracting investor interest.

With $8.4 million USDT raised and tokens now live for claiming and staking, BTCBULL is well-positioned to benefit from the current bull cycle.

The post Dogecoin Price Surges Past $0.17 as Triple Bottom Pattern Signals 130% Upside Potential appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.