Why Bitcoin As A Non-Correlated Asset Could Gain More Institutional Appeal

1

0

Bitcoin performance over the last few months has revealed a lot of noteworthy observations. Among them include the fact that there were instances where it seemed to lose its correlation with the S&P500.

For context, Bitcoin demonstrated significant correlation with the U.S stock market over the last few years. As a result, investors have been using economic data influencing stocks to make BTC-related moves.

This year Bitcoin lost its correlation with the S&P500 on multiple occasions. For example, Bitcoin demonstrated some resilience against the downside at times when stocks were crashing hard.

The main reason for those observations was largely the fact that most stocks were exposed to tariffs and their impact. Meanwhile, Bitcoin did not have a direct impact apart from shifts in market sentiment.

What Happens When Bitcoin Fully Detaches from the S&P 500?

Interestingly, Bitcoin did appear to regain its correlation with the S&P500 after the recent cool-down in tariff-related disruption. This observation allowed analysts to conclude that exposure to political-economic influences was the common denominator.

The discovery also raised more questions especially in terms of Bitcoin potentially becoming a non-correlated asset. Investors have been hoping for such an asset because it makes it easier to balance their portfolios.

A non-correlated classification for Bitcoin would be quite attractive. But what would that really mean for the market and for BTC itself? Negative influences that cause the stock market to crash would potentially lead to heavy liquidity flowing into BTC.

Such an outcome could potentially make it even more attractive to institutional investors. An outcome that may already be in play.

Data Signals Healthy Whales Demand

We recently observed healthy whale and institutional activity, which aligned with the recent demand. According to Santiment data on address categories in the 10 to 10,000 BTC range have been demonstrating resilience even during the bearish conditions.

The category highlights the sharks and whales in the BTC market. According to the data, retail holders experienced relatively more outflows compared to whales and sharks. A sign that the retail account holders with fewer BTC have been losing confidence.

According to the findings, whales and sharks have been demonstrating more confidence especially in the last 2 weeks compared to small holders. It was also in line with the recent recovery in institutional demand through ETFs.

In addition, the recent discounted prices paved the way for BTC to transfer from weak hands, to strong hands. A scenario that was akin to a shakedown as has been observed in past scenarios underpinned by uncertainty extremely volatile conditions.

Bitcoin Adoption Continues to Proliferate

Some interesting Bitcoin developments that highlight its adoption have recently been taking place. One of the most notable developments include Bhutan’s latest move aimed at attracting Bitcoin tourists.

Bhutan has reportedly collaborated with Binance Pay to create a system that will allow tourists to pay for services in the country using Bitcoin. This includes buying flight tickets, accommodation and even paying for food.

Bhutan has previously demonstrated interest in the cryptocurrency and was ranked among the top 5 in terms of BTC holdings by governments in April. The Bhutan government held over 8,500 BTC.

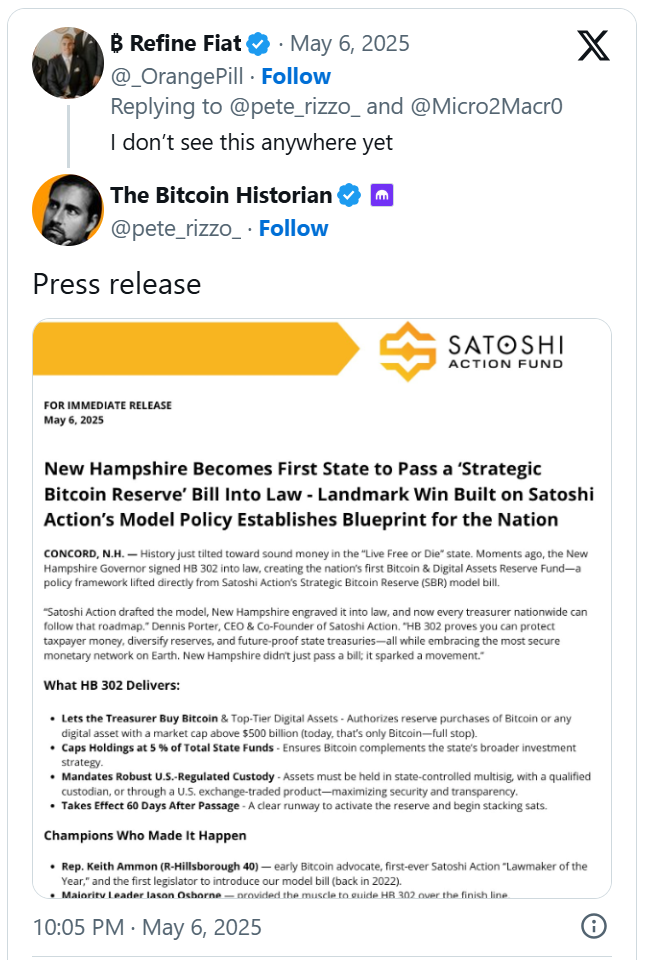

Allowing Bitcoin payments from tourism will allow Bhutan to grow its holdings. Back in the West, New Hampshire has reportedly become the first U.S state to create an official Bitcoin reserve after signing the HB 302 bill into law.

Numerous other states are expected to make such announcements further down the road. This means the states that adopt Bitcoin reserves could contribute significantly to demand for the cryptocurrency.

The post Why Bitcoin As A Non-Correlated Asset Could Gain More Institutional Appeal appeared first on The Coin Republic.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.