Tron Holders Cash Out 374% Gains: What is Behind the TRX Spike

0

0

Tron price has also recently marked an unexpected turn in the crypto scene. Whereas most leading coins, such as Bitcoin and Ethereum, are on a rollercoaster ride, TRX has been going up steadily.

This is backed by strong trading volumes, on-chain metrics, and growth in stablecoin activity, particularly with Tether (USDT).

Long-Term Holders Will Cash Out Big

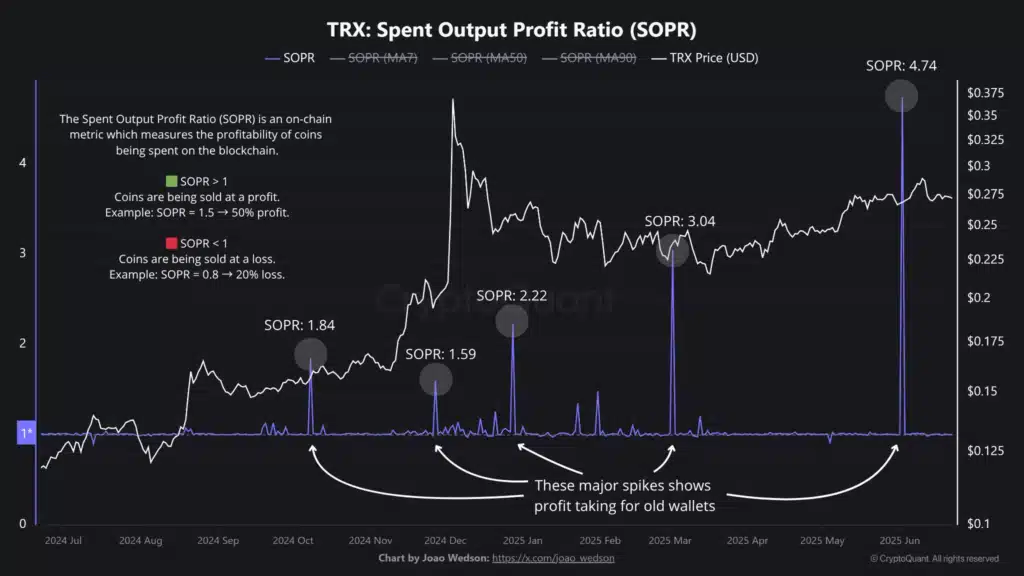

One such key indicator was provided by a measure known as SOPR (Spent Output Profit Ratio), which indicates whether individuals are selling at a profit or loss. A recent rally in TRX’s SOPR to 4.74 indicated that most long-term investors were finally selling their tokens at around 374% profit.

Data indicates that the average price at which these tokens were purchased was approximately $0.0566, whereas the price at which they sold reached $0.268. This action is considered a milestone; it typically indicates that old owners think it’s time to get out.

Interestingly, this was not the only large activity. Large TRX transactions, referred to as whale movement (more than $100,000), also increased. On one day alone, more than $599 million in Tron price moved. This jump of nearly 973% in whale trades shows that institutional players or big investors are either entering or repositioning themselves.

What’s notable is that this happened even as over $343 million was liquidated across the rest of the crypto market, showing just how strong tron price remained during that time.

Tether on Tron: A Great Network Activity

Another significant contributor to Tron price resilience is its leadership in the stablecoin market. Tether (USDT), the largest stablecoin, presently has more than 50% of the total $156.1 billion supply on the Tron blockchain.

This repeated usage brings in demand and confidence into the network. When individuals utilize stablecoins for exchanges, payments, or as a store of value, it increases activity on the chain and subsequently backs TRX’s purpose and price.

Although one might assume that all this profit-taking was in anticipation of cashing out, there are internal moves or long-term holders restructuring their portfolios that might be involved. But the usual activation of these older wallets is typically indicative of a change in the market cycle.

What to Watch Next for Tron price?

Technically, analysts have seen a “cup and handle” pattern emerging one of the most famous signals that more upside may be in the works. If Tron price crosses above $0.2958, it might move up towards $0.45, a 60% increase from here.

Another interesting tidbit is that almost 98% of all holders of TRX are in profit at present. That’s good for market sentiment but can also result in additional selling if those holders opt to lock in their profits.

In general, Tron’s uptrend is backed by savvy profit-taking, rising whale participation, and heavy use of USDT on its network. Although the market appears bullish, one must monitor whale actions, SOPR directions, and stablecoin flows to determine if this trend is sustainable.

Summary

Tron price is coming back strongly, with long-term holders selling up to 374% profits, evidenced in SOPR data. Institutional investors transferred $599M in a day of TRX. More than 50% of all USDT now runs on the Tron network, complementing its normal usage. Whereas technical charts indicate a potential increase to $0.45, the high returns might cause some owners to sell. Whale activity and stablecoin action are still worth monitoring.

FAQs

- Why did Tron (TRX) suddenly increase in price?

A combination of long-term holders of Tron taking profits, more whale transactions, and rising adoption of USDT stablecoins on the Tron blockchain led to the increase in price for Tron. All of these collectively improved demand and interest in TRX. - What does a SOPR value of 4.74 imply for Tron?

A SOPR of 4.74 indicates that on average, investors liquidated their TRX tokens for 374% higher than their original cost. This is reflective of significant profit-taking within the market. - What effect is USDT on Tron having on price?

Over 50% of all USDT (Tether) operates on the Tron network currently. Such heavy usage promotes transaction volumes and utility for the TRX token, which justifies its price strength.

Glossary

- SOPR (Spent Output Profit Ratio)

An on-chain measurement to determine whether investors are selling their tokens at a profit or loss. Above 1 indicates profits, while below 1 indicates losses. - Whale Activity

Large crypto transactions are typically perpetrated by investors or institutions controlling considerable sums. In Tron’s instance, \$599 million in TRX transferred in one day, a big player indicator. - Stablecoins

Cryptocurrencies tied to stable assets such as the U.S. Dollar. Tether (USDT) is among the most widely used, and its application on Tron boosts the blockchain’s transaction value and significance.

Sources

Read More: Tron Holders Cash Out 374% Gains: What is Behind the TRX Spike">Tron Holders Cash Out 374% Gains: What is Behind the TRX Spike

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.