December Rate Cut: Fed’s Bold Move to Protect Jobs Over Inflation Fears

0

0

BitcoinWorld

December Rate Cut: Fed’s Bold Move to Protect Jobs Over Inflation Fears

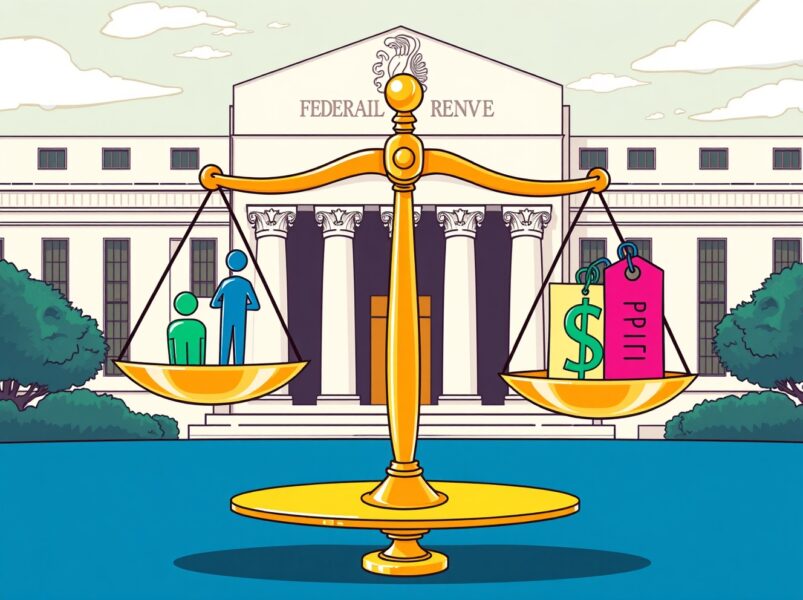

In a significant development that could reshape economic policy, Federal Reserve President Mary Daly has thrown her support behind a December rate cut, signaling a pivotal shift in the central bank’s approach to managing the US economy. This potential move comes as policymakers weigh competing risks in an uncertain economic landscape.

Why Does the December Rate Cut Matter?

San Francisco Federal Reserve President Mary Daly recently revealed her position supporting an interest rate reduction at the upcoming December meeting. She emphasized that the risk of sudden labor market deterioration now outweighs concerns about reaccelerating inflation. The Fed’s delicate balancing act aims to control prices without increasing unemployment rates.

This potential December rate cut represents a strategic pivot from the Fed’s previous inflation-focused stance. Daly’s position suggests that policymakers are increasingly concerned about maintaining economic stability and protecting job growth.

What’s Driving the Push for Lower Rates?

The argument for a December rate cut centers on several key factors:

- Labor market protection – Preventing sudden job losses

- Economic stability – Maintaining steady growth patterns

- Inflation management – Controlling prices without overcorrecting

- Risk assessment – Prioritizing employment over inflation concerns

Daly’s perspective highlights the Fed’s evolving approach to monetary policy. She argues that the central bank can achieve its dual mandate of price stability and maximum employment through careful, measured adjustments.

How Will Markets React to This Decision?

The announcement of a potential December rate cut could trigger significant market movements. Investors typically view rate cuts as positive for stock markets and economic growth. However, the timing and magnitude of any reduction will be crucial for maintaining confidence in the Fed’s policy direction.

Market participants will closely watch for several indicators before the December meeting:

- Employment data trends

- Inflation reports

- Consumer spending patterns

- Business investment signals

What Challenges Does the Fed Face?

Implementing a successful December rate cut requires navigating complex economic crosscurrents. The Fed must balance multiple competing priorities while maintaining credibility with markets and the public. Communication will be essential to ensure the policy shift doesn’t create uncertainty or volatility.

The central bank’s decision-making process involves careful consideration of forward-looking data and economic models. Daly’s comments suggest that Fed officials are conducting thorough risk assessments to determine the optimal timing and size of any rate adjustments.

Conclusion: A Pivotal Moment for Monetary Policy

The potential December rate cut represents a crucial turning point in Federal Reserve policy. By prioritizing labor market stability over inflation concerns, the Fed demonstrates its commitment to balanced economic management. This approach could set the tone for monetary policy throughout the coming year, influencing everything from business investment to consumer confidence.

Frequently Asked Questions

What is a rate cut and how does it work?

A rate cut occurs when the Federal Reserve lowers its benchmark interest rate, making borrowing cheaper for consumers and businesses to stimulate economic activity.

Why would the Fed cut rates in December?

The Fed might cut rates to prevent labor market deterioration and support economic growth while maintaining control over inflation.

How could a December rate cut affect everyday Americans?

Lower rates could mean reduced borrowing costs for mortgages, car loans, and credit cards, potentially stimulating spending and investment.

What risks come with cutting rates too soon?

Premature rate cuts could reignite inflation, requiring more aggressive future rate hikes that might harm economic stability.

How does Mary Daly’s position influence Fed decisions?

As a Federal Reserve President, Daly’s views contribute to policy discussions, though decisions require consensus among Fed officials.

What indicators will the Fed watch before December?

The Fed will monitor employment data, inflation metrics, consumer spending, and global economic conditions before making final decisions.

Found this analysis helpful? Share this article with others who need to understand the potential December rate cut and its implications for the economy. Your network will appreciate the clear explanation of complex Federal Reserve policy decisions.

To learn more about the latest economic trends, explore our article on key developments shaping monetary policy and future market movements.

This post December Rate Cut: Fed’s Bold Move to Protect Jobs Over Inflation Fears first appeared on BitcoinWorld.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.