Key Bitcoin Holders Now Hold 13.47M BTC as Market Rebounds

0

0

Highlights:

- Key Bitcoin holders acquire an additional 19,255 tokens, increasing their BTC holdings to 13.47 million coins.

- Santiment described the accumulation trend as one of crypto’s most powerful indicators.

- Bitcoin breaks above $90,000, heading towards $100,000.

Santiment reported that Bitcoin stakeholders kept buying the token as the crypto market attempted to recover from earlier declines. According to an April 25 X post, the on-chain intelligence platform said Bitcoin appreciated 11.2%, which coincided with massive Bitcoin accumulations from whales and sharks.

According to Santiment, wallets holding 10 to 10,000 BTC added 19,255 more tokens to their BTC stash in the past week, increasing their holdings to a record high of about 13.47 million BTC. The on-chain intelligence platform described this trend as one of crypto’s most powerful indicators.

Bitcoin's value has jumped +11.2%, and this has once again coincided with key whales & sharks adding on to their already enormous bags. Wallets holding 10-10K $BTC have added 19,255 more coins in this short stretch, and continue to be one of crypto's most powerful indicators. pic.twitter.com/b3TiVd71iD

— Santiment (@santimentfeed) April 25, 2025

On April 19, Santiment reported that Bitcoin stakeholders had acquired 13.45 million BTC, representing 67.77% of the coin’s entire supply. The analytical intelligence firm added that these investors capitalized on the crypto market’s volatility in April to procure 53.6K BTC between March 22 and April 19.

Bitcoin's key stakeholders comprised of wallets holding between 10 & 10K BTC currently hold 67.77% of the entire supply of crypto's top market cap asset. During the April volatility, these wallets continue to accumulate, and have now added over 53.6K BTC since March 22nd.

pic.twitter.com/eCalVW0FQf

— Santiment (@santimentfeed) April 19, 2025

Bitcoin Breaks Above $90,000

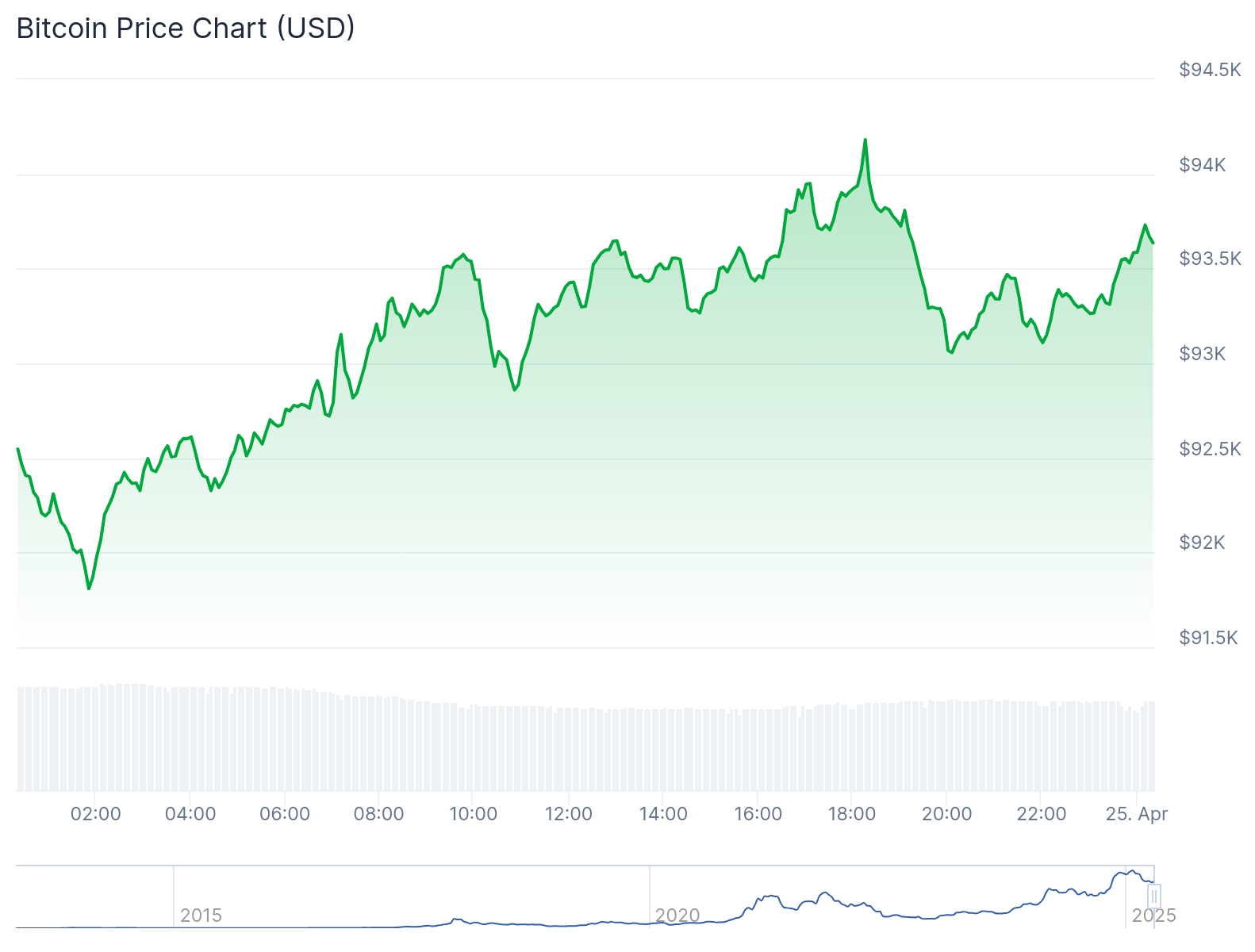

Bitcoin is changing hands at about $93,140 following a 0.4% surge in the past 24 hours. In the past week, Bitcoin spiked 10%, fluctuating between $84,093.83 and $94,294.96. This price range highlights a significant recovery from earlier declines this month.

Other extended market variables showed that Bitcoin recovered beyond its short-term price change variable. For context, BTC surged 15.2% 14-day-to-date, 6.6% month-to-date, and 44.8% year-to-date. Meanwhile, Bitcoin’s market capitalization is $1.85 trillion, and its 24-hour trading volume is $32.4 billion.

Bitcoin’s Price Surge Elicits FOMO

In another April 25 X post, Santiment reported that Bitcoin’s surge above $94,200 on April 23 has triggered Fear of Missing Out (FOMO) concerns among retail investors. This category of traders sold off most of their BTC holdings during the token’s dip in early April.

The on-chain intelligence firm added, “This crowd reaction typically leads to tops. $100,000 could very likely arrive in the near future, but it typically won’t happen till the bullish emojis calm.” This statement invariably implies that market participants should not anticipate an immediate BTC price rally until the market hypes drop.

Following Bitcoin's surge above $94.2K Wednesday, @santimentfeed data showed that FOMO began pouring in from retail traders. This crowd reaction typically leads to tops. $100K could very likely arrive in the near future, but it typically won't happen til the

emojis calm. https://t.co/KPiUTkyCWw

— Santiment (@santimentfeed) April 25, 2025

ARK Invest Forecasts BTC Could Reach $2.4 Million by 2030

Asset management firm ARK Invest recently published its latest Big Ideas 2025 report. The publication contained a detailed framework covering Bitcoin’s potential price predictions, adoption trends, and supply dynamics assumptions.

The investment firm predicted Bitcoin’s bull case estimate to reach about $2.4 million in 2030. This implies that the token will appreciate by 72% each year, starting December 31, 2024, to December 31, 2030. ARK Invests’ 2030 base case estimate was $1.2 million, while the bear case was $500,000.

In its publication, the asset management firm attributed the bullish predictions to growing institutional investment in Bitcoin. ARK research analyst David Puell noted that if interest in BTC remains strong, the token could capture a $200 trillion financial market, excluding gold. Other BTC price drivers were emerging market demand, on-chain financial services, and BTC’s inclusion in national treasuries and corporate cash reserves.

In related news, Bitcoin spot Exchange Traded Funds (ETFs) recorded a net inflow of about $442 million, marking five consecutive profitable outings. This shows that while institutions and whales acquire BTC, ETF traders invest in the token, underscoring strong faith in Bitcoin.

On April 24, spot Bitcoin ETFs recorded a total net inflow of $442 million, marking five consecutive days of net inflows. Spot Ethereum ETFs saw a total net inflow of $63.49 million, with Grayscale’s Ethereum Trust ETF (ETHE) being the only one to register a net outflow.…

— Wu Blockchain (@WuBlockchain) April 25, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.