0

0

Bitcoin (BTC) continues to trade within the recent consolidation phase, hovering around $90,000 at the time of writing on Friday, as investors digest the Federal Reserve’s (Fed) cautious December rate cut and its implications for risk assets.

BTC price action approaches a key descending trendline that could determine its next directional move. Meanwhile, institutional flows into Spot Bitcoin ETFs showed mild inflows, and Strategy added more BTC to its treasury reserve.

Bitcoin price started the week on a positive note, extending its weekend recovery during the first half of the week and holding above $92,600 on Tuesday.

However, momentum softened on Wednesday, with BTC closing at $92,015 after the Federal Open Market Committee (FOMC) meeting.

In a widely expected move, the Fed lowered interest rates by 25 basis points. But the FOMC meeting signaled a likely pause in January.

Adding to the cautious tone, policymakers projected only a one-quarter-percentage-point cut for the overall 2026 outlook. This was the same outlook as in September, which tempered market expectations of two rate cuts and contributed to short-term pressure on risk assets.

The Fed’s cautious tone, combined with disappointing Oracle earnings, contributed to a brief risk-off move.

All these factors weighed on riskier assets, with the largest cryptocurrency by market capitalization sliding to a low of $89,260 before rebounding and finishing above $92,500 on Thursday.

With no major US data releases ahead, crypto markets will now look to FOMC member speeches and broader risk sentiment for direction

at the end of the week.

BTC is likely to consolidate in the near term unless a significant catalyst emerges.

On the geopolitical front, US President Donald Trump is “extremely frustrated” with Russia and Ukraine, and he doesn’t want any more talk, his spokeswoman said on Thursday.

Earlier, Ukrainian President Volodymyr Zelenskyy said that the US was pushing the country to cede land to Russia as part of an agreement to end a nearly four-year war.

These lingering geopolitical tensions and stalled peace talks continue to weigh on global risk sentiment, limiting risk-on appetite and contributing to Bitcoin’s consolidation so far this week.

Institutional demand for Bitcoin shows mild signs of improvement.

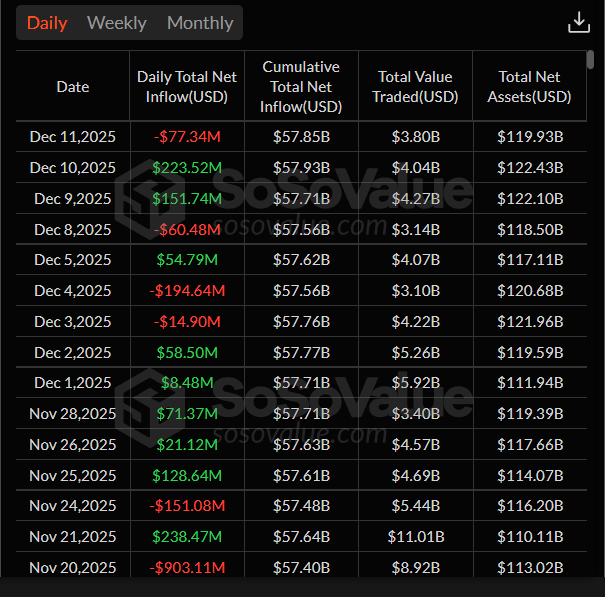

According to SoSoValue data, US-listed spot Bitcoin ETFs recorded a total inflow of $237.44 million through Thursday, following a mild outflow of $87.77 million a week earlier, signaling that institutional investor interest improved somewhat.

However, these weekly inflows remain small relative to those observed in mid-September. For BTC to continue its recovery, the ETF inflows should intensify.

Total Bitcoin Spot ETF Net Inflow Chart. Source: SoSoValue

Total Bitcoin Spot ETF Net Inflow Chart. Source: SoSoValue

On the corporate front, Strategy Inc. (MSTR) announced on Monday that it purchased 10,624 Bitcoin for $962.7 million between December 1 and 7 at an average price of $90,615.

The firm currently holds 660,624 BTC, valued at $49.35 billion. Strategy still retains substantial capacity to raise additional capital, potentially allowing for further large-scale Bitcoin accumulation.

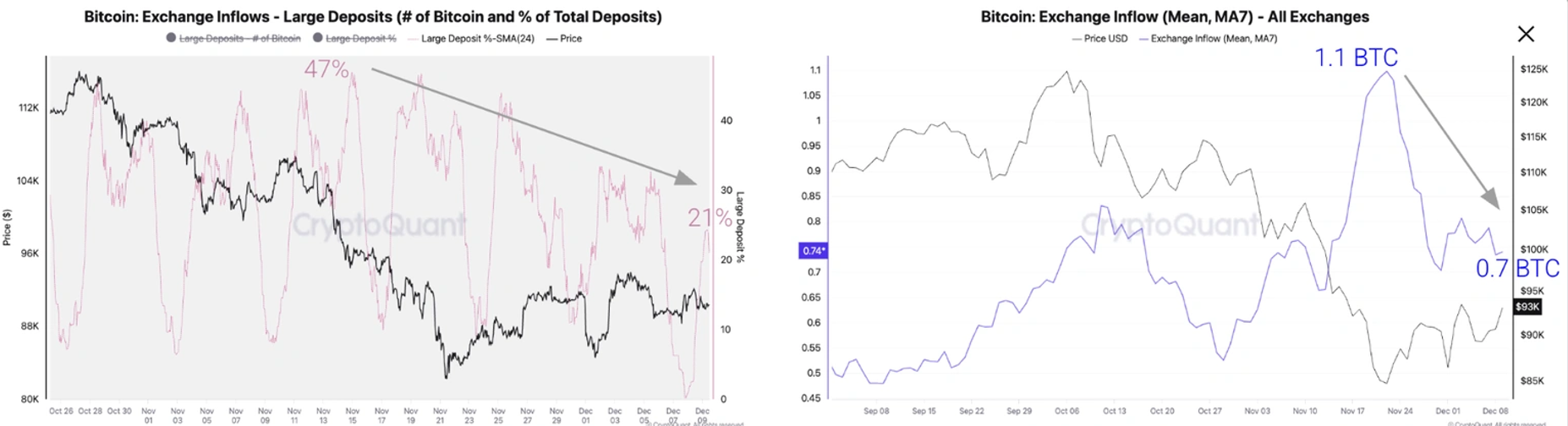

CryptoQuant’s weekly report on Wednesday highlights that selling pressure on Bitcoin is beginning to ease.

The report notes that exchange deposits eased as large players reduced their transfers to exchanges.

The graph below shows that the share of total deposits from large players has declined from a 24-hour average high of 47% in mid-November to 21% as of Wednesday.

At the same time, the average deposit has declined by 36%, from 1.1 BTC in November 22 to 0.7 BTC.

Bitcoin Exchange Flows. Source: CryptoQuant

Bitcoin Exchange Flows. Source: CryptoQuant

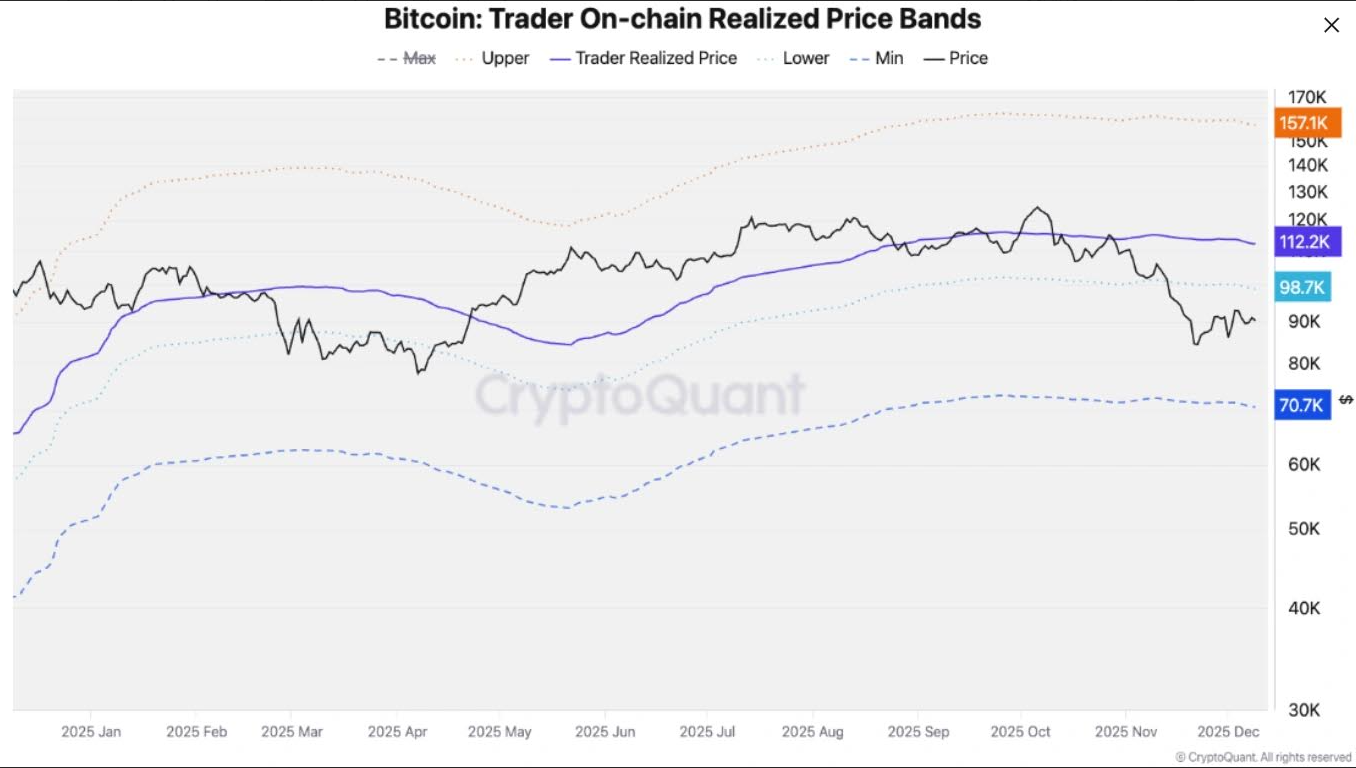

CryptoQuant concludes that, if selling pressure remains low, a relief rally could push Bitcoin back to $99,000. This level is the lower band of the Trader On-chain Realized Price bands, which is a price resistance during bear markets.

After this level, the key price resistances are $102,000 (one-year moving average) and $112,000 (the Trader On-chain Realized price).

Bitcoin Trader’s Realized Price Bands

Bitcoin Trader’s Realized Price Bands

The Copper Research report also signaled optimism about Bitcoin. The report suggests that BTC’s four-year cycle hasn’t died; it has been replaced.

Since the launch of spot ETFs, Bitcoin has exhibited repeatable Cost-Basis Return Cycles, as shown in the graph below.

Bitcoin USD Price Vs ETF Cost Basis

Bitcoin USD Price Vs ETF Cost Basis

Fadi Aboualfa, Head of Research at Copper, told FXStreet that “Since spot ETFs launched, Bitcoin has moved in repeatable mini-cycles where it pulls back to its cost basis and then rebounds by around 70%.

With BTC now trading near its $84,000 cost basis, this pattern suggests a move north of $140,000 in the next 180 days.

If the cost basis rises 10-15%, as in prior cycles, the resulting premium seen at past peaks produces a target range of $138,000 to $148,000.

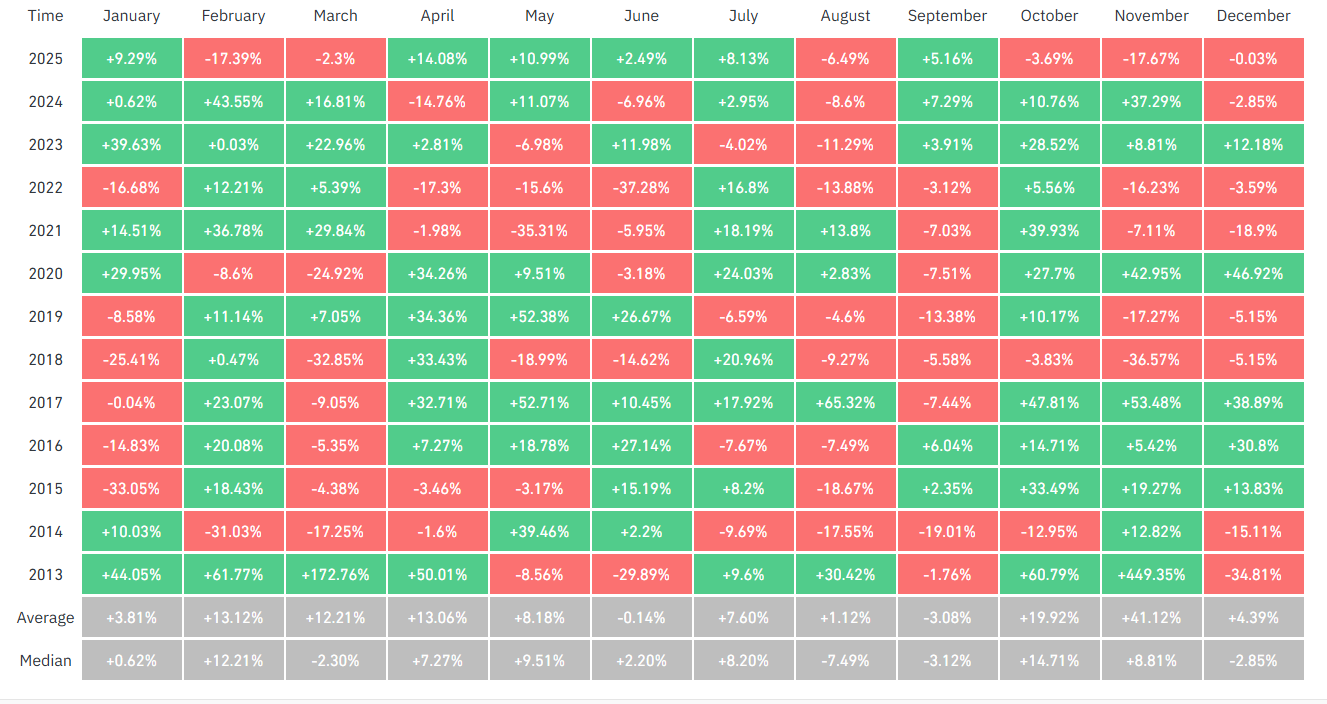

Bitcoin posted a 17.67% loss in November, disappointing traders who had anticipated a rally based on its strong historical returns for the month (see CoinGlass data below).

December has historically been a positive month for the king crypto, delivering an average return of 4.55%.

Bitcoin Monthly Returns. Source: CoinGlass

Bitcoin Monthly Returns. Source: CoinGlass

Looking at quarterly data, the fourth quarter (Q4) has been the best quarter for BTC in general, with an average return of 77.38%.

Still, the performance in the last three months of 2025 has been underwhelming so far, posting for now a 19% loss.

Bitcoin’s weekly chart shows the price finding support around the 100-week Exponential Moving Average (EMA) at $85,809, posting two consecutive green candles following a four-week correction that began in late October.

As of this week, BTC is trading slightly higher, holding above $92,400.

If BTC continues its recovery, it could extend the rally toward the 50-week EMA at $99,182.

The Relative Strength Index (RSI) on the weekly chart reads 40, pointing upward and indicating fading bearish momentum. For the recovery rally to be sustained, the RSI should move above the neutral level of 50.

BTC/USDT weekly chart

BTC/USDT weekly chart

On the daily chart, Bitcoin’s price was rejected at the 61.8% Fibonacci retracement level at $94,253 (drawn from the April low of $74,508 to the all-time high of $126,199 set in October) on Wednesday.

However, on Thursday, BTC rebounded after retesting its $90,000 psychological level.

If BTC breaks above the descending trendline (drawn by connecting multiple highs since early October) and closes above the $94,253

resistance level, it could extend the rally toward the $100,000 psychological level.

The Relative Strength Index (RSI) on the daily chart is stable near the neutral 50 level, suggesting the lack of near-term momentum in either side.

For the bullish momentum to be sustained, the RSI should move above the neutral level.

Meanwhile, the Moving Average Convergence Divergence (MACD) showed a bullish crossover at the end of November, which remains intact, supporting the bullish thesis.

BTC/USDT Daily Chart

BTC/USDT Daily Chart

If BTC were to resume its downward correction, the first key support is at $85,569, which aligns with the 78.6% Fibonacci retracement level.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.