Bitcoin ETFs See $321.4M in Inflows, BlackRock’s IBIT Leads

0

0

Highlights:

- Spot Bitcoin ETFs experienced $321.4 million in inflows, with BlackRock at the forefront.

- BlackRock’s IBIT marked 19 consecutive days of inflows, even amid Bitcoin price volatility.

- In its Bitcoin ETF filing, BlackRock flagged quantum risks, pointing to potential vulnerabilities in cryptography.

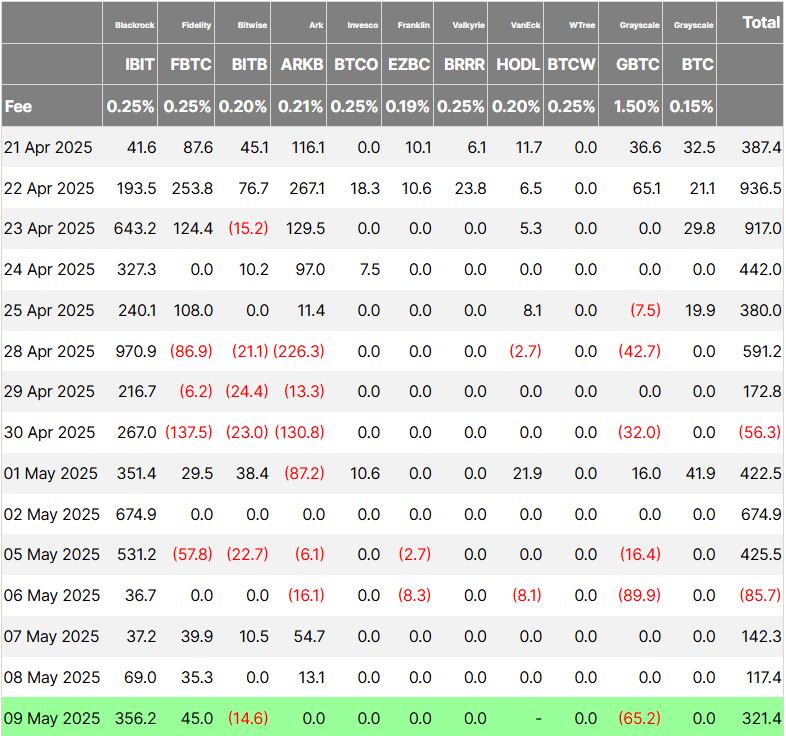

Spot Bitcoin (BTC) ETFs in the U.S. attracted $321.4 million in net inflows on May 9, marking the third consecutive day of positive momentum. Only two funds contributed to the gains. BlackRock’s iShares Bitcoin Trust (IBIT) led with a $356.2 million inflow, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with $45 million. In contrast, Bitwise’s BITB saw a $14.6 million outflow, and Grayscale’s GBTC lost $65.2 million.

BlackRock’s IBIT has now recorded 19 straight days of net inflows — its longest streak in 2025. The streak began on April 14 and has continued despite sharp price swings in the Bitcoin market, with BTC trading between $83,152 and $103,000 during this period. Investor confidence appeared to rise after Bitcoin climbed above $90,000 on April 23 and held that level.

Momentum grew as Bitcoin surpassed the $100,000 mark on May 8, a level not seen since February 1. IBIT saw $1.03 billion in inflows last week, according to Farside data. Its longest streak in 2025 had been nine days. That streak happened around Trump’s inauguration, from January 15 to 28.

BlackRock Adds Quantum Risk to Bitcoin ETF Filing

On May 9, Blackrock submitted an S-1 amendment for IBIT, outlining possible risks associated with quantum computing. The filing says that if quantum computing progresses, it might weaken Bitcoin’s cryptography. This could lead to security issues and potential attacks on Bitcoin wallets, causing losses for Shareholders.

James Seyffart, an ETF analyst at Bloomberg, mentioned that such disclosures are common in SEC filings. He explained that they typically outline any potential risks related to products or assets being listed or invested in.

Seyffart said:

“To be clear. These are just basic risk disclosures. They are going to highlight any potential thing that can go wrong with any product they list or underlying asset thats being invested in. It’s completely standard. And honestly makes complete sense”.

Discussions on quantum computing’s threat to Bitcoin security grew after Google revealed its Willow chip in December. Microsoft followed with its Majorana 1 chip, claiming it solves scalability issues.

BlackRock just tripled the length of the section on Quantum computing risks for $IBIT https://t.co/YmOhKh3ltD

— Eric Balchunas (@EricBalchunas) May 9, 2025

Moreover, BlackRock representatives met with SEC staff to discuss staking and options for crypto ETFs. They addressed regulatory issues around crypto assets. The world’s largest asset management firm has sought SEC approval for staking in crypto ETFs

Bitcoin Eyes $109K as Whales Continue Accumulation

Bitcoin continues to demonstrate strong momentum, currently trading around $103K, with the potential to break past its all-time high of $109K. This upward movement is fueled by significant whale accumulation. According to data from Cryptoranks, wallets holding between 1,000 and 10,000 BTC—referred to as Bitcoin whales—are continuing their accumulation trend. These whales often consist of institutional investors, including hedge funds and Bitcoin mining companies. They play a key role in influencing Bitcoin’s next price movement.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.