Ethereum Outflows Hit New Highs as Tom Lee’s BitMine Immersion Becomes Lone Buyer

0

0

This article was first published on The Bit Journal. The institutional Ethereum (ETH) demand is sharply diverging in November, and a few major players are intervening as wider Ethereum outflows keep putting strain on market sentiment.

BitMine Immersion, a treasury firm run by crypto bull Tom Lee, was the only buy-side standout in the month, with a 54,000 ETH purchase valued at an approximate of 173 million dollars. More than that, institutional interest in ETH has been waning significantly, notably in U.S.-traded spot-based Ethereum ETFs, where accelerating Ethereum outflows are a new commonality.

ETF Redemptions mark Record Ethereum Outflows

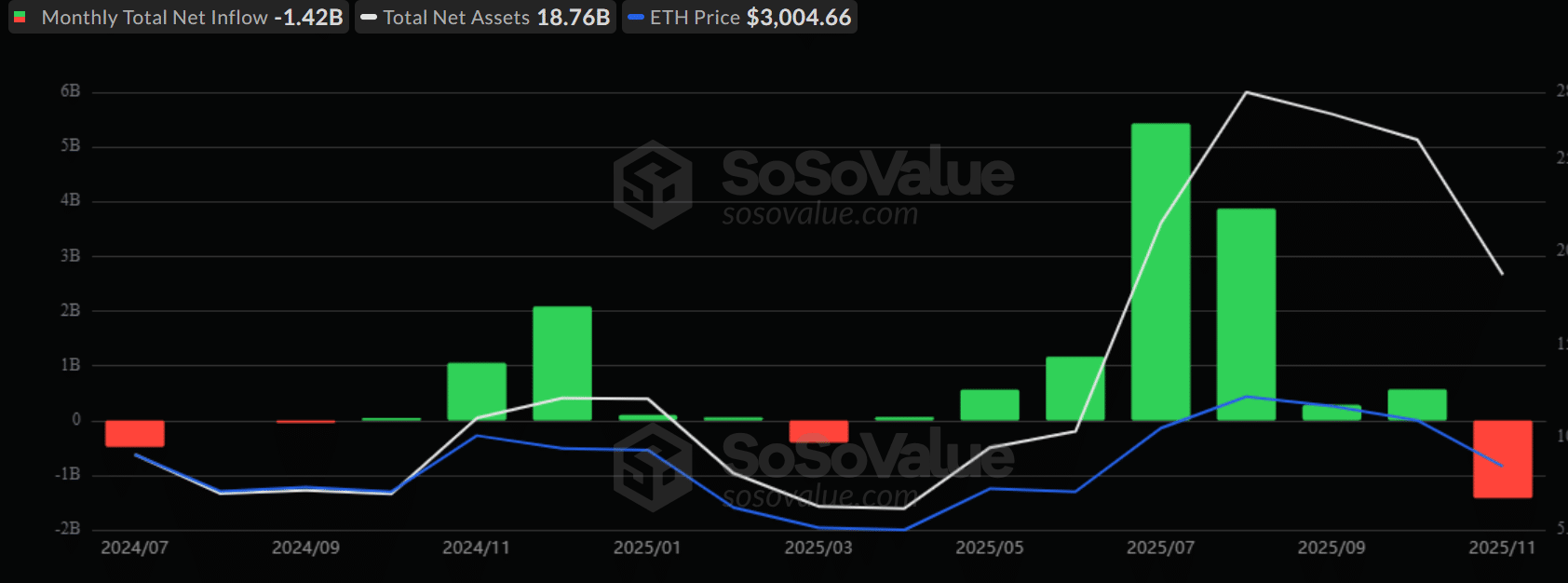

Statistics indicate ETF traders have sold 1.42 billion in the asset category thus far in November, becoming the biggest monthly Ethereum outflows since the launch of spot ETH products in 2024. The exodus shows an increasing risk-off position of institutional desks as the macroeconomic uncertainty increases.

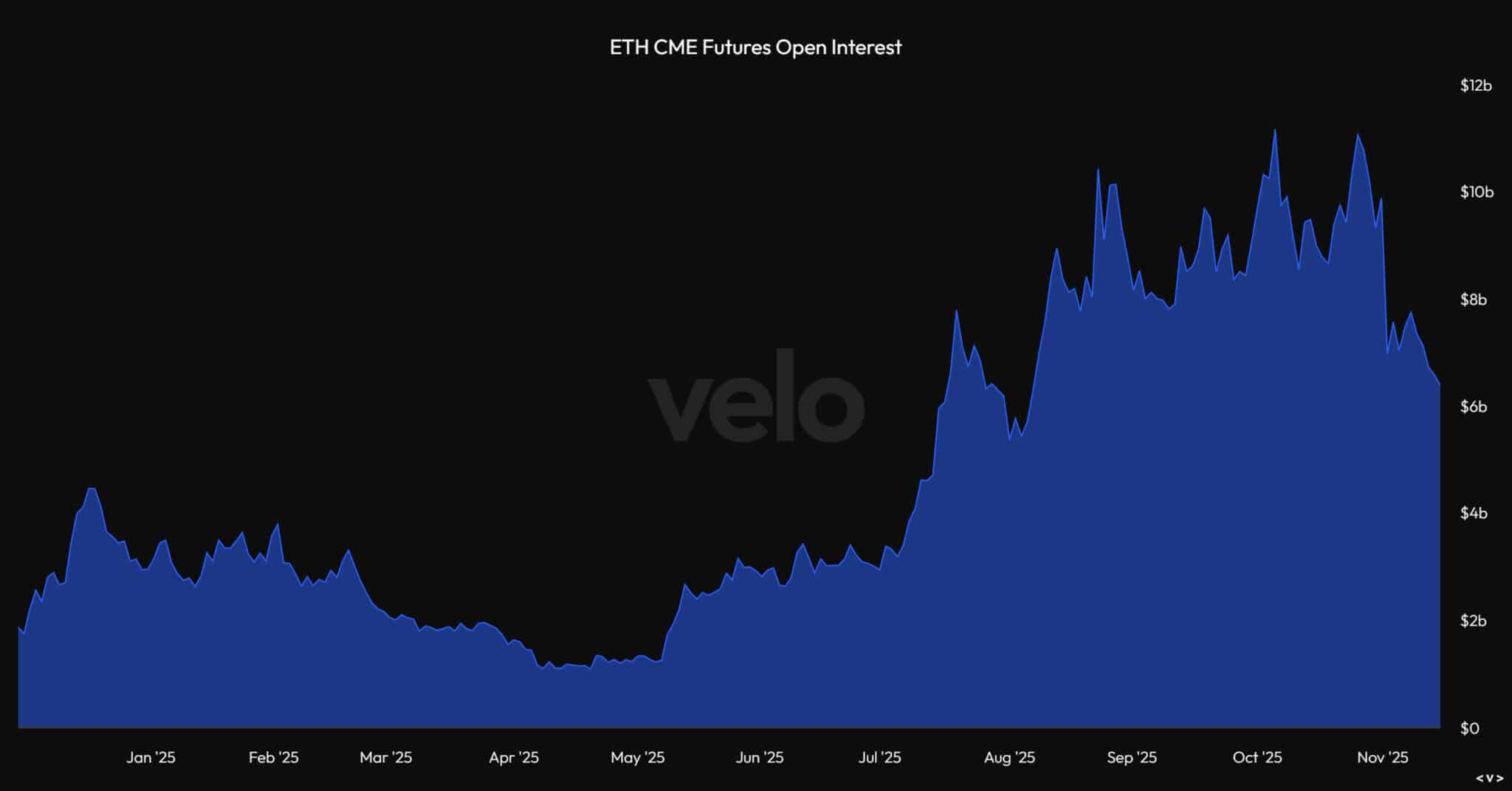

Cooling sentiment can be also observed in leveraged markets. Since the October 10 flash crash, almost $4 billion of Ethereum Open Interest has disappeared, which increases the concerns related to the constant Ethereum outflows on the institutional platforms.

As the result of this fall, the previously-popular ETH basis trade, of buying spot ETFs and hedging against CME shorts, has declined by a factor of 10 (10 percent mid-October to 3 percent) and thereafter stabilized around 4 percent.

ETH Stability Persists amid Ongoing Outflows

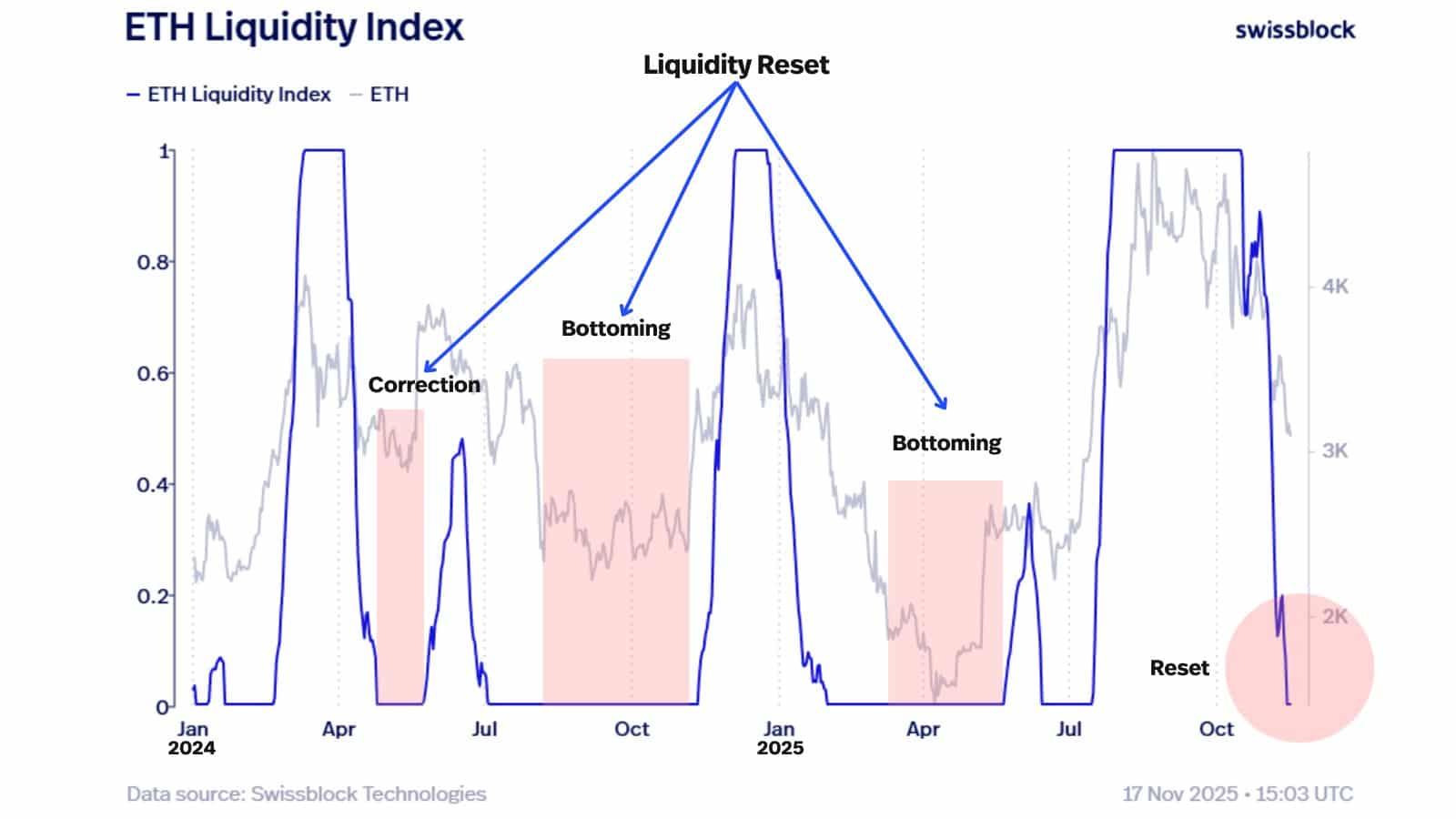

However, despite the combined demand environment and the continued Ethereum outflows, Ethereum has maintained its support zone of $3,000 over four days. Swissblock analysts observed that ETH has given a bottom signal in the Liquidity Index of the firm, which can be an indication that the market will soon be inflected. The firm wrote:

“It’s a matter of time: if liquidity is rebuilt in the coming weeks, the next expansion leg opens.”

These indications were also shown in late 2024 and early 2025 and both of them were followed by recoveries that drove ETH above 4,000 even at times of a significant Ethereum outflow.

Options flow highlights mixed trader sentiment

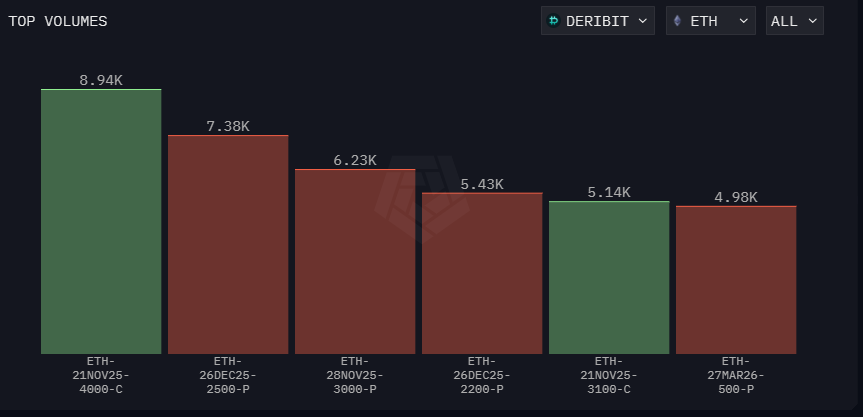

The activity on options seems to reflect such a carefully optimistic opinion. Within the last 24 hours, the majority of call buyers struck the $3,100 and $4,000 levels on November 21 and November 28 expiries, indicating expectations of an upside in the near future despite the recent Ethereum outflows.

Negatively, put buyers are protecting against possible falls to $3,000 and 2,500 to the end of November and December. Options flow indicates that some advanced traders believe that there is a high probability of ETH falling to as low as $2,500 should it lose its support.

Federal Reserve Outlook hinges on Jobs Data

The markets have switched to November 20 when the September U.S. Jobs Report is scheduled. Their data will likely be central to the formation of expectations regarding the Federal Reserve meeting in December.

An unexpectedly high labor figure may reduce the chances of further reduction in the rate and trigger further selling, which may intensify short-term Ethereum outflows. In the meantime, a negative report can raise the chances of a rate cut that might be a stimulus behind an ETH relief rally.

Conclusion

Ethereum is now at a major crossroad and macro data will guide its next step. Technical signals and options positioning give signs of recovery possibility, but institutional flows are still uneven, so the next jobs report is the most important catalyst to the short-term trajectory of Ethereum.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

- BitMine Immersion is the only major ETH buyer as U.S. ETFs see $1.42 billion in November outflows.

- Nearly $4 billion in futures open interest has vanished, shrinking the ETH basis trade sharply.

- ETH holds the $3,000 support, with Swissblock signaling a potential bottom similar to past $4k recoveries.

- Options traders show mixed sentiment, targeting $3,100–$4,000 upside while hedging for dips toward $2,500.

Glossary of Key Terms

BitMine Immersion: Tom Lee-led firm buying significant ETH.

ETF (Exchange-Traded Fund): Tradable fund tracking assets like ETH.

ETF Redemptions: Investor withdrawals from ETH ETFs.

Open Interest (OI): Outstanding derivative contracts not yet settled.

Liquidity Index: Metric indicating market liquidity and potential bottoms.

Options Flow: Trading activity of calls and puts reflecting sentiment.

Federal Reserve (Fed): U.S. central bank affecting rates and markets.

Jobs Report: Employment data influencing Fed policy and markets.

Macro Data: Economic indicators affecting market sentiment.

Frequently Asked Questions about Ethereum Outflows

1. Who is buying Ethereum now?

BitMine Immersion, led by Tom Lee, is the main institutional buyer.

2. Why are ETH ETFs seeing outflows?

Investors withdrew $1.42B in November, signaling a risk-off trend.

3. What supports ETH at $3K?

ETH holds $3K, with liquidity signals pointing to a potential bottom.

4. How could Jobs data affect ETH?

Strong labor data may pressure ETH; weak data could trigger a rally.

References

Read More: Ethereum Outflows Hit New Highs as Tom Lee’s BitMine Immersion Becomes Lone Buyer">Ethereum Outflows Hit New Highs as Tom Lee’s BitMine Immersion Becomes Lone Buyer

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.