Why Commerzbank expects US tariffs to push metal prices higher

0

0

US import tariffs are expected to be positive for the metals market, according to Commerzbank AG.

Financial market sentiment improved at the start of the week due to speculation that the US tariffs planned by the Trump administration for April 2nd would be more targeted than initially expected.

Bloomberg reported over the weekend that the likelihood of new tariffs being applied to all US trading partners was reduced, as the countries facing these tariffs would be carefully examined.

This approach differs from the previous tariffs on steel and aluminium, which were applied universally.

“The risk of sector-specific tariffs has also diminished,” Thu Lan Nguyen, head of commodity research at Commerzbank, said in an update.

“This was greeted with relief by market participants after increasing fears that US tariff policy could lead to a global trade war, with correspondingly negative consequences for the global economy.”

US President Donald Trump’s announcement during a White House cabinet meeting on Monday to introduce tariffs for the automotive industry and later for the pharmaceutical industry dampened the positive mood somewhat.

However, recent news suggests that these tariffs may be less severe than initially anticipated or, similar to previous instances, might be postponed.

Prices benefit from tariff threats

“Meanwhile, in addition to diminishing economic concerns, base metals are benefiting from the fact that new US tariffs are highly likely to hit the metals sector,” Nguyen said.

She said:

This in turn could prompt US companies to bring forward their demand and build up their inventories in order to avoid material shortages and thus ensure a surge in demand, at least in the short term.

These are fears that are currently driving the price higher.

Last year, net imports accounted for 45% of domestic copper consumption, according to USGS data.

This figure is comparable to the 47% net import share for aluminum, which has been subject to a 25% import duty since March 12. In response to these figures, Trump announced that he would explore measures to protect the domestic copper industry.

Copper prices on the London Metal Exchange are well over the crucial mark of $10,000 per ton, while aluminum and zinc have also gained ground on Tuesday.

Production rate may not rise steeply

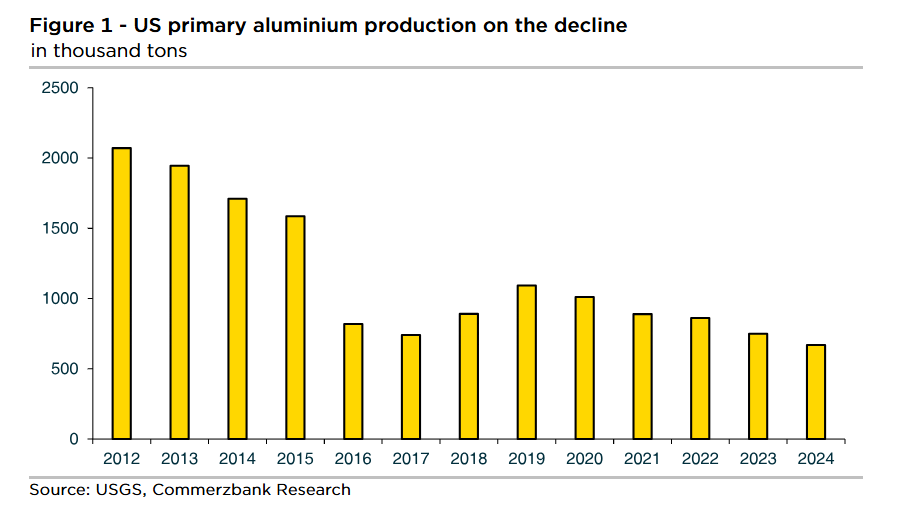

Meanwhile, it is improbable that US tariffs will significantly impact domestic metal production as was the case during Trump’s first presidency.

The US government imposed a 10% tariff on aluminum imports from all countries in 2018.

While the tariff was eventually removed for some countries, a few countries, including Argentina, Brazil, and Australia, were able to negotiate a quota system instead of tariffs.

The increase in US primary aluminum production that followed was not sustainable.

Production fell again in 2020 and has continued its long-term downward trend, although the 2019 cancellation of tariffs against Canada (a major aluminum supplier) may have also been a factor, Commerzbank noted.

In 2024, US aluminum production via recycling reached 3.6 million tons, according to USGS.

This is far greater than the total aluminum production of 670,000 tons in the previous year, when production fell to a historic low and accounted for less than 1% of global production, according to Commerzbank.

The upside potential is limited as the figure has been relatively stable since 2016, the German bank added.

Overall positive outlook

The tariffs may also negatively impact production outside of the US in the medium term. This is due to the risk of reduced US demand on the global market, which could initially lead to lower prices.

However, due to US tariff policies and the government’s pressure to reduce overcapacity in the metal industry, some producers, especially the leading producers in China, may limit their operations, Nguyen said.

“Overall, we therefore believe that the US import tariffs should have a positive price effect for the metals concerned,” she added.

However, there may be a price correction, at least temporarily, as soon as the pull-forward effect on US demand comes to an end, i.e. when US companies import less again because their inventories are sufficiently full.

The post Why Commerzbank expects US tariffs to push metal prices higher appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.