Ethereum Treasury Crosses $17.6B as Corporate Holdings Surge

0

0

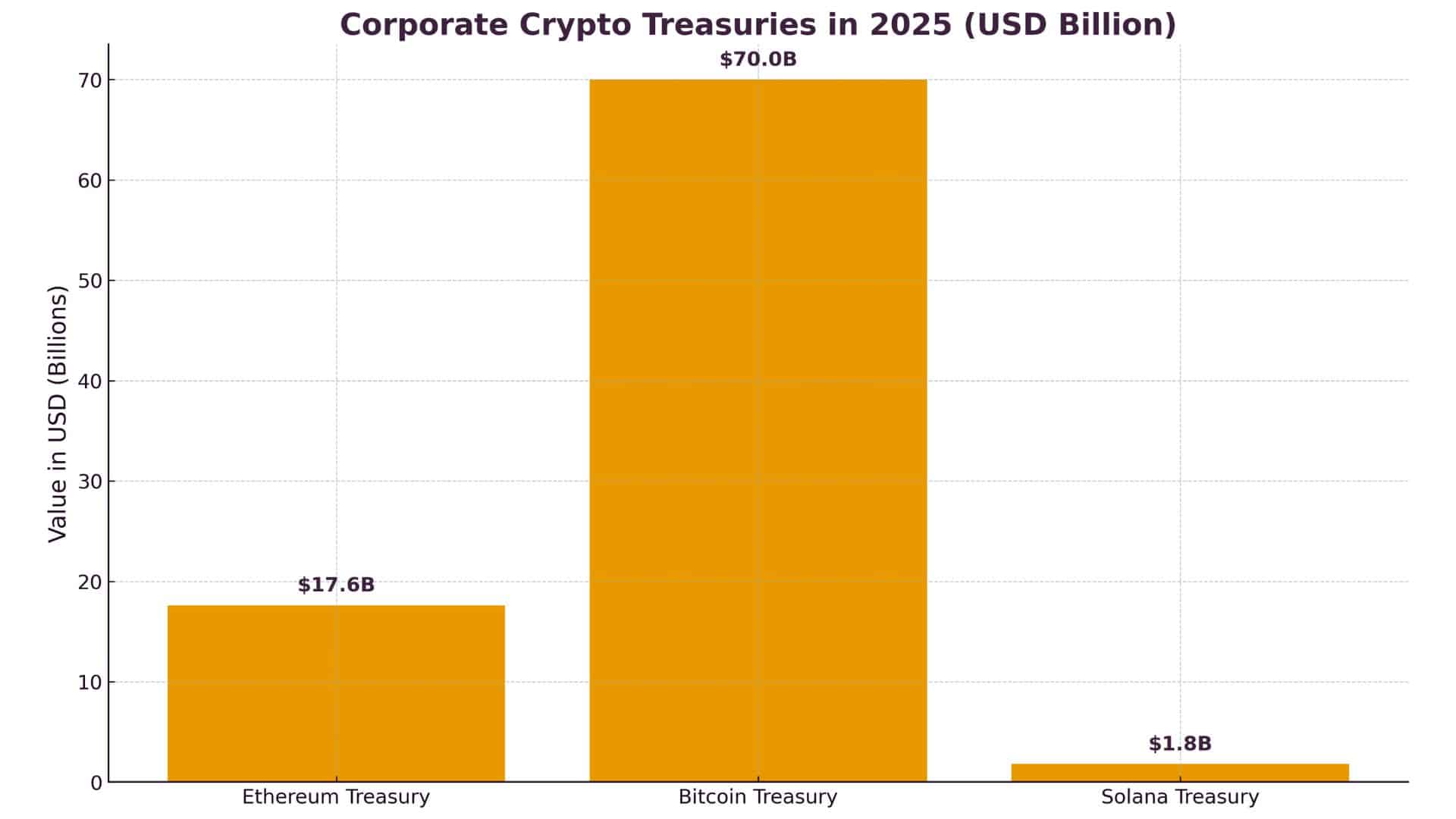

According to recent market data, the Ethereum treasury has become one of the most important indicators of institutional confidence in crypto. Public companies, funds, and institutions now control millions of ETH, placing it alongside the Bitcoin treasury and the smaller but growing Solana treasury.

These corporate moves highlight how digital assets are no longer speculative sidelines but part of real balance sheets.

Corporate Holdings Overview

Ethereum Treasury Growth

Ethereum treasury has expanded sharply in 2025. Public companies hold around 3.4 million ETH, valued at about $16.2 billion. When including all entities with more than 100 ETH, total holdings surpass 4.1 million ETH, worth over $17.6 billion.

The largest holder is BitMine Immersion, with more than 1.5 million ETH (~$6.6B). SharpLink Gaming follows with about 740,760 ETH, worth $3.2B. The Ethereum Foundation itself controls over 230,000 ETH. These figures show how Ethereum treasury has become a long-term reserve tool.

Also read: Vitalik Buterin Warns: How Ethereum Treasury Companies Risk ETH Stability

Bitcoin Treasury Dominance

Bitcoin treasury remains the biggest in dollar terms. Public companies hold more than 1,011,000 BTC, valued in the tens of billions with prices around $64,000–$70,000. One firm, formerly known as MicroStrategy, accounts for over half of this with more than 597,000 BTC, worth $64–73 billion depending on market price

Mining firms like Marathon Digital also contribute, holding tens of thousands of BTC. Bitcoin treasury shows heavy concentration, but it continues to serve as the leading store of value.

Solana Treasury on the Rise

Solana treasury is smaller but expanding quickly. Reports show 6.55 million SOL held by companies and governments, worth about $1.57 billion. Another survey lists 13 firms with nearly 8.9 million SOL, valued at $1.8 billion, around 1.5% of circulating supply.

Major holders include Upexi with 1.8 million SOL and DeFi Development Corporation with close to 1 million. Many stake their holdings to generate yield, supported by Solana’s growing ecosystem.

Why Companies Are Building Crypto Treasuries

Firms turn to Ethereum treasury and Solana treasury for yield, with ETH staking paying 3–4% and SOL often higher. Bitcoin treasury brings no yield but offers recognition and liquidity.

Clearer fair-value accounting also helps, letting firms report crypto at current prices. Many companies add ETH and SOL for diversification beyond Bitcoin.

Risks and Considerations

Large crypto treasuries carry risks. Prices swing fast, and heavy concentration among a few holders adds pressure. Rules differ across markets, creating uncertainty. Still, the Ethereum treasury, the Bitcoin treasury, and the Solana treasury are increasingly seen as long-term corporate tools.

Conclusion

Based on the latest research, Ethereum treasury marks a shift in how companies approach digital assets. Firms are adding ETH alongside Bitcoin and Solana to balance yield, diversification, and long-term strategy.

Bitcoin treasury still leads in scale, but Ethereum treasury brings added utility through staking. Solana treasury, though smaller, is steadily proving its place in institutional finance.

Also read: Metaplanet vs. MicroStrategy: Who Will Win the Bitcoin Treasury Race?

Summary

Ethereum treasury holdings have crossed 4.1 million ETH, worth $17.6B, with BitMine Immersion and SharpLink leading. Bitcoin treasury remains far larger, exceeding 1 million BTC, valued above $60B. Solana treasury is smaller but growing, with 6.5–8.9 million SOL worth up to $1.8B.

Companies adopt these assets for yield, diversification, and strategy, even as volatility and regulation pose risks. Corporate crypto treasuries are moving into mainstream finance.

Glossary of Key Terms

Ethereum treasury: ETH held by companies as part of their balance sheets or reserves.

Bitcoin treasury: BTC owned by corporations, governments, or institutions for long-term strategy.

Solana treasury: SOL held by firms or funds, often staked for yield.

Fair-value accounting: A system that records assets at their current market value, now applied to corporate crypto holdings.

FAQs for Ethereum Treasury

Q: Which company holds the most Ethereum in its treasury?

BitMine Immersion leads with over 1.5 million ETH, followed by SharpLink Gaming with about 740,000 ETH.

Q: How big is Bitcoin treasury compared to Ethereum treasury?

Bitcoin treasury is much larger, with over 1 million BTC held by companies, worth more than $60 billion, far exceeding ETH totals.

Q: Is Solana treasury significant?

Yes, while smaller, it is growing quickly. Around 6.5–8.9 million SOL are held by companies and institutions.

Q: Why do companies stake Ethereum or Solana?

They earn rewards of 3–4% on ETH and higher on SOL, turning treasuries into income-generating assets.

Read More: Ethereum Treasury Crosses $17.6B as Corporate Holdings Surge">Ethereum Treasury Crosses $17.6B as Corporate Holdings Surge

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.