Bitcoin Mining Difficulty Hits New Peak, Squeezing Miner Profits

0

0

Bitcoin BTC $116 204 24h volatility: 0.8% Market cap: $2.32 T Vol. 24h: $37.24 B miners are feeling the pressure as the network’s mining difficulty climbed to a new all-time high on September 19.

While the milestone makes Bitcoin more secure than ever, it also intensifies the economic challenge for those who maintain the network, forcing them to spend more resources for the same reward.

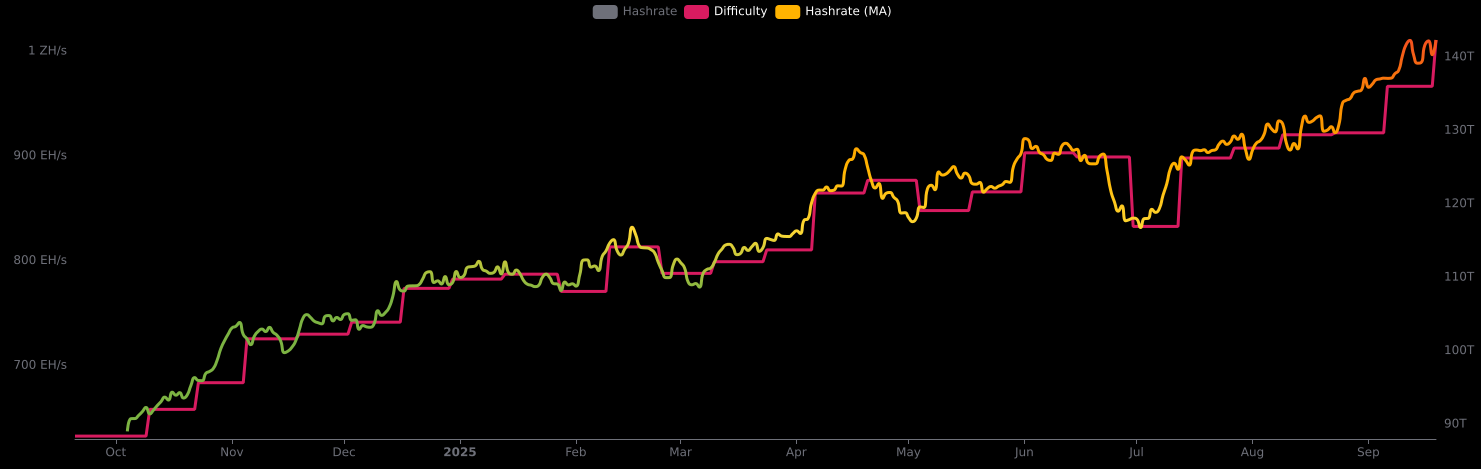

This difficulty adjustment is a built-in feature of the network, designed to respond to changes in computing power, or hash rate. The new record, visible on blockchain explorers like Mempool.space, confirms a massive influx of powerful hardware has come online.

This self-regulating mechanism makes sure blocks are found every 10 minutes on average, but it creates a competitive, high-stakes environment for miners.

A Shrinking Piece of the Pie

Chart showcasing the Bitcoin mining difficulty rate growth over the past year. | Image source: Mempool.space

The news sparked immediate and divided reactions from a community whose long-term sentiment has recently been shifting toward asset accumulation.

Many celebrated the network’s hardened defenses, with one X user noting it showcases Bitcoin’s “unmatched network strength.”

However, others pointed to the direct financial consequences. All miners compete for the same pool of rewards. Over the last 24 hours (approximately 144 blocks), that “pie” consisted of about 453.22 BTC, worth over $52 million.

With the new difficulty, each miner’s slice of that pie shrinks, meaning they must deploy more hash power just to maintain their earnings. This dynamic was captured by X user Flipstra Damus, who observed that thinning profit margins could accelerate miner consolidation.

Difficulty at 136T reflects surging hashrate, bolstering network security via PoW. But with margins thinning, how might this affect miner consolidation…

— Flipstra Damus (@Flipstra_damus) September 19, 2025

That consolidation is already a significant feature of the network. Data from the past year shows that the majority of the hash rate is controlled by a small number of entities.

The top three pools alone, Foundry USA (30.7%), AntPool (19.43%), and ViaBTC (13.52%), account for over 63% of all blocks found.

This pressure is already reshaping the industry, as some large-scale, publicly traded mining companies are exploring pivots into other sectors like AI to create new revenue streams.

For the dozens of smaller pools that make up the long tail of the hash rate, the choice is much starker. This growing operational challenge is compounded by external factors, including increased regulatory challenges for publicly listed firms.

The post Bitcoin Mining Difficulty Hits New Peak, Squeezing Miner Profits appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.