Jito (JTO) Tops Crypto Gainers List After SEC Engagement Sparks Optimism

0

0

JTO, the governance token of the Jito Network, is today’s top-performing asset, climbing almost 15% over the past day.

The bullish momentum follows Jito Labs’ June 13 meeting with the US Securities and Exchange Commission’s Crypto Task Force.

JTO Eyes Breakout After SEC Talks Spark Investor Accumulation

JTO has witnessed a resurgence in new demand following Jito Labs’ June 13 meeting with the SEC’s Crypto Task Force. At this meeting, the parties discussed a proposed Token Transparency Framework and a blockchain-based securities trading initiative dubbed “Project Open.”

In response, investor confidence has surged, sparking renewed buying pressure as a new trading week commences. Technical indicators reflect this renewed optimism, with readings from the token’s Relative Strength Index (RSI) confirming the growth in buy-side pressure. As of this writing, this momentum indicator is at 62.39 and is in an uptrend.

JTO RSI. Source: TradingView

JTO RSI. Source: TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

JTO’s RSI readings indicate market participants prefer accumulation over distribution. If this trend continues, its price could continue to rise.

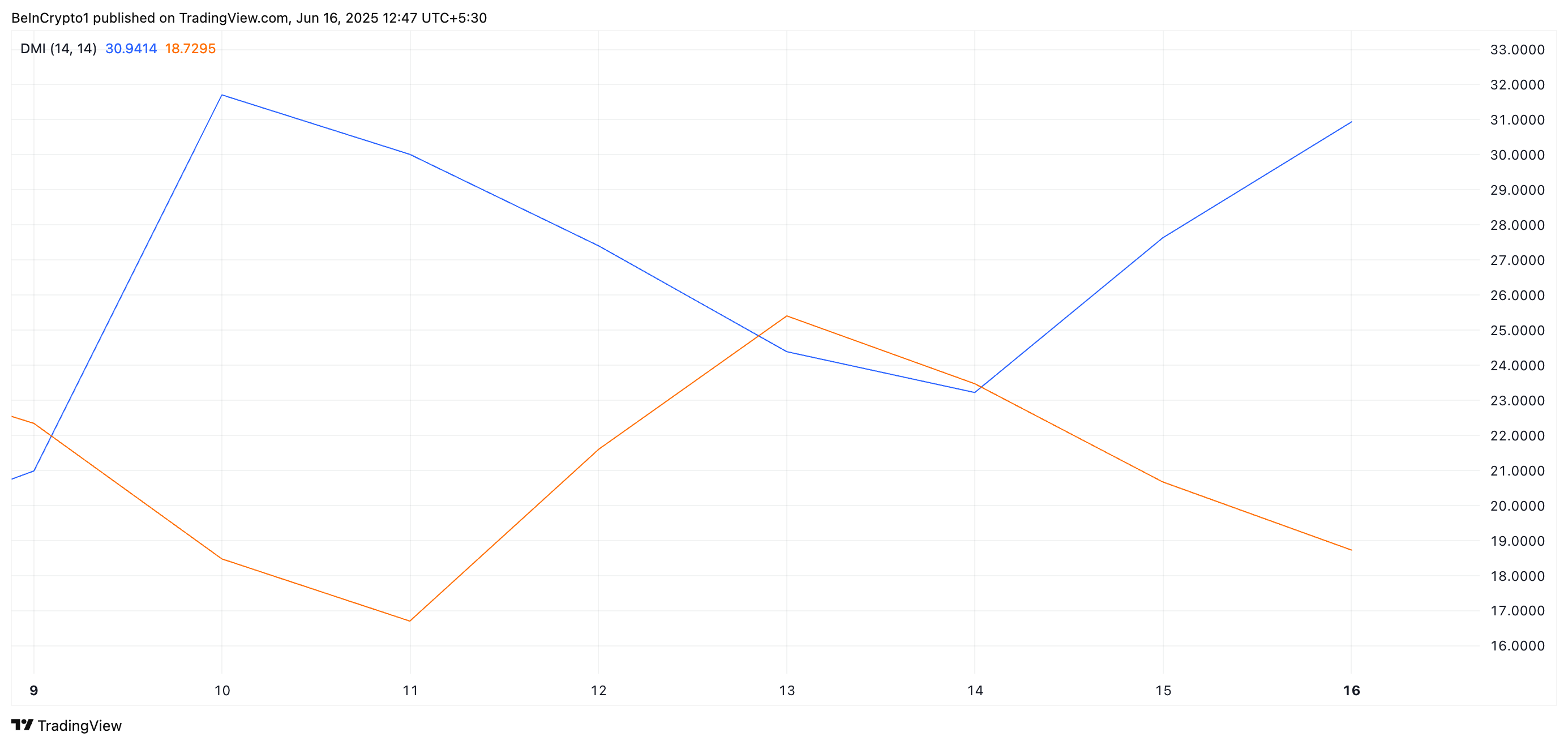

Furthermore, the token’s Directional Movement Index (DMI) highlights growing bullish dominance, with the positive directional indicator (DI+, blue) pulling ahead of the negative (DI–, orange).

JTO DMI. Source: TradingView

JTO DMI. Source: TradingView

The DMI indicator measures the strength of an asset’s price trend. It consists of two lines: the +DI, which represents upward price movement, and the -DI, which means downward price movement.

When the +DI rests above the -DI, it signals that upward price movements are stronger than downward ones, indicating a bullish trend. The widening gap between the two lines on the JTO/USD one-day chart confirms the stronger directional momentum in favor of buyers.

JTO Surges Toward Key Resistance—Will Bulls Push Through?

At press time, JTO trades at a two-month high of $2.30. With strengthening buying pressure, the altcoin could break above the resistance at $2.39.

A confirmed breakout and subsequent flip of this level into support could open the door for a move toward $2.53 in the short term.

JTO Price Analysis. Source: TradingView

JTO Price Analysis. Source: TradingView

However, if profit-taking gains traction, JTO may face a temporary correction, with potential downside toward $2.01.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.