Solana Price Spikes 2% in a Week as DeFi Development Corp Boosts Solana Holdings by $2.7M

0

0

Highlights:

- The Solana price drops 2.69% to $146, but bulls target recovery towards $156.

- DeFi Development Corp acquires 17,760 SOL, raising total holdings to 640,585 SOL worth $2.7M.

- Solana bulls-eye key resistance levels at $156, $165, and $177 for recovery.

As of July 4, the Solana price is down 2.69% to trade at $146, with a 27% decline in daily trading volume over the past 24 hours. However, the token is up 2% over the past week, indicating growing hype in the market.

Recently, the DeFi Development Corp acquired an additional 17,760 SOL tokens, valued at approximately $2.7 million, which increased its holdings to 640,585 SOL tokens. Such a tactical acquisition further solidifies DeFi Development Corp’s presence in the expanding Solana ecosystem. This also expresses optimism regarding the long-term development opportunities of the Solana blockchain.

NEW: DeFi Development Corp bought another 17,760 $SOL worth about $2.7M, totaling 640,585 $SOL in its treasury. pic.twitter.com/za6NeFxCYT

— DeFAI Alpha (@defaialpha) July 4, 2025

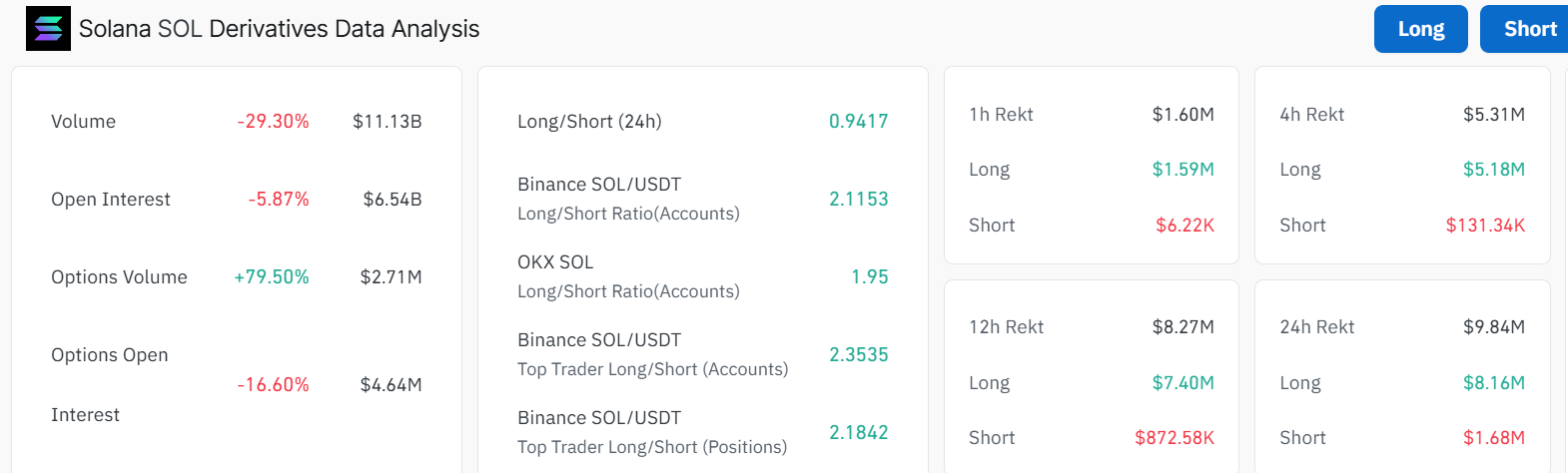

In parallel, the market statistics of Solana can be described as interesting changes. The daily trading volume of $SOL has decreased by 29.30%. This drop signals some short-term volatility, but the token still remains one of the most attention-seeking in the crypto world. Even after the price drawdown, the Solana market continues to attract attention with its current open interest of $6.54 billion.

The long-to-short ratio stands at 0.94, and high leverage is notable, indicating that people continue to be interested in $SOL. However, traders should probably watch volatility in Solana in the short term. Market activity is also worth monitoring by investors because these trends can make stronger price changes in the next few days.

Can Solana Price Rebound to the $156 Mark?

The Solana price is trading well within the confines of a falling wedge, with the bulls aiming for a potential reversal. Although the volume and recent price corrections are low, Solana still holds promise for a potential recovery. Despite the drop, the bulls seem to be gathering strength towards the immediate key barriers at $156 and $165.

The Relative Strength Index (RSI) of SOL at the moment stands at 47.64. This mid-range reading implies that $SOL may be well-positioned to reverse in the event of a positive market sentiment. However, traders must be cautious of any changes in the RSI, especially when it dips to oversold levels, as this may signal a potential retracement.

Additionally, the Moving Average Convergence Divergence (MACD) remains bullish, as the MACD line is above the signal line. Nonetheless, the spacing between the two lines has already reduced and this is an indicator that the bearish trend might be weakening. This means that traders are at liberty to buy more SOL tokens.

Solana Bulls Eye For a Bullish Reversal

The Solana price is showing mixed reactions. However, looking at the bigger picture, the 2% weekly pump signals growing hype, maybe fueled by the market sentiment surrounding the potential SOL ETF approvals soon.

In the meantime, if the bulls reclaim the $156 barrier and flip it into a support zone, a short-term rally could be plausible. The bulls could target $165, $177, and $185 marks. In the event of a clean breakout above the $185 mark, the $200 level is likely to follow. However, if the resistance zones prove too strong, the safety net at $136-$125 will cushion against further downside.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.