BlackRock’s BUIDL fund blows past $1bn as tokenised treasury sector hits record high

0

0

A year after its launch, investors have poured more than $1 billion into BlackRock’s tokenised treasury fund, BUIDL.

Issued by the $12 trillion asset manager and crypto firm Securitize, BUIDL offers crypto investors exposure to a basket of US Treasury bills, cash, and repurchase agreements on the Ethereum blockchain.

The fund crossed the ten-figure threshold on Thursday after a $200 million allocation by Ethena Labs, the creators of a dollar-pegged stablecoin called USDtb.

USDtb, which is backed primarily by BUIDL, is worth $542 million, according to CoinGecko.

“Ethena’s decision to scale USDtb’s investment in BUIDL reflects our deep conviction in the value of tokenised assets and the significant role they will continue to play in modern financial infrastructure,” Guy Young, the CEO and founder of Ethena, told DL News.

He said that BUIDL hitting the $1 billion benchmark indicates keen institutional interest in onchain products like BlackRock’s.

Tokenised treasuries hit new high

The influx of new investment into BlackRock’s fund has also sent the broader tokenised treasury sector into record territory.

Tokenised offerings from Franklin Templeton, Ondo Finance, and Superstate have pushed the market above $4.4 billion, according to data from RWA.xyz.

Since March 2024, the sector has quintupled and has been led primarily by the launch of BUIDL.

The buzzy sector has already led to some serious deal-making, too.

Last month, stablecoin giant Circle acquired Hashnote, which issues the second-largest tokenised fund.

Robert Leshner, the CEO and co-founder of Superstate, told DL News that the acquisition was “the firing gun” for a wave of traditional finance players to join the tokenised treasuries sector.

‘Disruptive trend’

Wall Street stalwarts have long been banging the tokenisation drum.

Jenny Johnson, the CEO of Franklin Templeton, oversaw the firm’s launch of its tokenised fund in 2021 and called tokenisation the “disruptive trend” to finance in 2024.

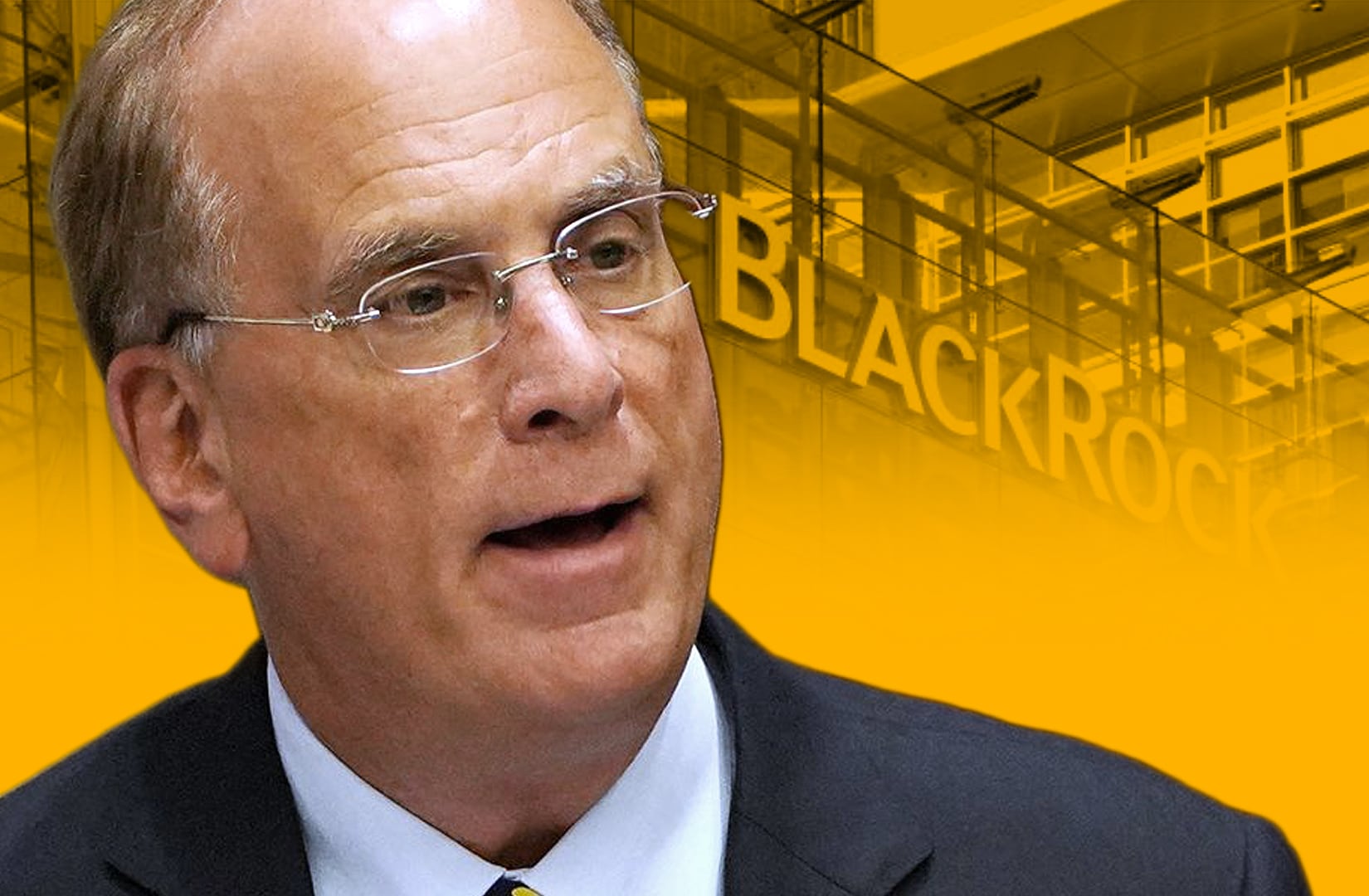

Larry Fink, the CEO of BlackRock, said in January he hopes the Securities and Exchange Commission will “rapidly approve the tokenisation of bonds and stocks.”

Liam Kelly is a Berlin-based reporter for DL News. Got a tip? Email him at liam@dlnews.com.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.