Bitcoin Price Drops Below $80K: Larry Fink Predicts Deeper Recession

0

0

The post Bitcoin Price Drops Below $80K: Larry Fink Predicts Deeper Recession appeared first on Coinpedia Fintech News

BlackRock CEO Larry Fink issued a stark warning about the US economy, saying that the country is likely already in a recession. Since the start of April, 2025, the S&P 500 index has declined by 10.11%. Currently, it sits at $5,062.24. Fink predicts that the stock market could fall another 20%. His comments come as Bitcoin signals bearish momentum with a death cross pattern. Here is what you need to know.

Bitcoin Triggers Death Cross: A Bearish Signal Emerges

Yesterday, the 50-day Simple Moving Average of Bitcoin dropped below its 200-day SMA. The pattern, which forms when a short-term moving average crosses below a long-term moving average, is known as a ‘Death Cross’. This is a bearish signal.

Since the start of April, the BTC market has declined by over 4.13%. On April 6 (just before the formation of the Death Cross pattern), the market dropped sharply by nearly 6.10%. Yesterday’s bullish momentum, which was triggered by a fake news report about the possible pause of Trump’s tariff action against China for around 90 days, failed to help the market recover from the sharp correction.

As of now, the BTC price sits at $79,060.

Experts believe that the crypto market is currently following the trend in the US economy, especially the US tech market.

The US stock market is currently in a highly turbulent state. The aggressive tariff policy of US President Donald Trump has created havoc across the globe, including in the US market.

Since the beginning of this month alone, the S&P 500 index has declined by approximately 9.56%.

Larry Fink: “We’re Probably in a Recession Already”

Interestingly, while speaking at an interview, BlackRock CEO Larry Fink stated that the US is probably already in a recession. He even warned that stock markets might fall another 20% due to fear triggered by steep US tariffs. He pointed out that tariffs might lead to higher prices and inflation.

No Major Rate Cuts Expected, Says Fink

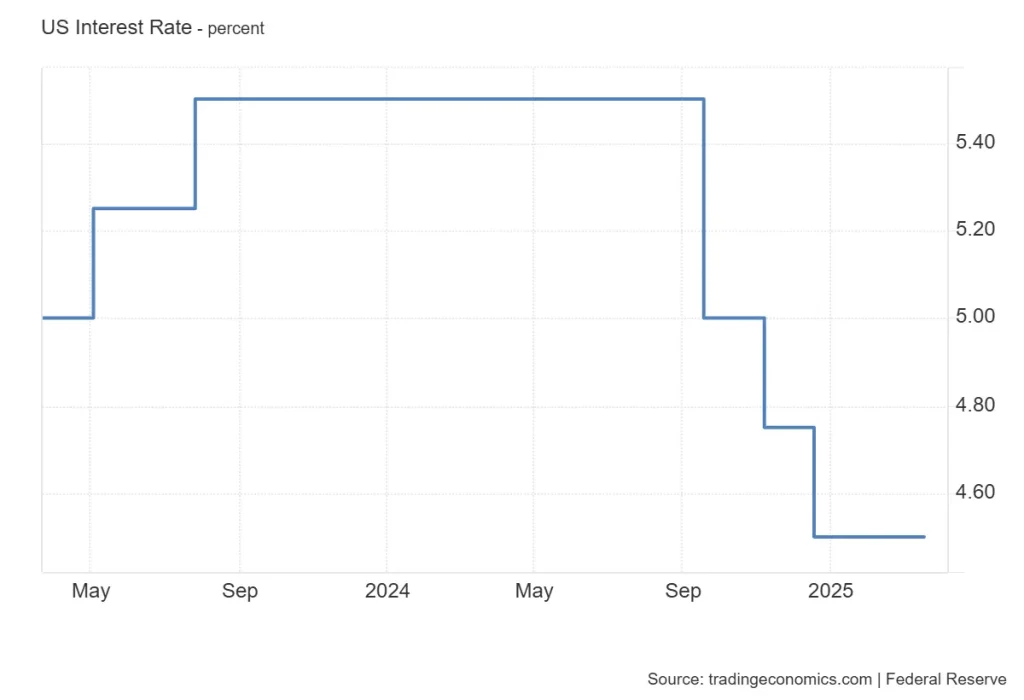

During the March 2025 meeting, the US Federal Reserve kept the funds rate unchanged at 4.25% to 4.5%.

There were rumours that the US Fed would resume its rate cut policy soon. In the previous year, the Fed implemented rate cuts at least 3 times.

While discussing the probability of Fed rate cuts, he denounced rumours that the Federal Reserve will consider 4 to 5 interest rate cuts this year.

Fink advised that the US government should implement pro-growth policies and focus more on deregulation.

Future Prospects of the Bitcoin Market

However, Fink revealed that the recent stock market fall could provide a long-term buying opportunity.

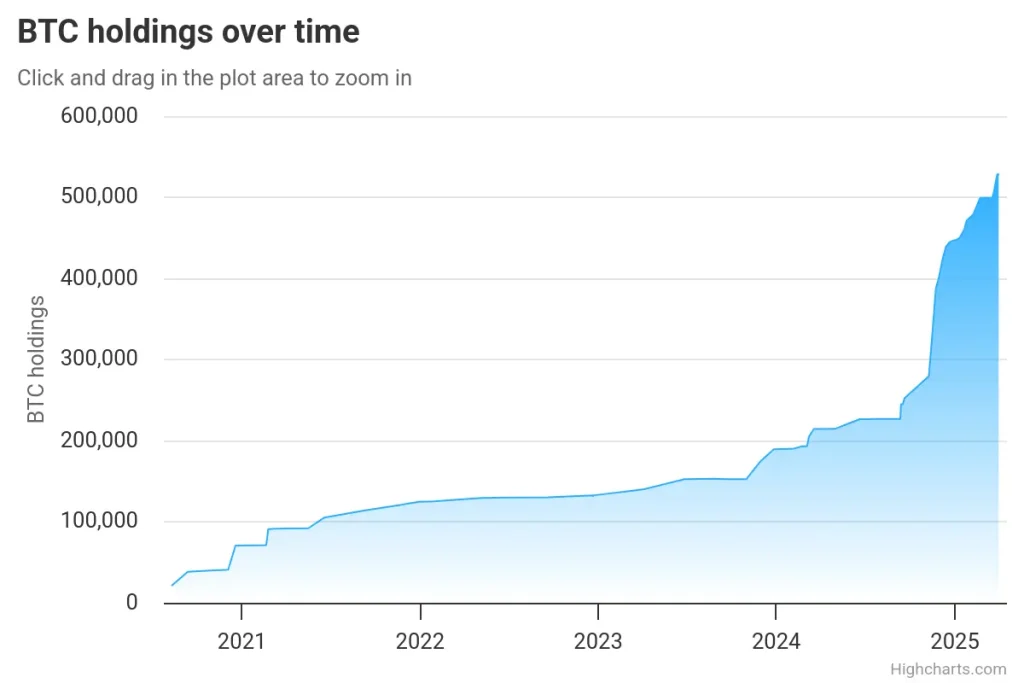

Interestingly, many crypto enthusiasts, especially Michael Saylor, share the same opinion as Fink on the matter of the future prospects of the BTC market.

Michael Saylor once said volatility would expel short-term players from the market and provide immense opportunities for long-term players.

Strategy holds at least 528,185 BTC, worth around $41,786,194,268. It is the public company that holds the highest number of BTC tokens.

BlackRock’s iShare Bitcoin Trust ETF is the largest BTC Spot ETF by market cap. It has a market cap of $44.82B. Its turnover rate is 10.647%. Its price is $44.27.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Yes, BlackRock CEO Larry Fink believes the U.S. is likely already in a recession due to tariffs and market instability.

Crypto often faces volatility in a recession as investors move to safer assets, but long-term holders may see opportunity.

Crypto usually drops too, as market panic leads to liquidity selling across stocks and digital assets alike.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.