$3.05M XRP Theft Traced to Southeast Asia’s Laundering Network: Key Lessons from Viral Ellipal Wallet Hack

0

0

- U.S. investor loses $3.05M XRP after Ellipal wallet hack.

- Stolen funds traced to Huione-linked laundering network in Southeast Asia.

- Experts warn confusion between cold and hot wallets risks major losses

A recent viral YouTube video has brought attention to a devastating crypto theft involving a U.S.-based investor who lost $3.05 million (1.2 million XRP) from their Ellipal wallet.

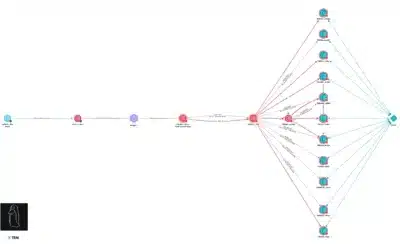

Blockchain investigator ZachXBT conducted an extensive tracing of the stolen funds and shared his findings on social media, revealing a complex laundering chain that led to criminal networks in Southeast Asia.

The case exposes the increasing sophistication of crypto thefts, as well as persistent issues surrounding wallet security, user awareness, and law enforcement response to digital crimes.

Tracing the Theft

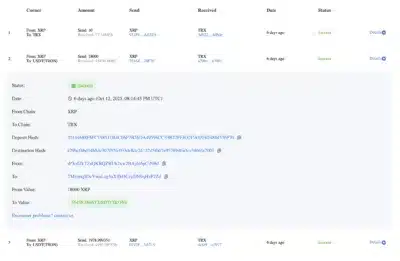

According to ZachXBT’s investigation, the theft took place on October 12, 2025, when the attacker carried out more than 120 Ripple-to-Tron swap transactions using Bridgers (formerly known as SWFT).

Although blockchain data showed the involvement of Binance, ZachXBT explained that Binance only served as a liquidity provider for Bridgers, which made tracing more complicated.

The stolen XRP was later consolidated into a Tron address (TGF3hP5GeUPKaRJeWKpvF2PVVCMrfe2bYw). Within three days, the entire amount had been laundered through over-the-counter (OTC) brokers connected to Huione, an online marketplace linked to several illicit activities across Southeast Asia.

Over the years, Huione has been associated with pig-butchering scams, investment fraud, human trafficking, and cyber exploits. The U.S. Treasury Department recently imposed further sanctions against the network after uncovering its involvement in billions of dollars’ worth of illegal transactions.

This finding reinforces Huione’s role as one of the largest laundering hubs for stolen cryptocurrencies.

Also Read: Jake Claver Drops Bombshell XRP Holders Need to Know: This Could Save You From Losing Thousands

5/ Huione has directly facilitated laundering billions in illicit funds over the past couple years from pig butchering scams, investment scams, human trafficking and hacks/exploits in Southeast Asia.

Last week the US applied additional restrictions against Huione in relation to… pic.twitter.com/L2ZIoMx6By

— ZachXBT (@zachxbt) October 19, 2025

Confusion Between Wallet Types

ZachXBT identified user confusion as one of the key reasons behind the theft. The victim believed they were using Ellipal’s cold wallet, an offline storage device that keeps private keys isolated from online access. However, upon investigation, it turned out that the wallet was actually a hot wallet, meaning it was connected to the internet and therefore far more vulnerable to attacks.

This misunderstanding is common among crypto users who often fail to differentiate between custodial and non-custodial wallets. A similar pattern has been observed with Coinbase users who, after being targeted by fake support agents, unknowingly transfer funds from their secure exchange accounts to compromised wallets.

ZachXBT stressed that crypto companies must do a better job in educating users about the different types of wallets and the risks involved, as product confusion continues to lead to major financial losses.

Challenges with Law Enforcement and Recovery

Despite the large amount stolen, the victim reportedly struggled to get assistance from U.S. law enforcement. ZachXBT noted that only a few countries, such as the United States, the Netherlands, Singapore, and France, have capable cybercrime units, and even then, the results often depend on the specific officers assigned to the case.

The shortage of experienced investigators in blockchain-related crimes means that even multimillion-dollar thefts often go unresolved.

Another issue highlighted by ZachXBT is the rise of predatory crypto recovery firms. He estimated that more than 95% of such companies take advantage of victims’ desperation, charging enormous fees for basic tracing reports with little or no real progress.

These firms typically stop their investigations at easily identifiable exchanges and issue reports suggesting victims “contact Binance,” even when the actual service involved, such as Bridgers, played a more critical role. Legitimate firms exist, but they face limitations, as recovering funds laundered through OTC brokers or unregulated markets is almost impossible.

Ripple Community and Broader Lessons

ZachXBT concluded that the likelihood of recovery in this case is extremely low, mainly due to the delay in reporting and the involvement of offshore networks. He advised victims to report stolen wallet addresses immediately to credible investigators or blockchain communities so the theft can be detected and flagged in time.

He also pointed out that Ripple’s victim support system is not as developed as those of other major networks like Bitcoin, Ethereum, and Solana, where collaborative tracing and community support are more active.

Ultimately, the case serves as a reminder that education and vigilance remain the strongest tools against crypto theft. As scams become more advanced and laundering networks expand across borders, crypto investors must ensure they understand their wallet systems, verify their storage methods, and act swiftly if funds go missing.

The Ellipal theft illustrates that in the crypto world, even a single misunderstanding can result in millions of dollars lost and almost no chance of recovery.

Also Read: Market Analyst: ‘XRP Predictions Overlook Basic Economic Principles’ – Here’s Why

The post $3.05M XRP Theft Traced to Southeast Asia’s Laundering Network: Key Lessons from Viral Ellipal Wallet Hack appeared first on 36Crypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.