Lion Group Holdings Unleashes Ambitious $600M Crypto Treasury Strategy with SUI Tokens Acquisition

0

0

BitcoinWorld

Lion Group Holdings Unleashes Ambitious $600M Crypto Treasury Strategy with SUI Tokens Acquisition

The world of traditional finance (TradFi) is increasingly intersecting with the dynamic, decentralized realm of cryptocurrencies. In a move that underscores this accelerating convergence, Lion Group Holdings (LGHL) has made a groundbreaking announcement that is set to reverberate across the digital asset landscape. For anyone tracking the evolution of institutional involvement in crypto, this development offers compelling insights into the future direction of corporate treasury management and digital asset integration.

Lion Group Holdings Dives Deep with Strategic SUI Tokens Acquisition

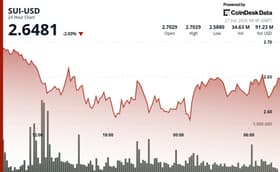

In a significant declaration, Lion Group Holdings has officially unveiled its plans to acquire a substantial amount of SUI tokens, marking a pivotal moment in the firm’s overarching $600 million crypto treasury strategy. This strategic pivot signals LGHL’s profound commitment to embedding itself within the burgeoning blockchain ecosystem. The news, initially reported by CoinDesk, highlights not just a passive interest but an active, aggressive push into digital assets.

Beyond the headline-grabbing SUI acquisition, LGHL also revealed a notable $2 million purchase of HYPE tokens. While SUI represents a foundational Layer 1 blockchain, HYPE tokens likely serve a specific utility within a particular ecosystem, showcasing LGHL’s diversified approach to its digital asset portfolio. This multi-token approach suggests a well-thought-out strategy rather than a speculative gamble, aiming to capitalize on various facets of the blockchain economy.

The core of this ambitious initiative lies in LGHL’s commitment to allocate a substantial 75% of proceeds from a convertible debenture facility specifically towards further token acquisitions. This mechanism provides a clear roadmap for how the firm intends to fund its aggressive foray into the crypto space, with SUI tokens explicitly named as a primary target for these future purchases. It’s a clear signal: Lion Group Holdings isn’t just dipping its toes; it’s diving in headfirst.

What Does a $600 Million Crypto Treasury Strategy Entail?

The concept of a crypto treasury strategy is gaining traction among forward-thinking corporations. Unlike traditional corporate treasuries that primarily focus on cash management, liquidity, and risk mitigation using fiat currencies and conventional financial instruments, a crypto treasury expands this scope to include digital assets. For Lion Group Holdings, a $600 million allocation represents a monumental commitment, positioning them as a significant institutional player in the crypto market.

Typically, a crypto treasury strategy aims to achieve several objectives:

- Diversification: Adding uncorrelated or less correlated assets to a traditional balance sheet to potentially reduce overall portfolio risk and enhance returns.

- Inflation Hedge: Viewing certain cryptocurrencies, like Bitcoin or potentially even robust Layer 1 tokens like SUI, as a hedge against fiat currency devaluation.

- New Revenue Streams: Exploring opportunities through staking, DeFi protocols, or participation in blockchain governance to generate yield or capital appreciation.

- Strategic Positioning: Establishing a presence in the Web3 space to understand and leverage emerging technologies and business models.

For LGHL, this strategy appears to be a blend of these goals, aiming to secure a competitive edge in a rapidly evolving financial landscape. The sheer scale of the $600 million allocation underscores the firm’s belief in the long-term value and disruptive potential of blockchain technology and digital assets.

Fueling the Future: How Does a Convertible Debenture Facilitate Token Acquisition?

The announcement mentioned that 75% of proceeds from a convertible debenture facility would be used for further token acquisition. This is a crucial financial detail that sheds light on LGHL’s funding mechanism.

A convertible debenture is a type of long-term debt instrument that can be converted into a predetermined number of common shares (or, in this case, potentially linked to the firm’s overall digital asset performance or specific tokens) at the investor’s option. Key aspects include:

- Debt First: Initially, it functions as a loan to the company, providing capital without immediate equity dilution.

- Conversion Option: Investors have the option to convert their debt into equity (or another asset class) if the underlying asset’s price performs well, offering potential upside.

- Lower Interest Rates: Due to the conversion option, convertible debentures often carry lower interest rates than traditional bonds, making them an attractive financing option for companies.

By using a convertible debenture facility, Lion Group Holdings can raise significant capital for its crypto treasury without immediately diluting its existing shareholders. It allows investors to participate in the potential upside of LGHL’s digital asset strategy while having the safety net of a debt instrument. This sophisticated financing approach highlights the seriousness and strategic depth behind LGHL’s move into the crypto space.

What Does This Mean for the SUI Blockchain Ecosystem and Beyond?

The institutional backing from a publicly traded entity like Lion Group Holdings is a significant validation for SUI tokens and the broader SUI blockchain ecosystem. SUI, developed by Mysten Labs (founded by former Meta employees who worked on Diem and Novi), is a Layer 1 blockchain designed for high performance, low latency, and scalability, utilizing the Move programming language. This acquisition could have several profound implications:

- Enhanced Legitimacy: Institutional investment often brings a stamp of approval, signaling to other large players and retail investors that the asset is viable and has long-term potential.

- Increased Liquidity: Large-scale acquisitions can boost market liquidity for SUI, making it easier for larger trades to occur without significant price slippage.

- Developer Confidence: With increased institutional interest and potential funding, the SUI ecosystem might attract more developers and projects, fostering innovation and growth.

- Broader Adoption: LGHL’s involvement could pave the way for SUI to be integrated into more traditional financial products or services, expanding its utility and reach.

This move by Lion Group Holdings also serves as a powerful case study for other traditional financial institutions contemplating their entry into the digital asset space. It demonstrates a viable pathway for integrating cryptocurrencies into corporate strategies, potentially catalyzing further institutional adoption across the entire blockchain ecosystem.

Navigating the Challenges in the Token Acquisition Journey

While the prospects of a robust crypto treasury are enticing, Lion Group Holdings will undoubtedly face a unique set of challenges in its token acquisition journey:

- Market Volatility: Cryptocurrencies are known for their extreme price fluctuations. Managing a $600 million portfolio in such a volatile environment requires sophisticated risk management strategies.

- Regulatory Uncertainty: The regulatory landscape for digital assets is still evolving globally. LGHL will need to navigate complex and often ambiguous regulations concerning token holdings, trading, and reporting.

- Custody and Security: Securing such a large volume of digital assets is paramount. Implementing robust custody solutions, whether self-custody or third-party institutional custodians, will be critical to prevent hacks or loss.

- Integration Challenges: Integrating digital assets into existing accounting, legal, and operational frameworks of a traditional financial firm can be complex and resource-intensive.

LGHL’s success will hinge on its ability to effectively address these challenges, demonstrating that traditional firms can indeed manage the complexities of the digital asset world responsibly.

Conclusion: A New Era for Lion Group Holdings and the Blockchain Ecosystem

Lion Group Holdings’ bold decision to pursue a $600 million crypto treasury strategy, spearheaded by significant SUI tokens acquisition, marks a transformative moment for the company and a strong signal for the broader financial industry. This strategic commitment to the blockchain ecosystem, funded in part by a sophisticated convertible debenture facility, positions LGHL as a trailblazer in integrating digital assets into traditional corporate finance.

As the lines between conventional finance and the decentralized world continue to blur, LGHL’s initiative offers valuable insights into the evolving landscape of institutional investment. It highlights the growing recognition of digital assets not merely as speculative instruments but as legitimate components of a diversified, forward-looking treasury. The journey ahead will undoubtedly present its share of challenges, but the strategic intent behind this substantial token acquisition signals a profound belief in the enduring power and potential of blockchain technology.

To learn more about the latest crypto market trends, explore our article on key developments shaping institutional adoption and future price action.

This post Lion Group Holdings Unleashes Ambitious $600M Crypto Treasury Strategy with SUI Tokens Acquisition first appeared on BitcoinWorld and is written by Editorial Team

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.