0

0

Digital asset investment products recorded another week of net inflows. According to CoinShares data, crypto ETPs attracted a total of $864 million in inflows over the past week, the third consecutive week of positive flows.

Total assets under management rose to around $180 billion, although this figure remains well below the previous all-time high of $264 billion, noted CoinShares in its digital asset fund flows report.

While the US Federal Reserve announced another interest rate cut, price action across major cryptocurrencies remained mixed. CoinShares added:

“Despite the recent interest rate cut by the US Federal Reserve, price performance has been subdued, with trading days following the cut showing mixed sentiment and uneven flows.”

Bitcoin BTC $86 796 24h volatility: 2.4% Market cap: $1.73 T Vol. 24h: $39.82 B once again captured the largest share of inflows. Last week, BTC-linked products attracted between $352 million and $522 million, depending on regional reporting.

At the same time, short-Bitcoin products recorded $1.8 million in outflows, a signal that investors aren’t betting against the asset.

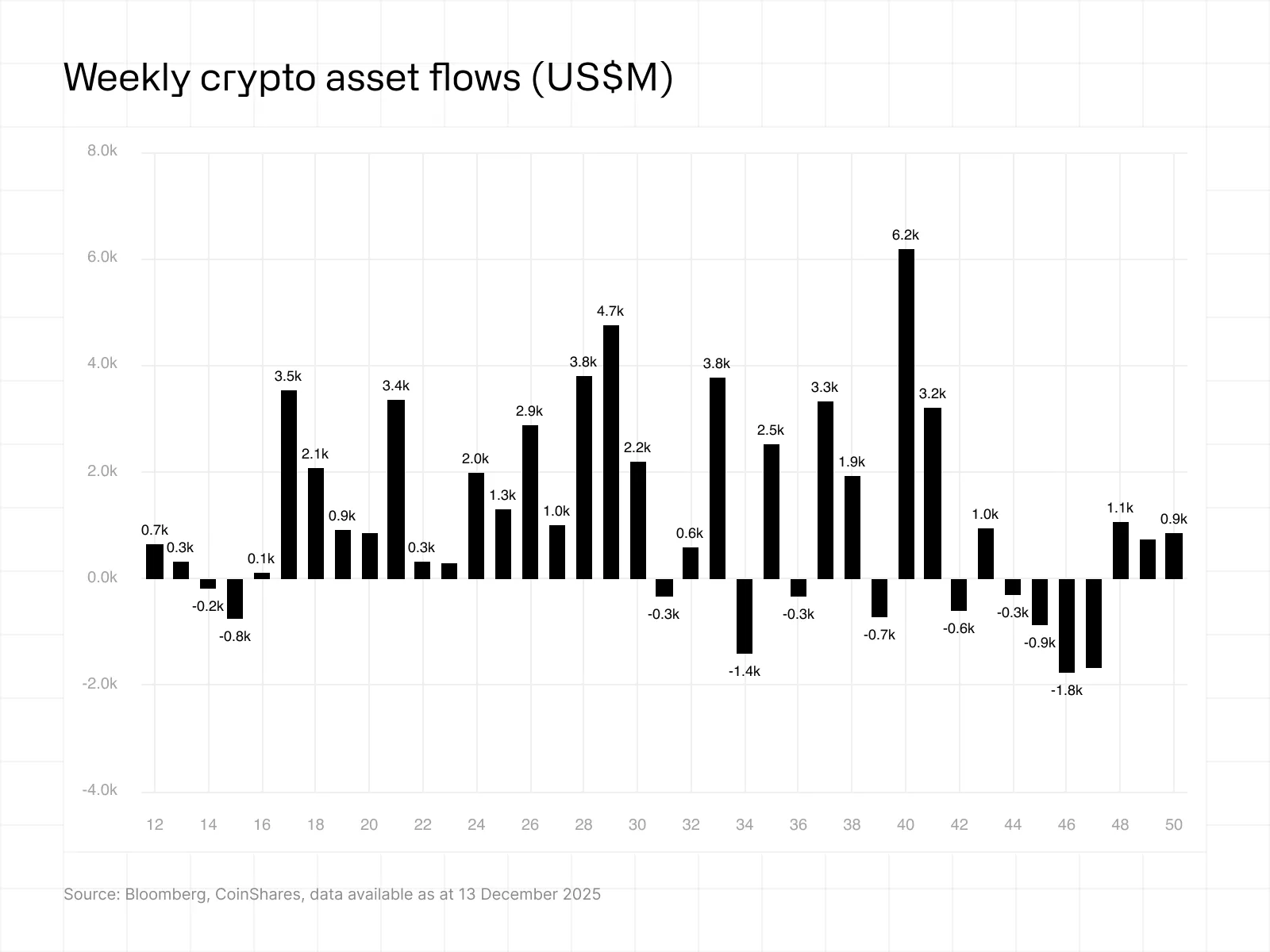

Weekly crypto asset flows in USD. | Source: CoinShares

XRP XRP $1.92 24h volatility: 3.6% Market cap: $116.25 B Vol. 24h: $2.54 B followed BTC with roughly $245 million in weekly inflows. This strong demand placed XRP among the top-performing assets in terms of fund interest. Chainlink LINK $12.84 24h volatility: 4.7% Market cap: $8.97 B Vol. 24h: $546.61 M also stood out, with $52.8 million in inflows.

Ethereum ETH $2 997 24h volatility: 2.7% Market cap: $362.17 B Vol. 24h: $24.99 B saw $338 million in inflows, bringing the year-to-date total to $13.3 billion, up 148% compared to the same period last year.

On the other hand, US-based products recorded between $483 million and $796 million in weekly inflows. Germany followed with inflows ranging from $68 million to nearly $97 million, while Canada added between $26 million and $81 million.

Together, the US, Germany, and Canada now represent nearly 99% of total year-to-date inflows. However, this also indicates how concentrated institutional crypto demand is, limited to a few regions around the globe.

CoinShares data shows mixed weekly flows across blockchain ETPs with funds such as VanEck Digital Transformation and VanEck Crypto and Blockchain recording notable inflows of $45.8 million and $20.5 million, respectively.

On the provider side, iShares led weekly inflows with more than $350 million, followed by strong contributions from Fidelity ($84 million), ProShares ($77.36 million), and Volatility Shares ($162 million).

Grayscale, meanwhile, continued to record outflows on both weekly ($12 million) and month-to-date measures ($20 million). However, the firm still holds a large share of total assets.

The post Crypto Inflows Hit $864M: BTC, XRP Dominate appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.