XRP Price Poised for 73% Rally or 68% Crash—What Happens at $2?

0

0

NAIROBI (Coinchapter.com)— XRP price hovered near $2.06 on Apr. 4 after days of intense volatility pushed major altcoins toward key support zones. While Bitcoin price in USD terms held above $83,000, Ripple’s XRP tested the $2.00 threshold multiple times, raising concerns over its short-term direction.

A bullish chart pattern now presents a possible 73% upside, but bearish signals and weak on-chain metrics suggest a potential 68% crash remains in play.

XRP $2 Support Holds—for Now

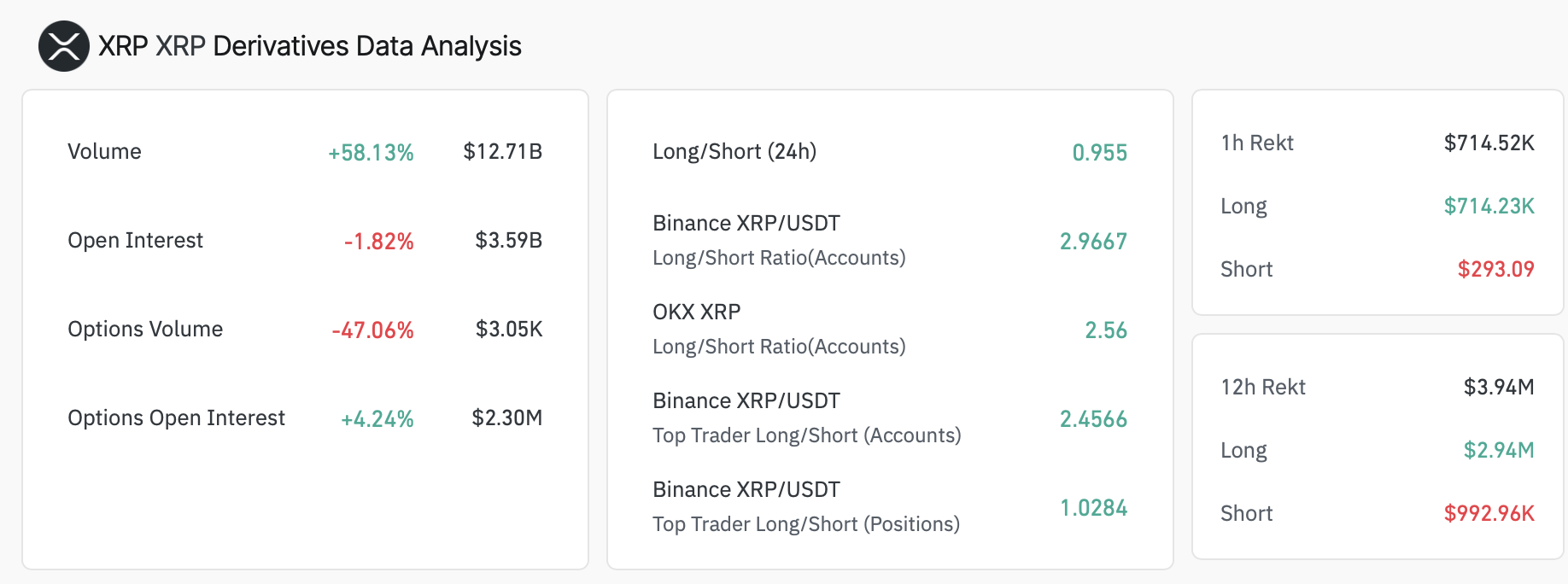

XRP stabilized near $2.06 after recovering from a sharp 5.3% drop triggered by U.S. President Donald Trump’s new reciprocal tariffs. The ‘Liberation Day’ policy, which imposes a 10% base charge on imports, rattled global markets, causing $3.94 million in XRP liquidations alone.

XRP derivatives liquidation. Source: Coinglass

XRP derivatives liquidation. Source: Coinglass

According to Coinglass, $2.94 million in long positions were wiped out within 24 hours. The cryptocurrency’s current bounce comes as broader risk markets digest Trump’s trade stance and await regulatory clarity.

Despite the bounce, XRP remains on shaky ground. The token retested its $2.00 support at least three times over the past two weeks. Analysts warn that repeated tests could exhaust buyer interest, potentially leading to a breakdown.

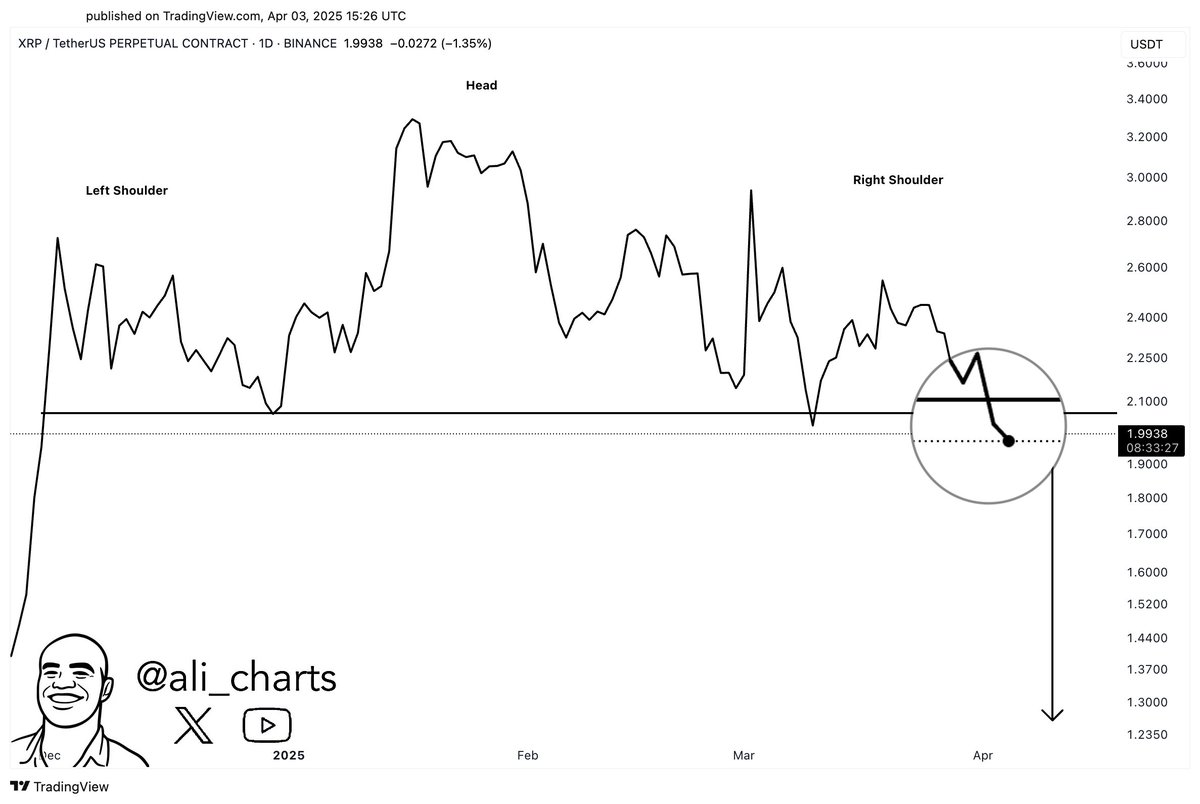

XRP Price Chart Patterns Hint at Diverging Paths

A symmetrical triangle breakout on XRP’s daily chart suggests a 70% upside target near $3.55, based on the pattern’s measured move. The breakout follows weeks of price compression between the 50-day and 200-day exponential moving averages.

At the same time, popular analyst Ali Martinez noted a bearish head-and-shoulders pattern. He warned of a possible drop to $1.30, tweeting,

“$XRP is breaking out of a head-and-shoulders pattern, setting the stage for a potential move to $1.30!”

Retail FOMO Losing Steam?

XRP’s explosive 600% rally in the past year came with a surge in speculative interest. But that momentum now appears to be fading. Data from Glassnode shows the number of active addresses fell from 10,200 in Jan. to just 4,388 as of Apr. 4.

Realized profit/loss ratios continue to decline. Analysts at Glassnode attribute this to retail traders facing unrealized losses, saying:

“Retail investor confidence in XRP may be slipping… this may also extend across the broader market.”

The XRP realized cap surged from $30.1 billion to $64.2 billion since late 2024, with over $30 billion coming from new holders. However, many of these addresses now face losses, which could pressure the price further if sentiment continues to sour.

Ripple’s Stablecoin Push and Utility Boost

Ripple’s integration of its USD-pegged stablecoin, RLUSD, into its cross-border payments system could offer some support. The company confirmed the move on Apr. 2, stating that RLUSD will enhance liquidity and adoption alongside XRP.

RLUSD’s market cap rose by 87% in March alone to $244 million, according to rwa.xyz. Alva, a crypto insights platform, noted on Apr. 3:

“Ripple’s $RLUSD integration is a pivotal move for cross-border payments… optimism around $RLUSD soaring, with eyes on its ripple effect on XRP.”

Pairing RLUSD with XRP on the XRP Ledger could drive trading volume on its decentralized exchange, reducing circulating supply.

Whale Selling Clouds Long-Term Outlook

However, long-term holders appear to be reducing exposure. CryptoQuant data shows over $1 billion worth of XRP moved out of whale addresses in the last 14 days. These positions were offloaded at an average price of $2.10, suggesting even large investors see limited upside near current levels.

On-chain supply data from Santiment also highlights growing concerns. The total supply of XRP continues to rise due to Ripple’s monthly token releases, adding downward pressure on price.

Network growth is also in decline, dropping from 514 to 42 since Feb., a signal of waning user adoption.

Bitcoin Price USD and Macro Sentiment

While XRP struggles near $2.00, Bitcoin price in USD terms remains rangebound above $83,000. The macro backdrop, including Trump’s tariffs and global market anxiety, continues to weigh on crypto sentiment.

With XRP now squeezed between conflicting technical setups and deteriorating fundamentals, the $2.00 level becomes a key pivot. A decisive move above $2.35 could validate the bullish breakout, while a dip below $1.95 may invite aggressive selling.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.