Bitcoin and Ethereum ETFs See Strong Inflows Amid Tariff Worries

0

1

Highlights:

- Bitcoin and Ethereum ETFs have ended the week profitably after attracting significant cash inflows between May 19 and 23.

- BTC funds recorded $211.74 million in gains on May 23, while ETH had $58.63 million in profits.

- The positive ETFs’ trend persisted amid growing tariff tension.

Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs) have continued their stellar performance, with combined net inflows totaling about $270 million on May 23. According to SosoValue’s data, Bitcoin ETFs extended their profitable streak to the eighth consecutive day with net inflows worth $211.74 million. Similarly, Ethereum ETF investors invested $58.63 million in ETH funds to mark the ETFs’ sixth straight gains.

On May 23, spot Bitcoin ETFs saw a total net inflow of $212 million, marking eight consecutive days of net inflows. Spot Ethereum ETFs recorded a total net inflow of $58.63 million, with six consecutive days of net inflows.https://t.co/ueXcZjub6m

— Wu Blockchain (@WuBlockchain) May 24, 2025

These profitable trends have persisted amid tension from Trump’s threatened tariffs on Apple and the EU (European Union) products. On May 23, the US president announced plans to impose a 50% import duty on EU goods and a 25% tariff on Apple products.

Trump stated in a social media post:

“Our discussions with them are going nowhere. Therefore, I am recommending a straight 50% tariff on the EU, starting on June 1, 2025.”

US-EU trade war,: Trump wants to impose 50% tariffs on goods from the European Union as early as June 1 pic.twitter.com/95zPrGRVCe

— King Chelsea Ug

(@ug_chelsea) May 23, 2025

Considering the generalized market declines that accompanied the trade war between the US and China, market participants have raised possible reoccurrence concerns. However, the crypto market has only suffered slight declines. For context, Bitcoin dropped 0.1% in the past 24 hours, reflecting about $108,800 in selling price. Within the same timeframe, Ethereum forfeited 0.5%, with price extremes fluctuating between $2,518.55 and $2,583.95.

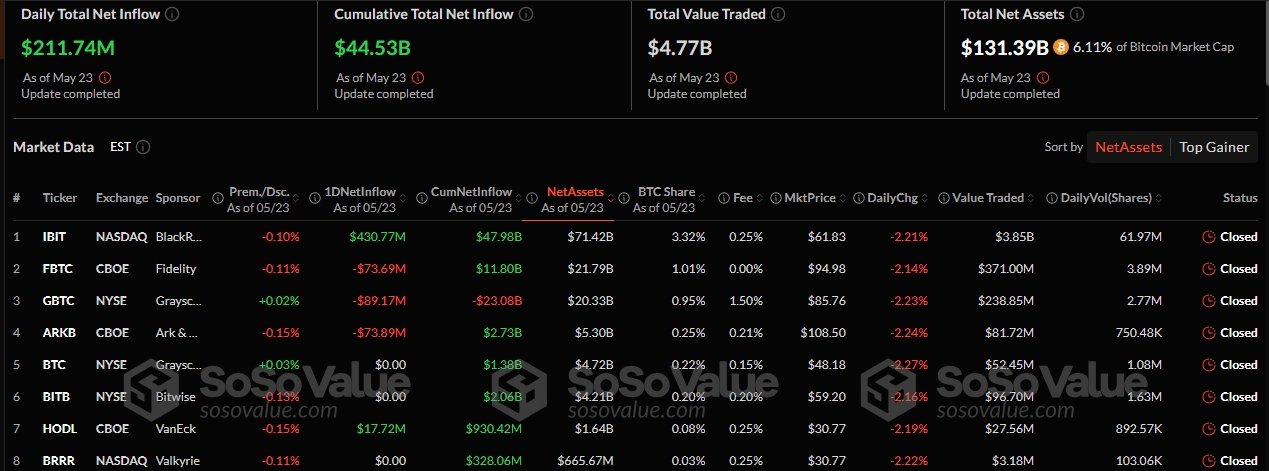

BlackRock Drives BTC ETFs’ Net Inflows Surge

Yesterday, only five Bitcoin ETFs recorded market activity, as the remaining seven experienced neither inflows nor outflows. Among the active funds, only BlackRock Bitcoin ETF (IBIT) and VanEck Bitcoin ETF (HODL) had inflows. These ETFs gained worth $430.77 million and $17.72 million, respectively.

The above inflows were sufficient to offset the deficits from three other funds, including Grayscale Bitcoin ETF (GBTC), ARK 21Shares Bitcoin ETF (ARKB), and Fidelity Bitcoin ETF (FBTC). These ETFs forfeited $89.17 million, $73.89 million, and $73.69 million, respectively.

Having recorded only profits between May 19 and 23, Bitcoin ETFs concluded the week with net inflows, valued at approximately $2.75 billion, marking the commodities’ sixth consecutive weekly gains. Meanwhile, Bitcoin ETFs’ total net assets depreciated from $134.30 billion to $131.39 billion. Similarly, the total value traded depreciated to $4.76 billion from $5.39 billion. However, the cumulative net inflows rose from $44.31 billion to $44.53 billion.

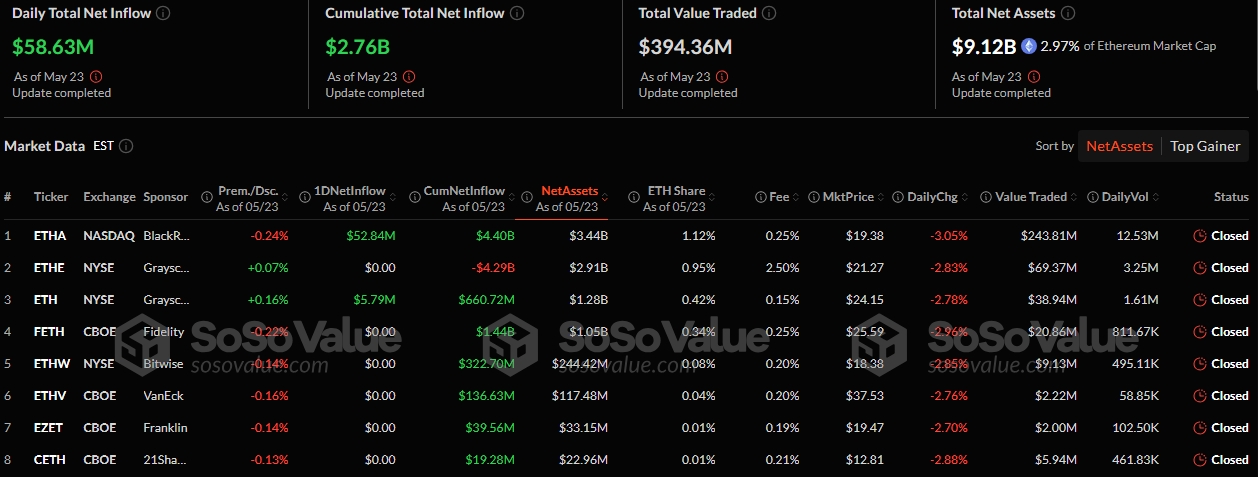

Ethereum ETFs Record Second-Highest Weekly Gains for the Year

On May 23, only two Ethereum ETFs were active, as the remaining seven funds neither gained nor lost. The active ETFs had only gains. They include BlackRock Ethereum ETF (ETHA) with $52.84 million cash inflows and Grayscale Mini Ethereum ETF (ETH) with profits worth $5.79 million. Yesterday’s net inflows imply that Ethereum ETFs had only profits in the just concluded week. Consequently, the funds’ net weekly profit surged to about $248.31 million, marking the ETFs’ second-highest weekly net inflows in 2025.

While ETF investors intensify ETH investments, whales’ interest in the token has remained strong. On May 20, Lookonchain tracked massive ETH accumulations from eight newly created wallets. The on-chain monitor stated that the wallets procured 105,736 ETH, valued at approximately $262 million on Kraken. “It is possible that Jeffery Wilcke did not intend to sell ETH but just transferred them to other wallets,” Lookonchain added.

Notably, 8 newly created wallets withdrew 105,736 $ETH($262M) from #Kraken after Jeffrey Wilcke's deposit.

It is possible that Jeffrey Wilcke did not intend to sell $ETH, but just transferred them to other wallets.https://t.co/LjqeHSUuQF https://t.co/f0DPKBmD1A pic.twitter.com/zsC40CkWaD

— Lookonchain (@lookonchain) May 20, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

1

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.