Why is Crypto Down Today? $630 Million Liquidated as Bitcoin Holds $120K and Solana Eyes HUGE Breakout

0

0

Why is Crypto Down Today? The crypto market just faced its sharpest liquidation wave of October, catching overleveraged bulls off guard. Peace in the Middle East, anon. All safe haven assets are going to crash 80 percent, and leveraged speculative investments are going to 100x.

Or are they?

So far more than $630 million in positions were wiped out on October 9, according to data from Coinglass, with over 81% of those being long bets. dropped around 2%, while , BNB, and XRP each fell roughly 4%.

Can you guys please keep the crash to yourself and not bring the other market down with you? Here’s what’s going on with Bitcoin and Alt-Season:

DISCOVER: Top 20 Crypto to Buy in 2025

Why is Crypto Down Today? Market Pullback Erases $200 Billion in Value

Crypto Fear and Greed Chart

The 2025 Altseason has been BNB and XRP gaining slight dominance and further milking the rest of the altcoin market

It’s grim. After brushing a record $4.27 Tn in the total crypto market cap earlier this week, nearly $200 Bn evaporated, pulling valuations back to mid-September levels. Bitcoin is still holding above $120,000, up roughly 8% on the month, while Ethereum hovers just under $4,500 as traders take some chips off the table.

Making money in crypto in 2025pic.twitter.com/lq8J3VyB7z

— Prince (@PetitPrinceETH) October 9, 2025

The selloff isn’t a mystery but macro. A cocktail of Fed uncertainty, fading liquidity, and simple profit-taking, all hitting at once, has drained liquidity from the market (all except from Zcash, BNB and a few others).

The sell-off coincided with renewed concerns from the Federal Reserve over inflation.

“The FOMC should be cautious about adjusting policy so that we can gather further data,” Barr said, signaling that the Fed is not ready to declare victory over inflation.

Bond markets reflected that caution. 10-year Treasury yields held near 4.13%, while 30-year notes hovered around 4.72%, both showing minimal movement from last week’s auctions.

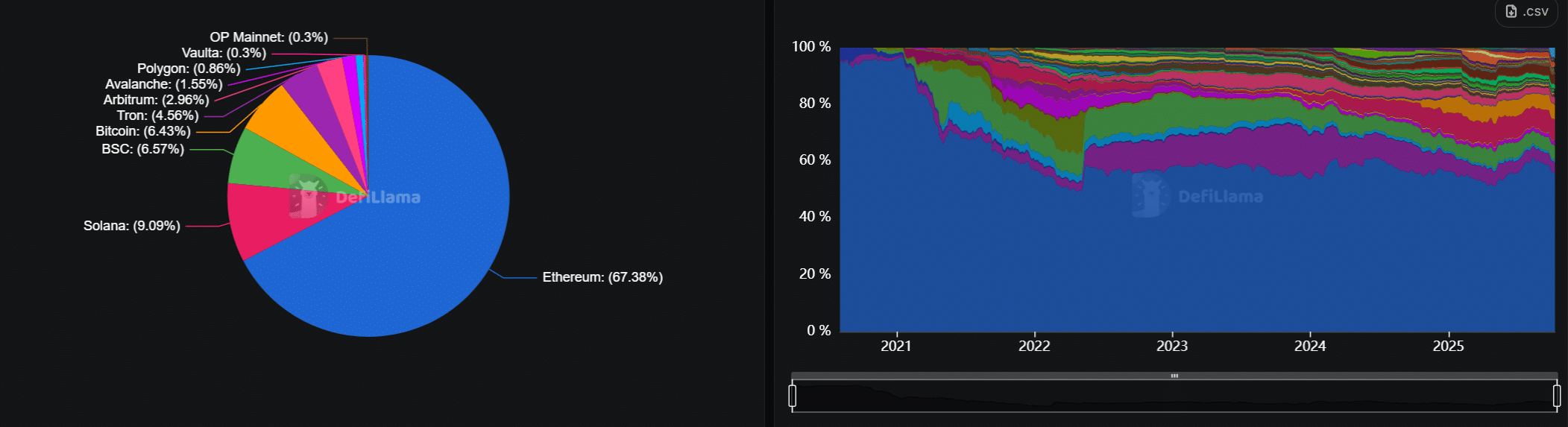

Mid-cap projects such as Aptos (APT) and Sui (SUI) declined between 3–6% as leveraged traders exited positions. Yet data from DeFi Llama shows that overall total value locked (TVL) across DeFi protocols remains near $166 billion, suggesting that long-term confidence hasn’t broken.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Altcoins Under Pressure as Traders Reset: Where Do We Go Next?

99Bitcoins analysts note that market structure remains broadly bullish despite the pullback. The correction was likely a leverage flush, not the start of a new downtrend.

Amid the sea of red, is flashing one of the strongest technical setups of any major asset. The token appears to be forming a classic “cup and handle” pattern on its monthly chart.

With speculation mounting around a potential Solana ETF approval, SOL’s bullish structure could signal a breakout opportunity for traders positioning into Q4.

DISCOVER: 20+ Next Crypto to Explode in 2025

Macro Still Favors Risk in the Long Term

Despite the shakeout, fundamentals remain supportive for digital assets. Liquidity metrics from the Federal Reserve’s FRED database show global money supply expanding by nearly 8% year-over-year, and institutional inflows into spot Bitcoin ETFs continue to trend higher.

For now, Bitcoin above $120,000 remains the key line in the sand and if that holds, the bulls might not stay quiet for long.

EXPLORE: Binance Japan Banks On PayPay’s Network Effect For Smoother Crypto Payments

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The crypto market just faced its sharpest liquidation wave of October, catching overleveraged bulls off guard

- Mid-cap projects such as Aptos (APT) and Sui (SUI) declined between 3–6% as leveraged traders exited positions.

The post Why is Crypto Down Today? $630 Million Liquidated as Bitcoin Holds $120K and Solana Eyes HUGE Breakout appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.