Cardano Price Stabilizes Around $0.66 After Sharp Dip: What to Expect?

0

0

Key Insights:

- Cardano price holds firm at $0.66 after retesting $0.58–$0.62 support zone multiple times since March 2025.

- Large ADA transactions topped $9.12B in April 2025, signaling renewed whale accumulation.

- Bitcoin OS enables bridgeless BTC transfers to Cardano, boosting cross-chain functionality without intermediaries.

Cardano(ADA) price is holding steady near $0.66 following a sharp drop in early May. The digital asset, trading under the ticker ADA, faced strong market pressure and saw its value dip to a low of around $0.6541.

Despite a 2.78% 24-hour loss, data shows the token remains above a key support range. Investors and analysts are now closely watching this zone for signs of stability or further weakness.

Cardano Price Technical Structure Holds Near Key Support Levels

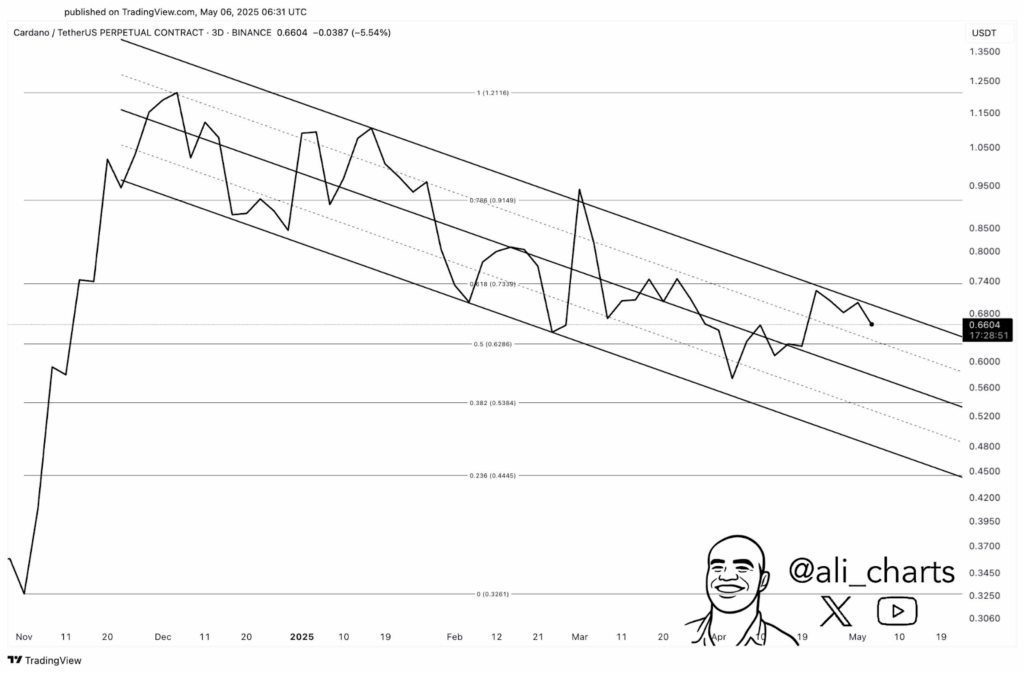

Cardano’s recent trading range falls between $0.6692 and $0.6936, which reflects a period of low volatility after recent declines. Analysts such as Ali Chart noted that ADA was rejected at the upper boundary of a descending channel. This movement suggests continued resistance and the potential for a short-term dip toward $0.60 or $0.54.

Despite the downward movement, ADA price continues to hold above the midline Fibonacci retracement level of 0.618, near $0.739. The price now consolidates just above $0.66, which has acted as an accumulation zone in previous cycles.

Chart patterns show consistent rebounds from the lower boundary of a long-term descending channel, a technical structure often watched for breakout setups.

While price action remains limited, recent volume spikes on green candles hint at rising buying interest. Technical momentum indicators such as MACD and RSI are neutral. However, there are signs of hidden bullish divergence developing, where price makes lower lows while indicators make higher lows.

Whale Activity Signals Institutional Repositioning

On-chain data highlights a sharp increase in large transaction volumes during April 2025. According to blockchain metrics, transactions exceeding $100,000 rose significantly before ADA reached the $0.90 to $1.00 range.

These moves are commonly associated with whales and institutional participants, signaling possible accumulation during price weakness.

Whale volume peaked at $9.12 billion on December 2024, and saw a low of $7.46 billion by April 2025. This decline may indicate a cooling-off period or consolidation. Analysts caution that traders should monitor upcoming volume patterns to determine whether it reflects accumulation or distribution.

Historical comparisons to earlier cycles, including early 2021, show similar spikes in large transactions followed by strong price rallies. Market observers are now watching to see if these conditions return as ADA price tests resistance near $0.70 and support at $0.60.

New Blockchain Development Shows Cross-Chain Progress

In a major development, developers from BitcoinOS successfully transferred Bitcoin to a Cardano wallet and back without a bridge or third-party service. This was done without using custodians or intermediaries, which is often seen in current bridge technologies.

The developers claim this breakthrough allows Bitcoin to be used across blockchains while maintaining control of private keys. Experts say that this could support new decentralized applications on Cardano by enabling direct Bitcoin interaction.

This bridgeless transfer process may help expand Cardano’s role in blockchain interoperability. It could also drive developer interest and adoption, especially for decentralized identity and governance systems in global markets.

Cardano Price Holds Key Support as Buyers Defend $0.66 Level

The price of Cardano (ADA) is currently at $0.66 as shown in the TradingView chart below, indicating that it is still in a descending channel. From this chart, one can state that it is a relatively new formation for ADA price, and it has made a higher low recently – this can mean that the situation is changing.

Subsequently, the price bounced off the $0.58 – $0.62 support area as it is a valid price level where buyers could congregate to accumulate more coins.

The trading channels show tight Bollinger Bands around $0.66 and a neutral MACD line close to zero. Flattened and long tail of green candles implies that volume has been slightly rising implying more buyers are coming into the market.

Analysts are monitoring resistance levels at $0.70, $0.78, and $0.88, with a potential breakout toward $1.00 if ADA moves above the descending trendline.

The Fibonacci retracement tool on TradingView places ADA in the 0.618–0.5 range, often known as the “golden pocket.” This level is particularly considered as a reversal zone level. So, if this pressure continues and volume starts accumulating, ADA could retest upper resistance levels any time soon, especially with strengthened bullish candlestick formation.

The post Cardano Price Stabilizes Around $0.66 After Sharp Dip: What to Expect? appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.