Crypto Prices Today, Nov 10: Relief Rally Lifts BTC, ETH, XRP, SOL as Buyers Return

0

0

The crypto prices caught a breath with lawmakers moving a funding bill forward, risk appetite improved and majors turned green. Bitcoin hovered near 106,500 after brushing a 101,500 floor earlier in the session. Ethereum climbed toward the mid 3,600s. XRP traded near 2.45. Solana pushed to the high 160s. The broader market value expanded, while sentiment nudged out of fear as leveraged shorts unwound.

Real-time board data backed the move. The global market cap advanced by roughly four percent on the day, with aggregate volumes rising and Bitcoin dominance steady in the high fifties. Spot readings for BTC, ETH, XRP, SOL, and BNB aligned with the rebound narrative, pointing to orderly demand rather than a one-off squeeze.

The drivers to watch today

Progress on reopening the government reduces uncertainty around agency operations. Crypto prices participants have treated that as a quiet liquidity release, the kind that gradually restores risk taking. The same playbook appeared before, and the article’s tape shows traders leaning back into longs while liquidations fade and open interest rebuilds. If the headline risk keeps cooling, dips may find buyers faster than last week.

Bitcoin: holding the 106,000 shelf

Bitcoin’s intraday structure improved after reclaiming 106,000. If price holds above that shelf, a push into 107,500 to 110,000 is reasonable, where prior supply sits and momentum traders often take profits. A daily close back below 103,500 would invalidate that path and reopen 101,000 to 102,000. With dominance near the upper fifties, leadership remains intact even as select alts outperform in bursts.

Ethereum: rotation tailwind returns

Ethereum’s bounce to the mid 3,600s flips focus to 3,700 to 3,780, an area that stalled advances last week. A clean break targets 3,950 next. Failure to hold 3,520 would hand control back to sellers and invite a revisit of 3,420 support. For now, improving depth on order books plus firmer market breadth keeps the bias slightly positive.

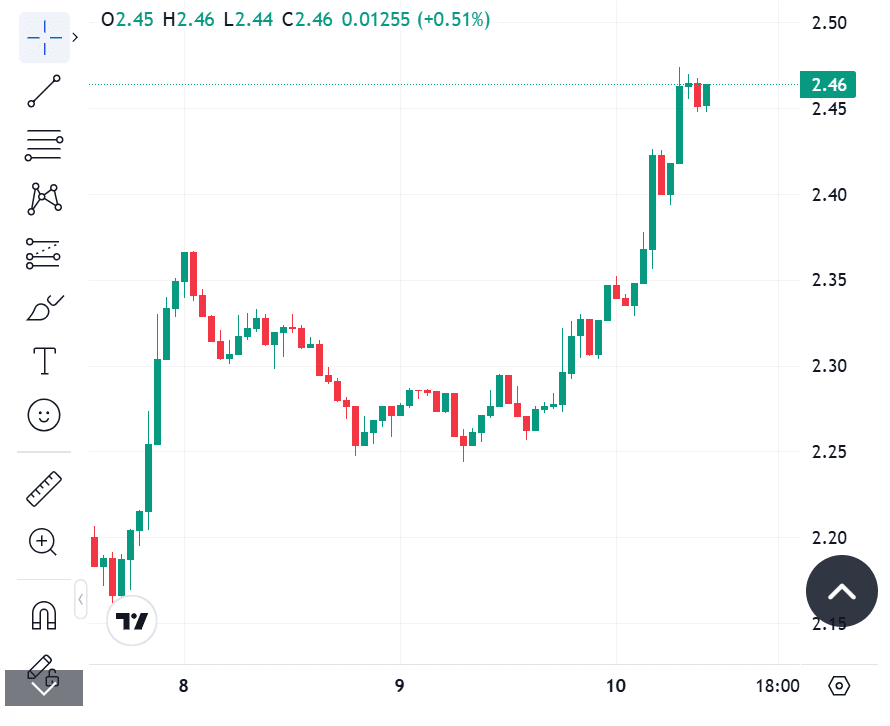

XRP: constructive above 2.40

XRP reclaimed 2.45. Maintaining acceptance above 2.40 keeps 2.55 to 2.60 in view, followed by 2.75. If momentum fades and price slips under 2.35, the next demand zone sits near 2.25. Traders will watch whether today’s bid holds once U.S. hours start and volumes peak.

Solana: range ceilings in sight

Solana’s climb toward 167 puts a familiar ceiling at 170 to 172 back in play. Strength through that band opens 178 next. Lose 162 and the rally risks stalling near the 24-hour average price. Given how quickly SOL trends once it breaks, confirmation matters more than anticipation.

Market internals and what they imply

The sentiment gauge lifted from extreme fear, while the tape logged smaller liquidation waves compared with last week’s flush. Open interest recovered, which usually signals that traders are redeploying capital rather than retreating to the sidelines. That setup often favors a grind higher with sharp but shorter pullbacks, provided policy headlines do not flip the script.

Base case for today is a constructive drift with rotational leadership. Bitcoin holds the 106,000 area and probes 107,500 to 109,500. Ethereum attempts 3,700 to 3,780 and, if successful, opens 3,950 later this week. XRP seeks confirmation above 2.45 for 2.55. Solana needs a clear break of 170 to extend. If the funding bill momentum stalls, expect a quick reset to prior supports as algos fade the move. Live board metrics and dominance will be the tiebreaker.

Conclusion

This is a relief bounce with improving breadth and cleaner liquidity. It becomes something bigger only if policy tailwinds persist and spot flows stay positive. Levels are defined, and reactions around them will tell the story. Smart money respects the trend, but it respects risk even more.

Frequently Asked Questions about crypto prices

Is the rebound sustainable today?

It can be if policy headlines stay calm and BTC holds above 105,000. Watch volumes into U.S. hours.

What could invalidate the bullish view?

A break back below 103,500 on BTC or a sharp drop in aggregate volumes would warn of a failed bounce.

Why does dominance matter here?

High dominance means BTC still sets the tone. If dominance slips, capital may rotate into alts instead of lifting the whole board.

Glossary

Dominance: The share of total crypto market cap captured by Bitcoin.

Open interest: The total value of outstanding futures contracts that have not been closed.

Liquidations: Forced closures of leveraged positions when margin is insufficient.

Resistance/Support: Price zones where selling or buying pressure tends to stall moves.

Market cap: The total value of a crypto asset, calculated as price times circulating supply.

Read More: Crypto Prices Today, Nov 10: Relief Rally Lifts BTC, ETH, XRP, SOL as Buyers Return">Crypto Prices Today, Nov 10: Relief Rally Lifts BTC, ETH, XRP, SOL as Buyers Return

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.