Stablecoin Market Soars to $281B as US Rules Spark Massive Crypto Surge

0

0

- US stablecoin market surges after GENIUS Act boosts investor confidence.

- Ethereum and Tron lead gains as stablecoin inflows hit record highs.

- China tightens grip while US opens doors to digital currencies.

The global stablecoin market has climbed to an unprecedented capitalization of $281 billion, signaling a major shift in cryptocurrency liquidity. CoinGecko suggests this growth has been accompanied by a 12 percent increase in the average daily trading volumes that have reached approximately $187 billion.

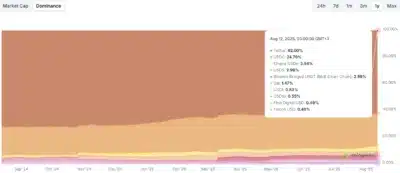

Tether USDT and Circle USDC still lead the race, with a combined market share of approximately 66 percent. CoinMarketCap data, indicates that USDT alone had a turnover of $164.6 billion on Tuesday, with an average daily turnover of nearly $135 billion. Such performance supports the idea of USDT being the primary driver of on-chain activity.

Source: Coingecko

Also Read: Ripple CTO Trolls SEC With Monty Python Joke After XRP Lawsuit Finally Ends

US regulatory clarity accelerates market growth

A significant factor behind the surge is the introduction of clearer regulations in the United States. Since President Donald Trump signed the GENIUS Act, which provides institutions with a defined framework for issuing stablecoins, the market has grown by more than $20 billion. On this crest of momentum, a stablecoin issuer, Paxos, has sought a national charter with the Office of the Comptroller of the Currency. This move would legitimize institutional involvement even further.

The US level of regulatory openness is opposite to what has happened in China, where regulators have tightened the screws with a so-called shadow ban on stablecoins, according to market observers. In the meantime, Europe is also looking into its own policies to tap the increasing demand for regulated digital assets.

Ethereum and Tron emerge as major beneficiaries

The capital inflow has notably benefited the blockchain networks that host stablecoins. Data from DefiLlama shows Tron’s stablecoin market capitalization has risen from $59 billion at the beginning of 2025 to $83 billion. The market cap of stablecoins on Ethereum surged to $137 billion in November 2024, up 50 percent from the previous month, making both networks the main places to issue stablecoins.

This adoption of stablecoins has also contributed to optimism in the cryptocurrency market. The price of Ethereum has recently breached an essential resistance spot of $4,100 due to the rising liquidity and trade volume associated with the rise of stablecoins.

The leap to a $281 billion market cap highlights how regulatory clarity in the US, coupled with rising global adoption, is propelling stablecoins into a central role in crypto market expansion.

Also Read: Do Kwon to Change Plea in $40B Terra Collapse Fraud Case Today

The post Stablecoin Market Soars to $281B as US Rules Spark Massive Crypto Surge appeared first on 36Crypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.