Bitcoin tests resistance near ATH as analysts eye $120K, KAIA leads altcoins

0

0

Bitcoin bulls attempted to break past all time highs today as momentum returned across the market amid bullish developments on the macro front.

Crypto bulls found fresh footing as the market’s total capitalisation soared past $2.6 trillion, snapping back to highs last seen in late May.

Meanwhile, the Fear & Greed Index spiked seven points to 64, capturing a decisive turn in sentiment towards ‘greed’ levels.

With global risk appetite on the rise, traders appear to be chasing momentum across majors and altcoins alike.

Why is Bitcoin going up?

Bitcoin’s latest surge comes on the heels of growing optimism that the U.S. and China are nearing the end of their long-standing trade standoff, a geopolitical development that has historically influenced broader market sentiment.

A statement from U.S. President Donald Trump on Truth Social confirmed that a trade agreement is “done,” pending final approval with Chinese President Xi Jinping.

One of the key pressure points, rare earth exports, now appears less volatile, with both sides signalling a de-escalation.

Although equity futures responded cautiously, digital assets reacted more decisively.

For crypto markets, the prospect of reduced geopolitical friction translates to diminished systemic risk, opening the door for renewed capital inflows.

Easing trade hostilities sets the stage for a more supportive macro environment. That’s particularly bullish for Bitcoin, which remains highly sensitive to shifts in liquidity and investor risk appetite.

As a hybrid asset that straddles the line between speculative growth and macro hedge, Bitcoin has responded sharply to this potential turning point in global policy dynamics.

The prospect of a U.S.–China trade resolution is prompting investors to rotate capital back into risk assets, with many expecting dormant institutional flows to re-enter the market.

With fears of escalation receding, Bitcoin is regaining its appeal as a high-conviction bet on reflation, policy flexibility, and long-term digital asset adoption.

The momentum was further reinforced by remarks from China’s Vice Commerce Minister Li Chenggang, who confirmed that the two countries had reached an “in-principle agreement” and engaged in “candid and in-depth” talks during negotiations in London.

This adds credibility to Trump’s remarks and signals a coordinated effort toward finalizing the deal.

For crypto markets, the timing is critical. The rally aligns with broader risk-on signals in global markets, rising open interest in Bitcoin futures, and strengthening fundamentals.

With macro headwinds softening and sentiment improving rapidly, Bitcoin may be entering a new phase of price discovery.

Will Bitcoin rise again?

Market analysts appear increasingly confident that Bitcoin is on the verge of reclaiming its all-time high, with several pointing to a technical setup that suggests price acceleration is near.

At the time of writing, BTC was trading just less than 2% below its all-time high of over $111,000, testing key resistance amid growing bullish momentum.

Popular analyst Jelle noted that Bitcoin’s monthly chart “looks ready for acceleration,” suggesting the market may be gearing up for a sustained breakout.

He expects an immediate rally towards $120,000 if the $108,000 level flips into support, with the possibility of a cycle top forming around $140,000 to $150,000.

A similar sentiment was echoed by MN Capital’s Michael van de Poppe, who argued that the recent break above $106,500 triggered the current rally.

He believes that another push above $110,500 could set the stage for fresh all-time highs, although some short-term consolidation may be required before that happens.

“The first period of consolidation typically lasts a few days. Then, we’re going to have the next breakout above the ATH,” Poppe said in a recent X post.

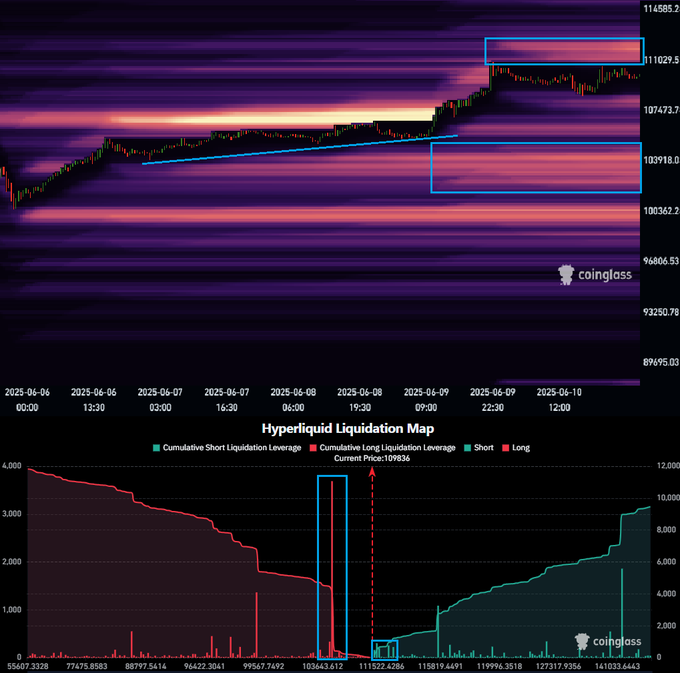

On-chain data further supports the bullish thesis. The BTC/USDT liquidation heatmap on Binance shows a dense concentration of leveraged positions near the $112,000 mark, a level now acting as both resistance and a potential catalyst.

A breakout here could spark what traders refer to as a liquidation squeeze, rapidly forcing short sellers to exit and propelling the price toward the next liquidity cluster at $114,000.

However, according to analyst AlphaBTC, more consolidation maybe required before a decisive break above the $110,000 mark. See below.

The immediate upside target for BTC at the moment remains $120,000, according to most analysts on X.

Some pointed to a recent breakout above a descending wedge structure on the daily chart, a pattern often associated with confirmation of bullish reversals.

Altcoins see renewed momentum

With macro headwinds easing and risk appetite on the rise, altcoins are beginning to gain traction which some analysts are viewing as the early signal of an incoming altcoin season.

Historically, new Bitcoin all-time highs are often followed by capital flowing into altcoins, and several metrics now point to a similar rotation underway.

Bitcoin dominance remains elevated at 64–65%, yet the Altcoin Season Index has quietly climbed into the low 30s, a subtle but telling sign that investors are beginning to broaden their exposure.

With risk sentiment improving, traders appear more willing to rotate into altcoins in search of higher upside.

Pseudonymous analyst Moustache pointed to an ascending broadening wedge forming on altcoin dominance charts, now approaching a key breakdown level. He noted that a similar structure preceded a strong altcoin rally in November.

Over the past 24 hours, the altcoin market cap rose nearly 3% to $1.4 trillion at the time of writing.

Ethereum, the leading altcoin by market cap, rose 3.5% over the day, trading at $2,840, its highest level seen since February 24, while other large-cap altcoins like XRP, Solana (SOL), Dogecoin (DOGE) and Cardano (ADA) recorded gains ranging between 1-5% while Tron (TRX) being an exception dipping 1% over the period.

Kaia (KAIA) stood as the leading gainer of the day among the top 99 altcoins with gains of 23.3%, while SPX6900 (SPX) and Jito (JTO) followed, holding on to gains of 18.8% and 13.3% respectively.

KAIA’s gains today came as excitement grew around its plan to launch a South Korean won–based stablecoin following its recent launch of native USDT on Kaia Chain.

Some of the momentum was also fuelled by news of a potential partnership with Japanese messaging giant LINE.

SPX6900 hit a new all-time high of $1.62, supported by an uptick in whale accumulation, and the broader shift in market sentiment triggered by Bitcoin’s rebound.

Similarly, Jito rallied with no particular catalyst driving the move apart from broader market momentum.

The post Bitcoin tests resistance near ATH as analysts eye $120K, KAIA leads altcoins appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.