SharpLink Acquires 39K ETH for $177M, Total Ethereum Holdings Now $3.6B

0

0

Highlights:

- SharpLink acquires 39K ETH for $176.75 million, increasing its holdings to over 800K tokens.

- The company paid an average of $4,531 for each ETH token.

- SharpLink Gaming also revealed that it raised $46.6 million through its at-the-market (ATM) program.

Nasdaq-listed company and second-largest corporate holder of Ethereum (ETH), SharpLink Gaming, has increased its ETH holdings with a fresh investment worth $176.75 million. The company announced the new purchase in a September 2 post on X.

According to the tweet, SharpLink Gaming added 39,008 ETH, which spiked its ETH reserves to 837,230 tokens worth $3.6 billion. Notably, the company paid an average of $4,531 per ETH token, totalling $176.75 million. SharpLink Gaming also noted that it bought the ETH tokens between August 25 and August 31, 2025.

Meanwhile, today’s purchase comes a few days after SharpLink had announced the acquisition of 56,533 ETH during the week ending on August 24, 2025. The company paid an average of $4,462 per ETH, totalling roughly $252.25 million. SharpLink Gaming adopted an Ethereum treasury in July 2025 and has quickly grown to become one of the leading corporate holders of ETH.

SharpLink Gaming Financial Updates

Aside from the purchase, SharpLink Gaming shared details of its recent financial moves during the acquisition period. SharpLink reported that it raised $46.6 million through its at-the-market (ATM) program. The company has also earned 2,318 ETH staking rewards since the program began on June 2, 2025.

Other relevant developments include reaching 3.94 in Ethereum concentration, marking a 97% spike since June 2. SharpLink Gaming also boasts over $71.6 million in undeployed capital, implying that the company possesses considerable capital to fund more ETH purchases or network operations.

NEW: SharpLink acquired 39,008 ETH at an average price of ~$4,531, bringing total holdings to 837,230 ETH, valued at ~$3.6B.

Key highlights for the week ending Aug 31st, 2025:

→ Raised $46.6M through the ATM facility

→ Added 39,008 ETH at ~$4,531 avg. price

→ Staking… pic.twitter.com/dy7x1Ux0NY— SharpLink (SBET) (@SharpLinkGaming) September 2, 2025

SharpLink Edges Closer to Becoming the Largest Corporate Holder of ETH

CoinGecko’s data on Ethereum treasury companies shows that only a few companies have included Ethereum in their treasury. Ten of these are US companies, while Intchains is the only Chinese firm. These companies own 3.08 million ETH, which accounts for 2.55% of the total ETH circulating supply.

The companies’ total ETH holdings are worth roughly $13.49 billion, following a 10.2% surge in the past 24 hours. On CoinGecko, BitMine leads with the largest ETH holdings. For context, it owns roughly 1.866 million ETH, valued at $8.15 billion after its most recent $668 million purchase for 153,075 ETH.

Bitmine(@BitMNR) bought another 153,075 $ETH($668M) last week and currently holds 1,866,974 $ETH($8.15B).https://t.co/N7lzz9R3Uthttps://t.co/1QXovuJmnY pic.twitter.com/F8ufqduLyg

— Lookonchain (@lookonchain) September 2, 2025

BitMine stated:

“As of August 31, the company’s crypto holdings are comprised of 1,866,974 ETH at $4,458 per ETH, 192 BTC and unencumbered cash of $635 million. BitMine crypto holdings reign as the #1 Ethereum treasury and #2 global treasury, behind Strategy Inc., which owns 629,376 BTC valued at $71 billion.”

Aside from BitMine and SharpLink Gaming, companies with over 100,000 ETH holdings include Coinbase, Bit Digital, and ETHZilla. These firms own 136,782 ETH, 120,306 ETH, and 102,237 ETH, respectively. Other entities that made up CoinGecko’s list of public companies that own Ethereum include BTCS, Fundamental Global, The Ether Machine, GameSquare Holdings, Intchains, and Exodus Movement.

Ethereum Records Slight Dip as SharpLink Acquires 39K ETH

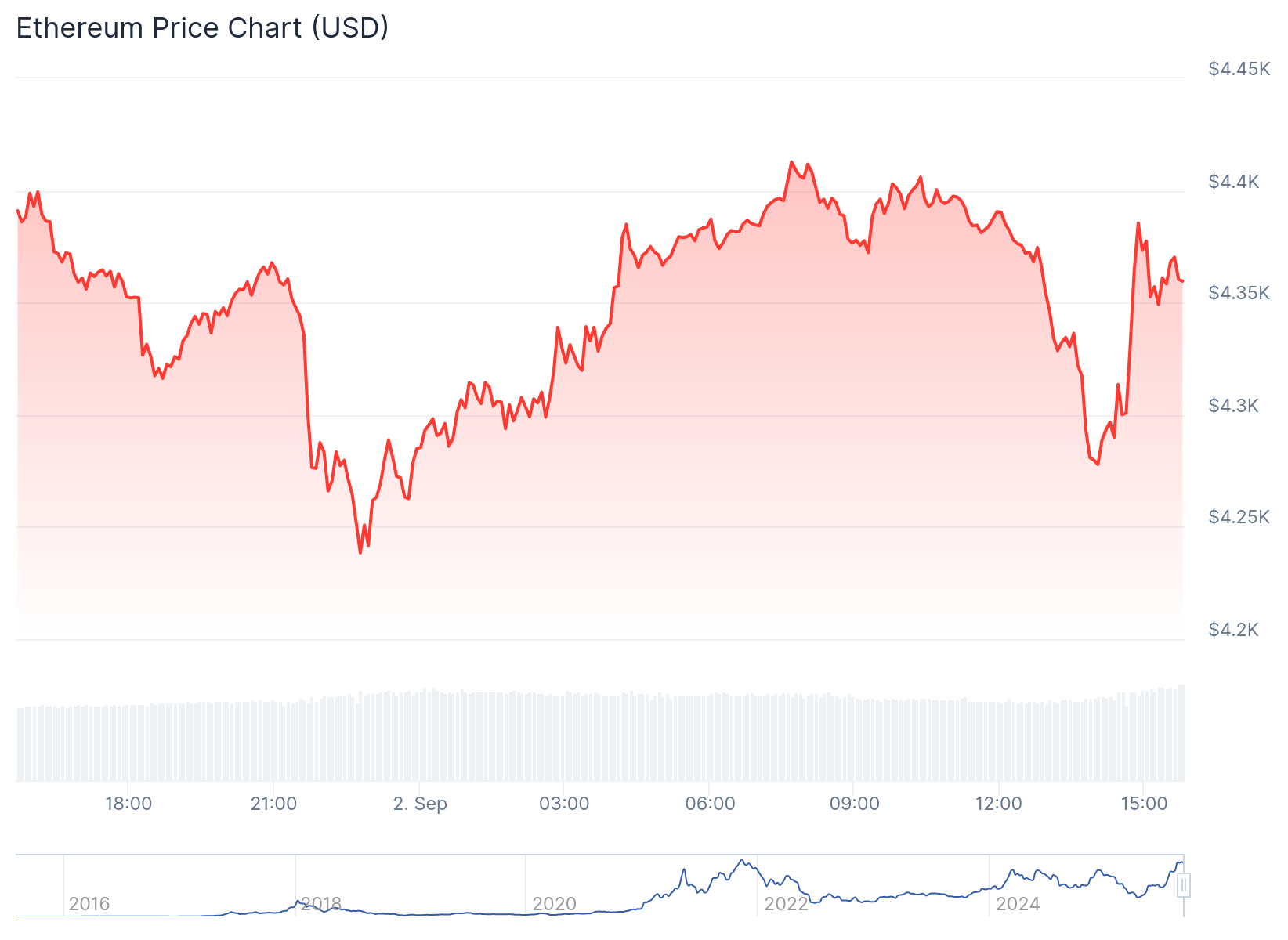

At the time of press, ETH is changing hands at about $4,356, following a 0.7% decline in the past 24 hours. Within the same timeframe, Ethereum’s price has fluctuated between $4,238 and $4,412. Its 7-day-to-date price change data showed a 2.8% decline, with price extremes oscillating between $4,241 and $4,653. On Coincodex, Ethereum’s supply inflation is low at 0.34% with a 13.67% dominance. The token’s volatility is high at 8.14%, while sentiment remains bullish, with a Fear and Greed Index that reflects neutral at 49.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.