MYX Finance (MYX) Hits Record Highs, But Analysts Warn of Mantra (OM) Playbook Repeat

0

0

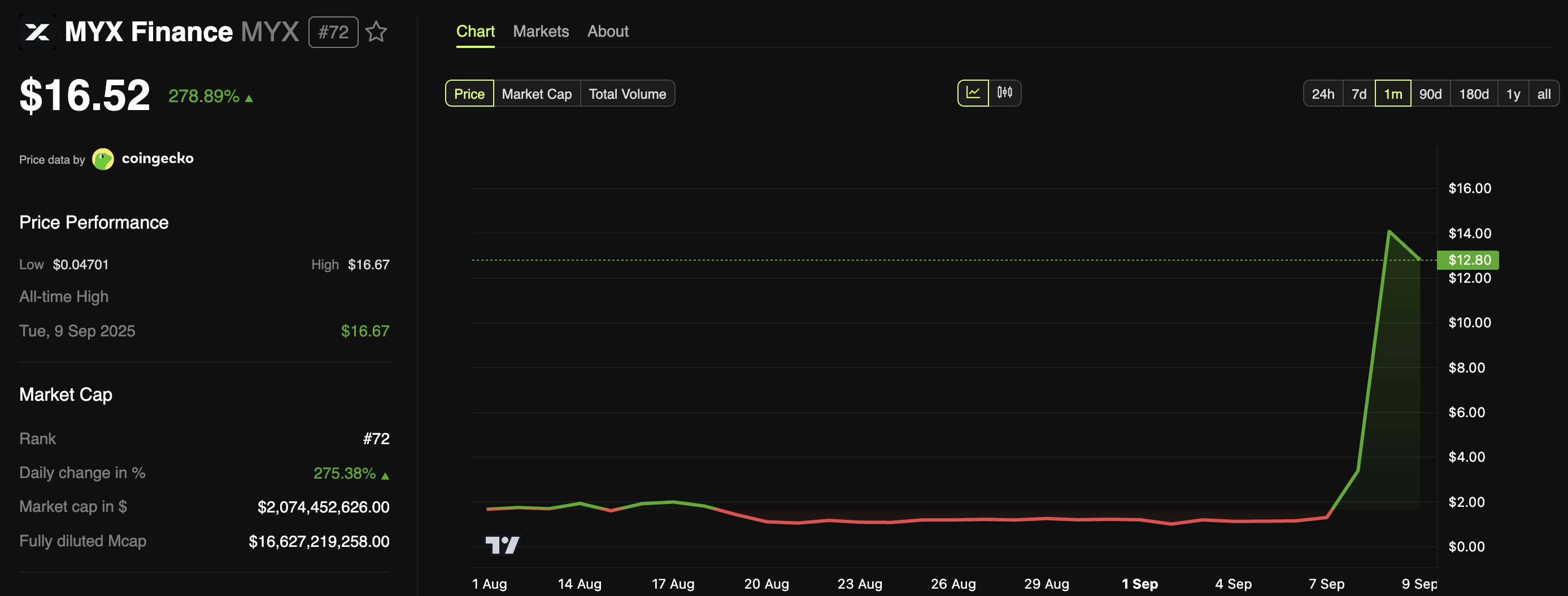

MYX Finance’s native token, MYX, continued its record-breaking rally today, surging nearly 279% over the past 24 hours.

The triple-digit rise has done little to alleviate investor concerns. Many are drawing parallels to the collapse of MANTRA (OM) and fear a similar fate for MYX.

Is MYX Finance (MYX) The Next Mantra (OM)?

BeInCrypto reported that the MYX token pumped 1,957% in early August before experiencing some volatility. Yesterday, the coin appreciated by another 167%, and today shows a similar trend.

According to BeInCrypto Markets data, the altcoin reached a new all-time high. Its value rose nearly 279% in the past 24 hours, making it the top daily gainer in the crypto market. The latest jump brings its total monthly gains to 893%.

MYX Finance (MYX) Price Performance. Source: BeInCrypto Markets

MYX Finance (MYX) Price Performance. Source: BeInCrypto Markets

The project’s market capitalization now exceeds $2 billion. However, according to DefiLlama data, its total value locked (TVL) is at just $32 million.

This raises concerns about potential overvaluation driven by fear of missing out (FOMO) rather than underlying demand.

“MYX Finance has gone off the charts, over 200x from the bottom. Looks like a clear case of manipulation when a project with little / no activity is sitting at a market cap of $2.5 billion,” an analyst posted.

Moreover, many market watchers also fear that MYX could collapse like MANTRA (OM) did earlier this year. An analyst suggested that MYX’s trading pattern closely resembles OM’s rally last year.

It was marked by sharp gains that quickly propelled it from outside the top 150 market cap into the top 50 and beyond, followed by a steep decline.

“You guys can take a look at OM, it’s the same playbook, pumping up to around 9, then crashing hard. At first OM claimed it was still a team effort, but later it was found out to be operated by Chinese folks, the Shenzhen crew. Not sure if this MYX is also operated by Chinese folks,” the analyst said.

Another crypto analyst observed that MYX’s recent surge may not reflect retail investor momentum, but rather deliberate market control by the project team.

“Almost no one is showing off their profitable trades; instead, the screen is full of shorts screaming in pain. Why? Because retail investors didn’t get any of the meat at all; the ones calling for shorts are actually quite close to the project team,” he remarked.

According to the analysis, the team is reclaiming airdropped tokens, driving prices up to force accumulation, then selling at the top to shake out retail before buying back at lower levels. The analyst suggested that the ultimate goal is to dominate supply and profit from volatility once contracts are listed, turning futures trading into their real revenue source.

“The huge run-up in MYX isn’t the result of sudden market consensus, but a combination of token accumulation by the project and profit-taking via contracts. With Binance futures involved, volatility itself becomes a money-printing machine — and the script already hints at who wins and who loses,” the analyst concluded.

How MYX Became a ‘Volume Powerhouse’ Amid Skepticism

Meanwhile, it is worth noting that MYX Finance won the ‘Volume Powerhouse’ title at the BNB Chain Awards yesterday.

“The perps exchange MYX Finance is gaining serious traction with over $2 billion in weekly trading volume. Opportunities everywhere, you just need the right eyes!” Whale Coin Talk added.

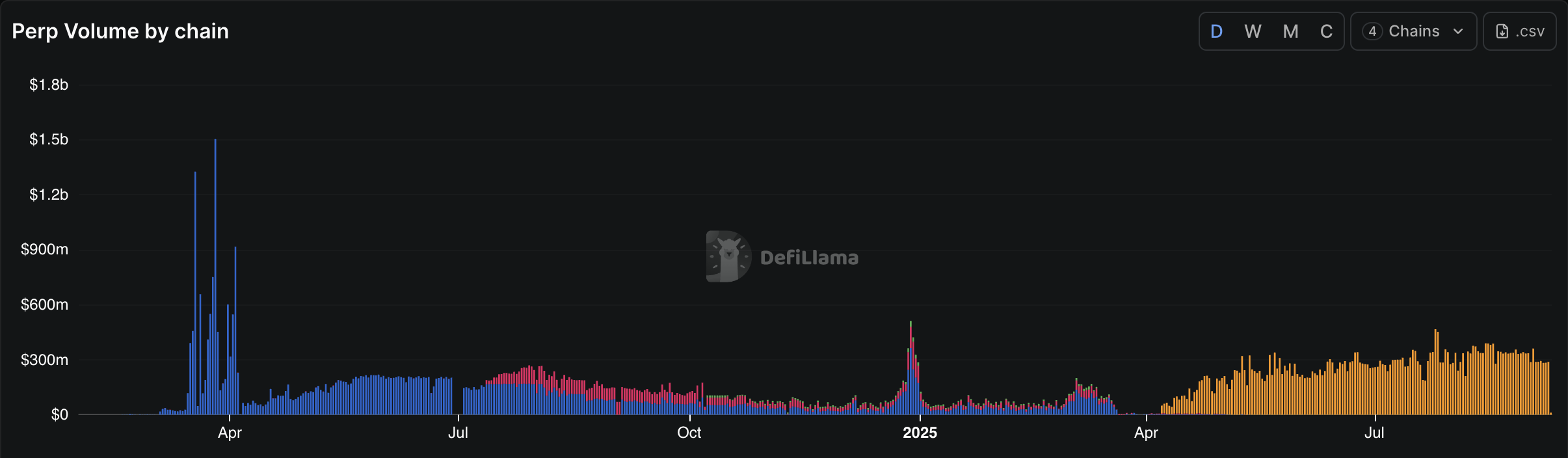

This has again attracted a lot of scrutiny. Perpetual futures (Perp) volume data from DefiLlama indicated a significant shift in MYX’s trading activity.

Since April, most Perp volume has moved to the BNB Chain, averaging around $200-$300 million daily, compared to its earlier focus on the Arbitrum (ARB) network.

MYX Finance Perp Volume. Source: DefiLlama

MYX Finance Perp Volume. Source: DefiLlama

Analyst Jordi Alexander argued that MYX highlights deep flaws in the perpetual futures market. Despite lacking Tier 1 or Tier 2 listings, the token reached a $10 billion FDV, generating $200 million in open interest on Binance, where traders paid negative funding rates.

Alexander noted that while Binance collected tens of millions in fees from $9 billion in trading volume, customers faced steep losses. He also warned that perpetual contracts are unsound without sufficient spot liquidity.

“If there internal MMs arent hit Im guessing business as usual. They delist this at some point and it just gets run on the next token,” Alexander commented.

BeInCrypto has reached out to the MYX Finance team for comment and will update this article if we receive a response.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.