Will Injective Crypto Follow ZEC and Take Off in December? INJ Bulls Target $7

0

0

Only a few crypto tokens have reversed losses of October 10. ZCash ZEC crypto leads the way. Looking at some of the best cryptos to buy in December, Injective looks like a decent candidate.

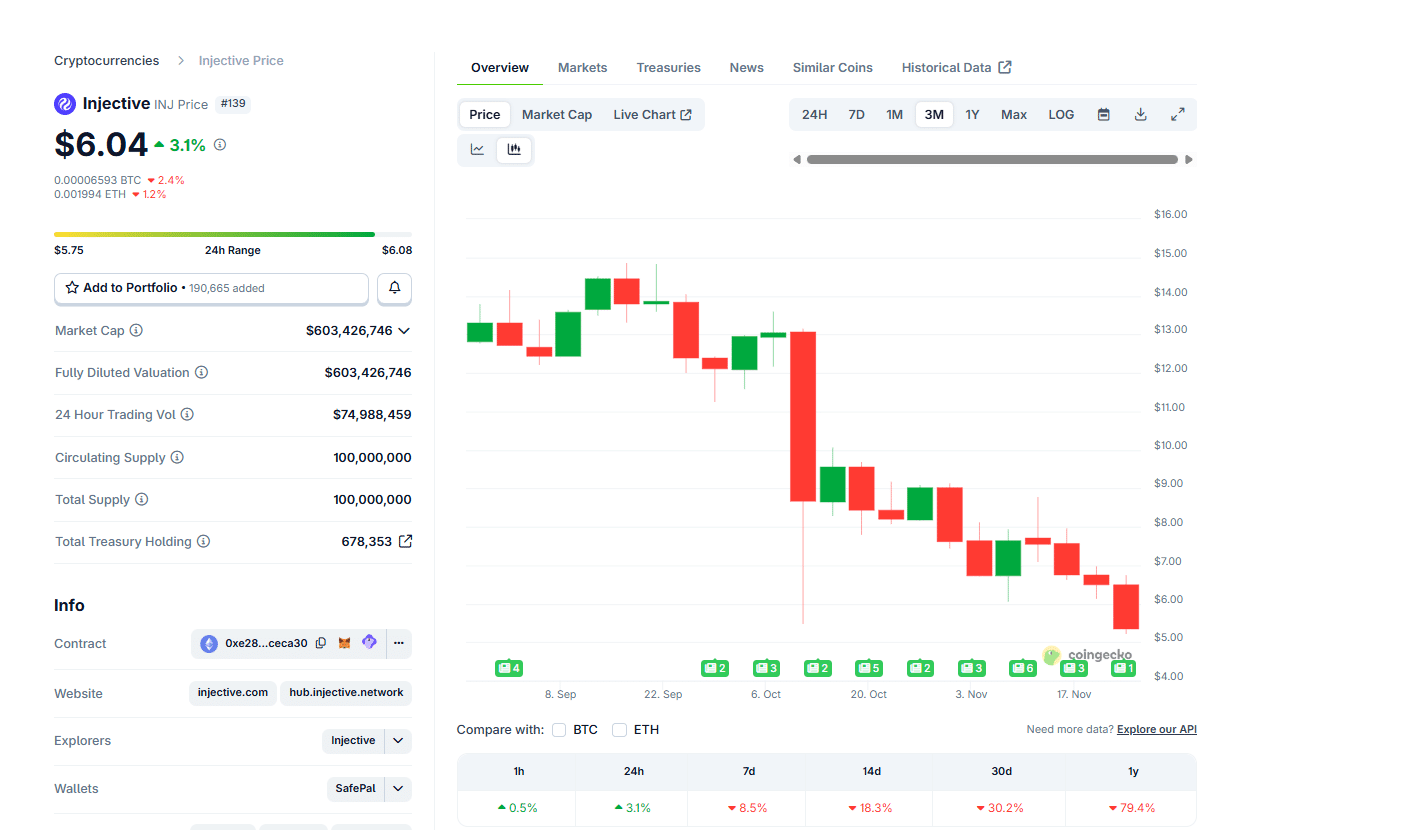

INJ USDT is still trying to shake off weakness after the hammering on October 10. Since the collapse, INJ crypto has lost over -50% and is still stuck inside a descending channel.

(Source: Coingecko)

Technically, the path of least resistance, but there are interesting fundamental developments that might offer the right tailwinds for optimistic buyers.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Is Injective Crypto The Next ZEC in December?

Given the decimation of mid-October and the destructive aftermath of the collapse, the sudden surge of ZEC in the better part of November is an inspiration.

Although the momentum is fading and ZEC crypto is down nearly -25% in the past week, buyers dominate. However, for those who missed out on a possible 10X surge from late H1 2025, alternatives like Injective can be considered.

At spot rates, INJ USDT is stable, adding roughly +3% in the past 24 hours. Injective crypto remains in the red territory over the last week, down nearly -80% year-to-date.

Yet, despite this sell-off and obvious weakness, INJ USDT has withstood all bearish salvos for the better part of this week.

From the daily chart, INJ found a floor at around $5.11 before bouncing higher with decent trading volume.

Although participation is declining, buyers have the upper hand. The local resistance is at $7, and if this level is broken with decent trading volume, the next feasible target in December should be $10 and later $14, for a +100% spike.

DISCOVER: 10+ Next Crypto to 100X In 2025

Injective Buyback Program and RWA Drive

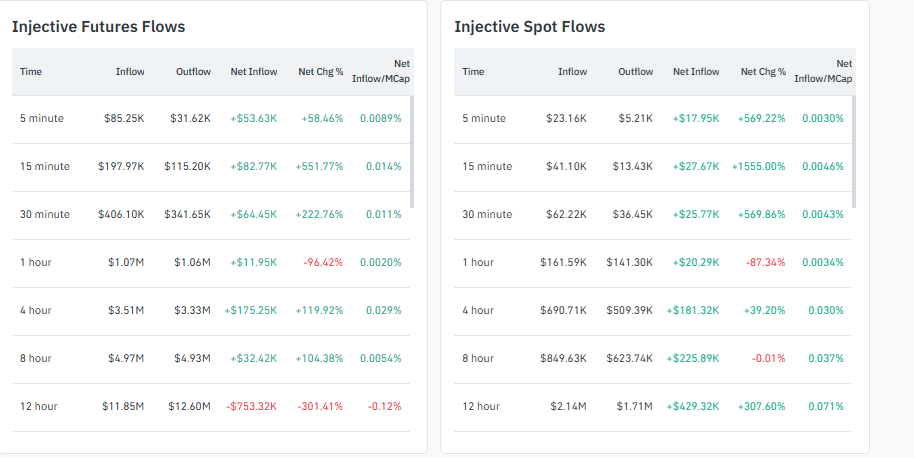

Traders on Binance, some of whom are holders of the next 100X cryptos, are already positioning themselves for this possibility.

On average, the long/short ratio is above one, signaling bullish intention. Specifically, among the top traders on Binance, the skew is bullish as the ratio is above two.

Meanwhile, on spot exchanges, mainly on MEX and LBank, netflow remains largely bullish. The more traders accumulate INJ on spot exchanges, the stronger the trend, which, in turn, amplifies the chances of a decent breakout above local resistance levels.

(Source: Coinglass)

Besides the accumulation of INJ crypto via spot exchanges, the protocol has been scooping up more tokens from the secondary markets. In November, they bought back $39.5M worth of INJ, reducing supply and directly rewarding the community.

The $INJ Community BuyBack is now complete!

Only on Injective do buybacks reduce token supply and directly reward the community at the same time.

The next burn is coming in December

pic.twitter.com/wldlBdxtr2

— Injective

(@injective) November 26, 2025

As market forces dictate, the lower the supply, the higher the probability of a better repricing. All the INJ bought are burned. In October, they bought and burned 6.78M INJ.

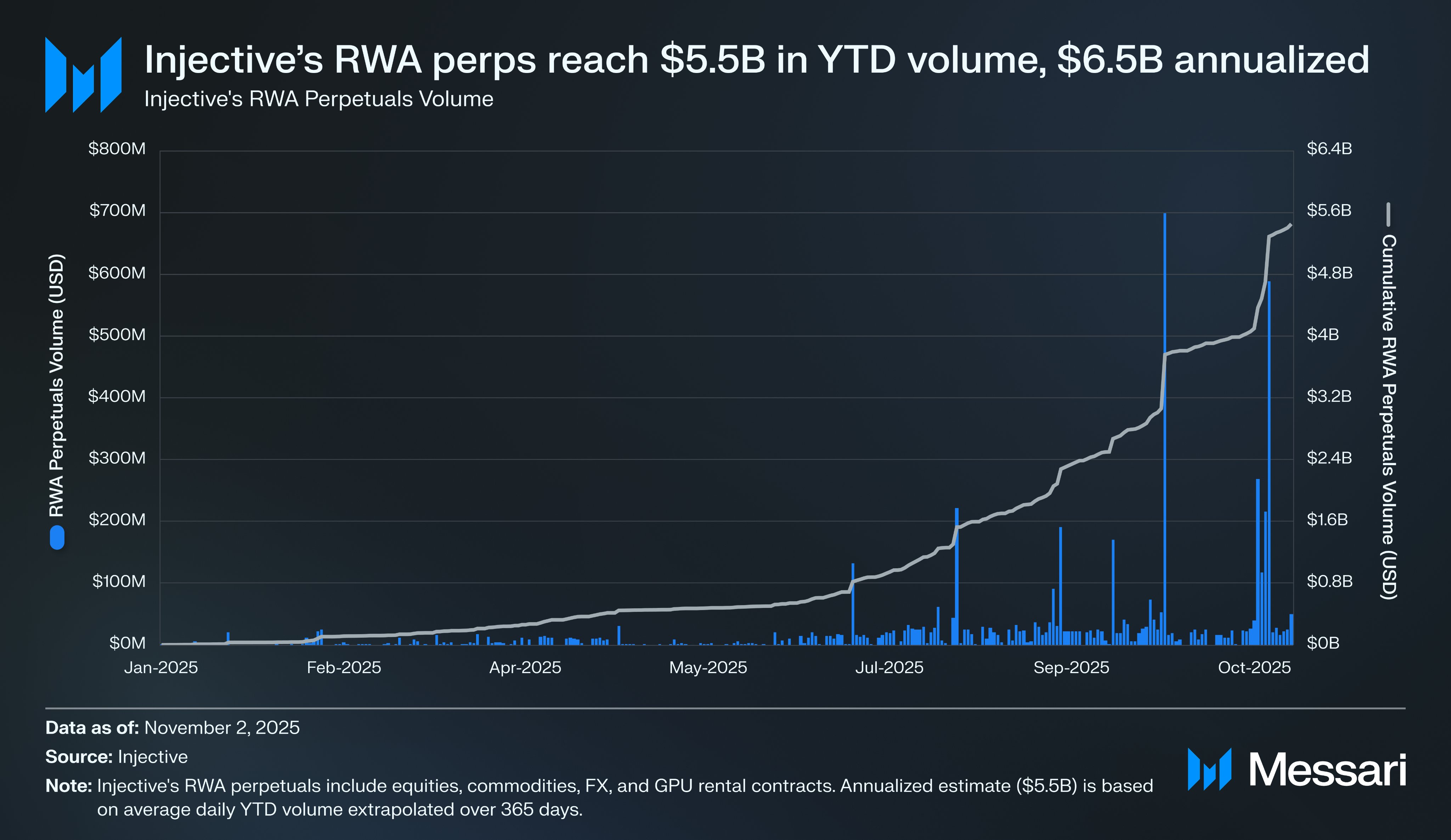

Onchain data also shows that Injective is playing a key role in the rise of RWAs.

Specifically, the protocol’s RWA perpetual markets have processed over $6B in volume, allowing traders to get exposure in equities, commodities, and other TradFi instruments with up to 25X leverage.

(Source: ahbeaudry, X)

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Will Injective Crypto Follow ZEC and Take Off in December?

- Injective crypto bearish but stable

- Will INJ USDT break above $7 and 2X in December?

- Injective bought back 6.8M INJ in November

- Injective processes over $6B in RWA perpetual markets

The post Will Injective Crypto Follow ZEC and Take Off in December? INJ Bulls Target $7 appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.