Retail Sentiment Hits April Low. Here’s Why This is Bullish for Bitcoin

0

0

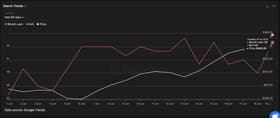

Retail sentiment around Bitcoin has turned sharply negative, reaching its most pessimistic point since early April. Yet, data analytics firm Santiment suggests this could be a positive sign, based on how markets typically react when sentiment hits extreme lows.

😰 With crypto in a bit of a lull, traders are showing signs of impatience & bearish sentiment. There are just 1.03 bullish comments for every 1 bearish comment, which hasn’t happened since peak FUD during initial tariff reactions on April 6th. This is typically a bullish sign. pic.twitter.com/Bw0vkiGpMI

— Santiment (@santimentfeed) June 19, 2025

According to the analytics firm, bearish messages now slightly outnumber bullish ones on social platforms, with a current ratio of 1.03 to 1. This is the first time in over two months that bearish opinions have taken the lead.

A Bullish Signal for BTC?

Santiment interprets the recent shift in retail sentiment as a potential signal for a price reversal. The firm explained that sharp declines in sentiment often precede market rebounds, as fear among retail users typically marks local bottoms.

Back in April, it pointed to a trend when Bitcoin dropped below $75,000 amid concerns about potential U.S. tariffs. Online sentiment turned deeply negative during that period, but once fear peaked, Bitcoin quickly rebounded.

“Markets historically move the opposite direction of retail’s expectations,” Santiment added.

At the time of writing, BTC is trading around $104,145, down 0.7% in the past 24 hours and 3.2% over the week. Despite the pullback, it remains over 60% higher compared to the same period last year.

Geopolitics Weighs on Retail Sentiments

The negative sentiment comes amid mounting concerns over the global economy and political tensions. Amid these concerns, crypto analyst Axel Adler Jr. highlighted Thursday’s weak performance in European stock markets. He attributed the decline to anxiety over potential U.S. military involvement in Iran.

Adler further warned that continued instability in the Middle East could push Bitcoin lower, as market participants seek traditionally safer assets. Echoing this outlook, technical analyst Ed_NL noted that Bitcoin may revisit key support zones if it repeats the double-dip pattern seen in mid-2024.

However, on-chain signals suggest a more resilient outlook. For example, asset manager Fidelity reported on June 18 that dormant BTC holdings are rising, with coins staying untouched for longer periods. This accumulation pattern, where long-term holders outpace new supply issuance, often reflects a strong conviction in the asset’s future.

Reinforcing this trend, institutional demand remains steady. CoinTab reported that spot Bitcoin ETFs saw over $388 million in net inflows on Wednesday. Notably, this marks eight consecutive days of positive flows, signaling sustained interest from larger market participants.

The post Retail Sentiment Hits April Low. Here’s Why This is Bullish for Bitcoin appeared first on Cointab.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.