Michael Saylor’s Strategy Bets $13.4B on Bitcoin Price Again, What to Expect?

1

0

Key Insights:

- MicroStrategy boosts holdings with $1.34B Bitcoin purchase at $99K.

- Bitcoin ETFs see record $62.9B in net inflows YTD.

- Sui overtakes Solana with stronger institutional inflows this quarter.

MicroStrategy has once extended its control over the Bitcoin market by buying 13,390 BTC. This happend recently in a major transaction for $1.34 billion, at an average BTC price of $99,856 per coin.

These Bitcoins raise MicroStrategy’s Bitcoin holdings to 568,840 BTC, which the company acquired for an average cost of $69,287 and a total cost basis of $39.41 billion. To date in 2025, up to May 11, the firm’s Bitcoin yield had risen to 15.5%.

Record Institutional Inflows Confirm Momentum

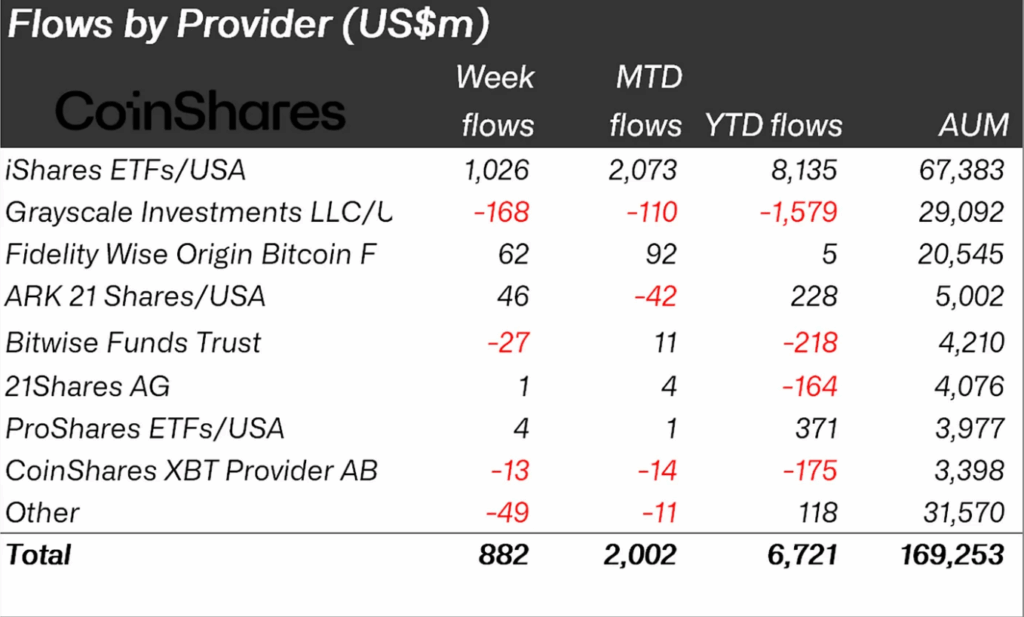

The scope of this acquisition corresponds to the broader increase in institutional involvement in Bitcoin and digital currencies. The latest Digital Asset Fund Flows report from CoinShares shows that last week brought in $882 million of inflows into crypto investment products. This extends a run of positive flows for four weeks. As a result of these latest inflows, the annual total is now $6.72 billion.

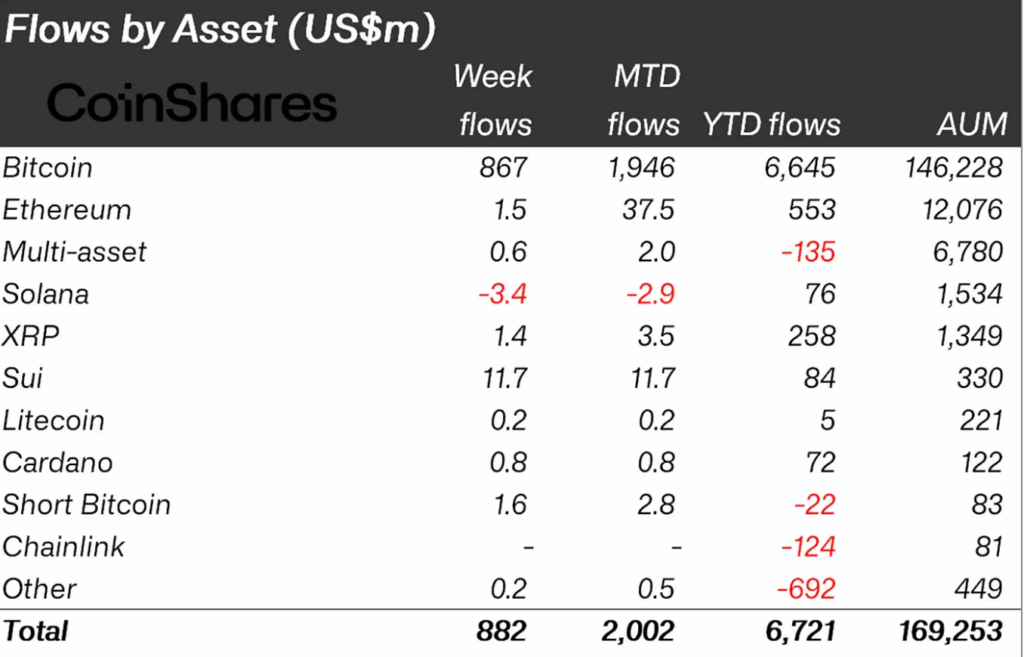

Last week, Bitcoin received $867 million in inflows, thus reinforcing its primacy and appeal with institutional investors. Between January and the current date, U.S.-listed Bitcoin ETFs have collectively attracted $62.9 billion. The data breaks the record of $61.6 billion previously set earlier in February.

Last week, iShares (BlackRock) ETFs/USA led with $1.03 billion in inflows and has amassed $2.07 billion so far this month. The inflows last week stood at $2.07 billion, raising the 2025 total to $8.13 billion and assets under management to $67.4 billion.

Grayscale Investments, in comparison, experienced outflows of $168 million last week and another $110 million over the month. As of now, Grayscale Investments has experienced $1.58 billion in outflows this year. This shows that investors continue to move from their trust-based products to less expensive ETFs.

Fidelity, by adding $62 million to its Wise Origin Bitcoin Fund and ARK 21 Shares noting inflows of $69 million, outperformed Bitwise, which lost $27 million during the week.

Bitcoin Drives AUM Growth, while Ethereum Lags

Bitcoin still has control in terms of inflows, attracting $1.95 billion in new capital over the current month and $6.65 billion this year. Its asset under management remains at $146.2 billion, making up a large 86.4% of all assets tracked.

Despite notable price increases, Ethereum attracted just $1.5 million in inflows last week. Ethereum has only brought in $37.5 million this month and $553 million so far this year, far below Bitcoin’s totals.

Sui saw unexpectedly robust performance among the cryptocurrencies. $11.7 million in new capital came to Sui last week, more than Solana’s $3.4 million in departing funds. After $84 million in YTD inflows, Sui now outpaces Solana’s total of $76 million. XRP kept up its momentum, receiving $3.5 million in the month so far, while its yearly figure has reached $258 million.

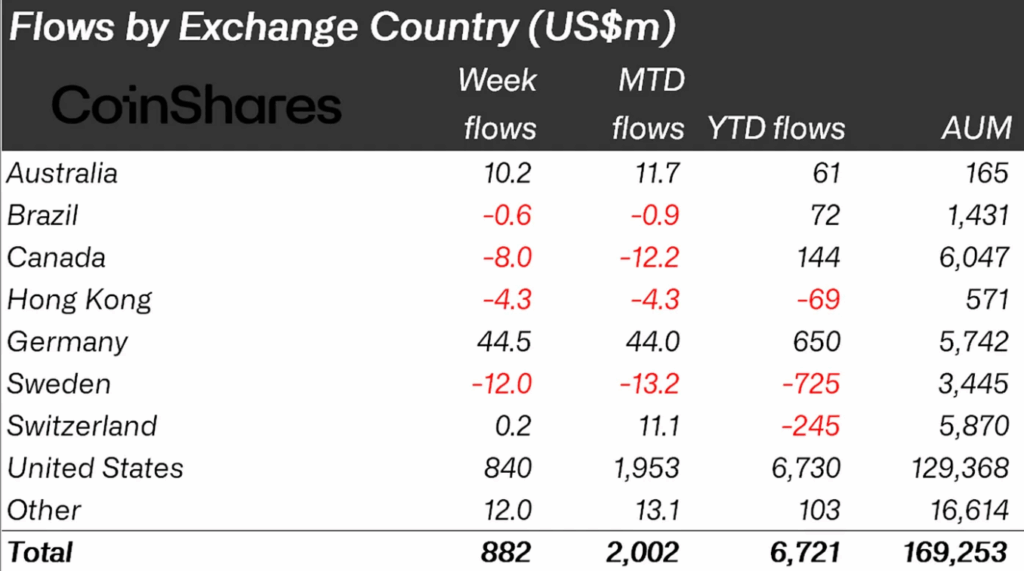

U.S. Market Dominates Exchange-Based Inflows

The United States continues to dominate regional inflows with $840 million for the week and $1.95 billion so far this month. So far this year, the United States has attracted $6.73 billion. The data accounts for 99% of all 2025 inflows and confirms its lead in the digital asset ETF industry.

For the week, Germany attracted $44.5 million and has a year-to-date total of $650 million. This is while Australian investors added $10.2 million this week and $61 million so far this year. By comparison, Canada and Sweden registered $8 million and $12 million in outflows, indicating ongoing investor withdrawal.

Switzerland had cumulative outflows of $245 million for the year so far, despite last week seeing a tiny $0.2 million in new investments. Hong Kong recorded outflows of $4.3 million over the week, which added to a $69 million shortfall year to date.

The rising institutional interest should not be viewed in isolation from other recent trends. Experts maintain that the macroeconomic backdrop, such as rises in M2 money supply worldwide alongside ongoing stagflation in the U.S., is behind both higher inflows and recent price movements.

Likewise, more than one U.S. state has deemed Bitcoin a strategic reserve asset, which may lead to an expansion in long-term demand.

The post Michael Saylor’s Strategy Bets $13.4B on Bitcoin Price Again, What to Expect? appeared first on The Coin Republic.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.