RiskLayer Gains Investment for Developing DeFi Security Middleware on EigenLayer

0

0

RiskLayer has announced its Builders Round, co-led by Antler and Momentum6, to develop a DeFi Security Middleware on EigenLayer. This initiative addresses key economic security concerns in the decentralized finance (DeFi) space.

This round includes participation from Wagmi Ventures, Hypotenuse Ventures, and several notable angel investors.

New Funding Round Fuels Development of RiskLayer’s AVS Infrastructure

RiskLayer plans to use the funds to accelerate the development of its Actively Validates Services (AVS) infrastructure and prepare for an upcoming pre-staking launch. This will enhance risk-optimized capital efficiency for DeFi protocols, institutions, and users.

The funding will support the development of two AVSs on EigenLayer, designed to address fundamental economic security concerns in DeFi. These services aim to provide a strong framework for indexing and economically securing app-specific rollups.

Read more: Ethereum Restaking: What Is It And How Does It Work?

RiskLayer is an economic security middleware for DeFi built on EigenLayer’s shared security primitives, developed by Chainrisk Labs. It broadcasts risk data across markets and aids in building risk-intelligent DeFi.

The RiskLayer team aims to bridge the gap between economic security and practical DeFi applications by proposing the Risk Oracle AVS and Risk Rollup AVS. The Risk Oracle AVS leverages a “proof of risk” consensus to provide accessible and actionable risk data, enabling investors to deploy capital more efficiently. Concurrently, the Risk Rollup AVS focuses on economically securing app-specific rollups, fostering the development of risk-intelligent financial products.

Moreover, the firm offers comprehensive economic risk management solutions to protocols like Compound, Angle Labs, Gyroscope, and Ebisu Finance. Its approach spans entire ecosystems, including Arbitrum and the Fuel Network. Sudipan Sinha, Core Contributor at RiskLayer and CEO at Chainrisk Labs, highlighted the team’s strategic focus.

“Economic security is being solved at the network level by EigenLayer. At RiskLayer, we abstract economic security from the protocol layer and scale it to the application layer,” he said in a statement to BeInCrypto.

Read more: What Is EigenLayer?

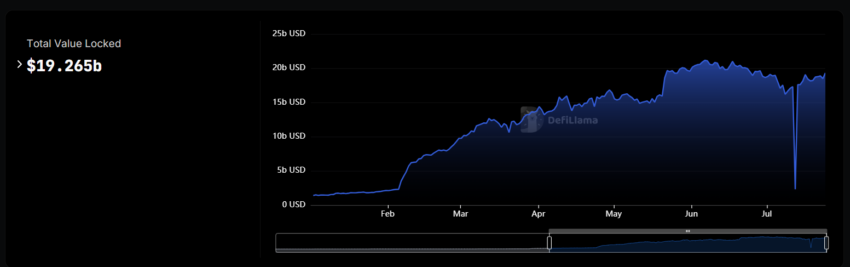

Restaking TVL. Source: DefiLlama

Restaking TVL. Source: DefiLlama

Accelerated by Symbiote, RiskLayer aims to scale the internet’s shared security and commercialize risk as a metric. This approach seeks to unlock new potential in total value locked (TVL) within the decentralized financial market. According to DefiLlama data, the TVL for the restaking sector is $19.26 billion at the time of writing, with EigenLayer contributing $16.95 billion.

0

0