Building a utility token for your software product: Why, How, and what Blockchain Platform to…

0

0

Building a utility token for your software product: Why, How, and what Blockchain Platform to choose

In the age of decentralized innovation, forward-thinking software companies — whether browsers, VPN services, or productivity tools — are exploring new ways to engage users and extend functionality. One of the most promising directions is creating a utility blockchain token to incentivize users, enhance loyalty, and embed native crypto-powered interactions within the product.

But how do you do it right? Which platform should you choose? And what are the real benefits of launching your own token?

This guide is designed to walk you through the “why”, “how”, and “where” of launching your own utility blockchain token, with a strong focus on comparison across blockchain platforms. It’s designed as a summary to save you time and make things simple.

This article is for anyone who’s ever considered creating their own token — or already has — and wants to explore what modern technologies and platforms have to offer. You’ll not only gain valuable insights, but might even enjoy the read.

Why create a utility Blockchain token?

Utility tokens allow your users to:

- Incentivise product usage

- Earn rewards for activity, referrals, contribution, or reviews

- Access premium features in your app

- Trade or hold value as part of a branded ecosystem

- Participate in governance or community-led product development

- Authenticate or secure sessions via blockchain

By integrating a native token, your company can build a loyal and incentivized user base, while also enhancing privacy, decentralization, and internal workflows.

Advantages of Tokenization for software creators

Crucially, a token provides a way to monetize development and strategically invest in future growth.

- Increased retention: Token-based rewards drive habit-forming behaviors

- Decentralized trust: Removes reliance on centralized user databases or billing systems

- New monetization: Create in-app economies with low-cost transaction models

- Cross-border compatibility: Crypto tokens are globally accessible, bypassing traditional payment barriers

- Automation: Smart contracts and bots simplify processes like KYC-less access tiers or usage rewards

Here is few use cases for creating a cryptocurrency token:

- A browser giving internal tokens for usage time or ad views

- A VPN offering token discounts or uptime rewards

- A productivity app rewarding daily goals

- A CRM where sales reps earn tokens per conversion

- A secure messaging platform with internal crypto-based payment system

The state of the industry

Many companies are still experimenting with Web3 integrations. Yet, Brave Browser’s BAT vision shows real-world demand for crypto utilities embedded into everyday software.

Despite this, many projects struggle with high costs, technical complexity, and lack of control when building on existing blockchains like Ethereum or Solana. That’s where leaner, more customizable options — like ADAMANT Business — come in.

Tokenomics: Plan it right

When creating a utility token, consider:

- Purpose of the Token: Rewards, Access control, Governance, Payments/settlements, Proof of usage or time

- Supply Model: Fixed or inflationary, Mined (forged) or pre-minted, Reserve pools

- Distribution Strategy: Airdrops to users, Internal reward campaigns, Exchange listings or private swaps

- Incentive Structures: Milestone-based rewards, Referral bonuses

- Burning and Circulation: Will tokens be burned on use, Will they circulate externally or stay within the ecosystem

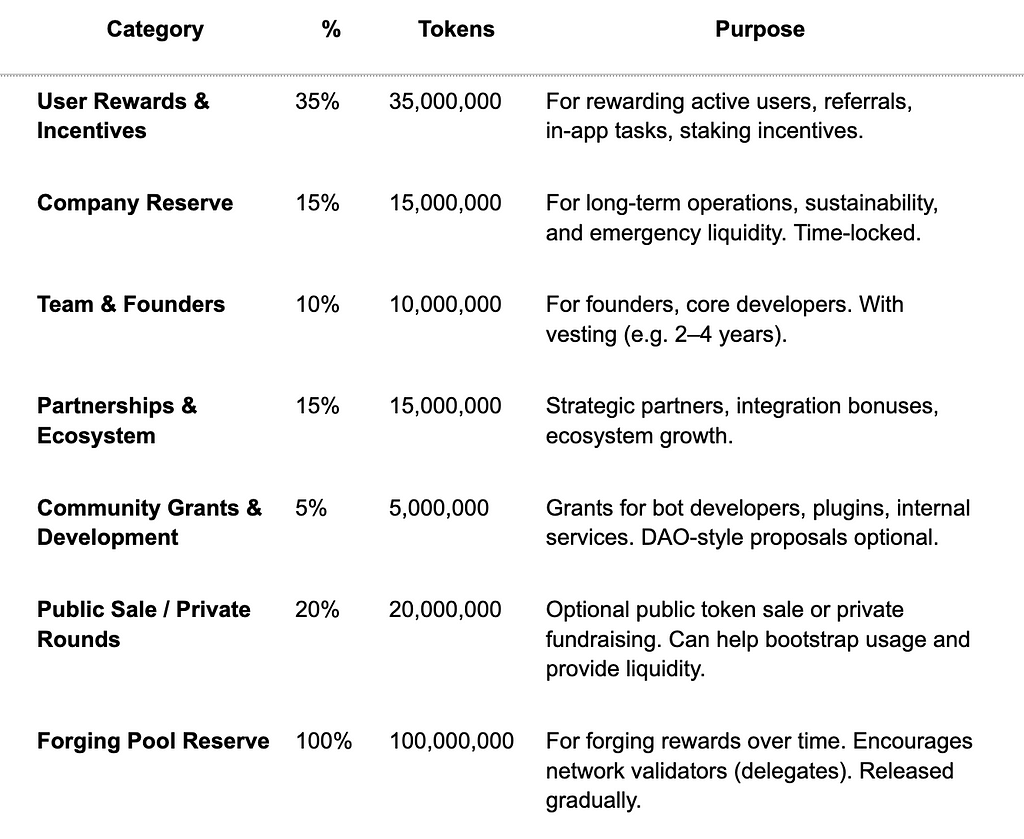

Here’s a realistic token distribution model for a fixed max supply of 200M utility tokens, where 100M is pre-mined, with future forging possibilities (e.g., via dPoS like in ADAMANT Business). This model balances incentives for early users, company operations, partners, and long-term sustainability.

And we provide further details on some categories.

Forging Mechanism after distribution:

- For forging rewards over time. Encourages network validators (delegates). Released gradually.

- Forging rewards come only from the Forging Pool of 100M tokens

- Fair dPoS model: Token holders vote for delegates to produce blocks

- Delegates are rewarded, and may optionally share rewards with their voters

- Low inflation — no new tokens beyond the initial plan

- Forging pool depletes slowly over 50 years (e.g., via halving, linear release, or activity-based model)

Vesting & Lockups:

- Team & Founders: 4-year vesting, 1-year cliff

- Company Reserve: 2-year lockup, then linear release

- Forging Pool: Released via smart contract or core protocol logic

- Public Sale (if any): Optional vesting depending on goals

Platform comparison: Which Blockchain to choose

When building your own utility token, selecting the right blockchain platform is crucial. The decision impacts scalability, control, costs, flexibility, and user experience.

We’ve reviewed numerous blockchain platforms and compiled a concise comparison to help you make an informed decision.

Our evaluation criteria include: Scalability, Security, Decentralization, Maintenance, Transaction Fees, Customizability, Transaction Types, Ecosystem & Wallet Support, Blockchain Interoperability, Open-Source Availability, Total Cost of Ownership, Documentation Quality, Messaging/Interoperability Capabilities, Listing on Exchanges, Market-making.

After a thorough analysis of various blockchains, we selected the most relevant ones for comparison: Ethereum, Binance Smart Chain, Solana, a Bitcoin fork, TON, Massa, BitDiamond v4, Klayr (formerly Lisk L1) sidechain, and ADAMANT Business.

1. Scalability

- Ethereum: Moderate scalability, constrained by legacy architecture and network congestion. Layer 2s like Optimism help, but integration adds complexity.

- Binance Smart Chain (BSC): High throughput due to centralized validators, but at the cost of decentralization

- Solana: Extremely high TPS (transactions per second), suitable for high-volume apps. However, it has suffered multiple network outages and there are also concerns about centralization.

- Bitcoin Fork: Not scalable for real-time utility tokens. Block times are slow, and transaction capacity is low. POW consensus requires hardware for block confirmations.

- TON: Promises high scalability, but real-world performance is still evolving. Sharding adds future potential.

- Massa: Highly scalable due to its multi-threaded block graph architecture

- BitDiamond: Parallel transaction processing and asynchronous consensus, enabling the network to handle at least 400 transactions per second

- Klayr Sidechain: Medium scalability; sufficient for most apps, but not battle-tested than Ethereum or Solana

- ADAMANT Business: Adjustable with block times and number of transactions per block. It’s more than adequate for internal utility tokens, especially given most company apps don’t require millions of TPS.

2. Security

- Ethereum: Very secure due to broad decentralization and battle-tested infrastructure. Smart contract exploits remain a risk.

- BSC: Moderately secure; less decentralized makes it more vulnerable to validator collusion

- Solana: Historical bugs and outages have raised security concerns

- Bitcoin Fork: Extremely secure if hashing power is high. Still it’s not the case for fork projects, where they get “low security” scores.

- TON: Security promises are strong, but its young ecosystem needs time to validate.

- Massa: Uses a custom Proof-of-Stake consensus with endorsements that help confirm the best chain view. The system includes: Randomized slot selection to prevent deterministic attacks, Finality guarantees via block endorsements, Sybil resistance through stake-weighted leader selection.

- BitDiamond: The HBBFT consensus algorithm brings asynchronous Byzantine Fault Tolerance, which makes the network resilient to network latency, censorship attempts, and forks

- Klayr Sidechain: Fairly secure depending on configuration; depends on parent chain’s anchoring.

- ADAMANT Business: Secure by design but implementation requires many independent nodes. Fair dPoS consensus and secure network architecture reduce attack vectors.

3. Decentralization

- Ethereum: Strong decentralization. Thousands of nodes and permissionless participation.

- BSC: Low decentralization. Controlled by a small set of validators under Binance’s oversight.

- Solana: Low decentralization; validator set includes selected participants

- Bitcoin Fork: High decentralization if widely adopted, though forks often end up with weak networks

- TON: Low; validator sets are controlled and onboarding is permissioned

- Massa: Architecture resists centralization pressures common in other high-TPS blockchains. Anyone can run a node on consumer-grade hardware. Smart contract autonomy reduces reliance on external triggers. Front-end hosting is fully on-chain.

- BitDiamond: DMD is DAO-governed and runs with a set of validators. Still, decentralization is not yet time-proved.

- Klayr Sidechain: Medium decentralization depending on setup. Can be customized.

- ADAMANT Business: You choose from a fully owned and controlled network to total decentralization. Private or public operation.

4. Maintenance

- Ethereum: Maintained by third-parties: Ethereum developers and node runners. No actions to maintain a token running from your side. Though it requires Solidity developers and devops for node management and smart contracts if you are interested in features beside token transfer.

- BSC: Nearly the same as for Ethereum

- Solana: Nearly the same as for Ethereum, but demands for Rust / C / C++ developers instead of Solidity.

- Bitcoin Fork: High maintenance costs. Requires developers, devops, and expensive hardware infrastructure from start.

- TON: Nearly the same as for Ethereum, but demands for FunC / Tact developers instead of Solidity.

- Massa: Nearly the same as for Ethereum, but demands for AssemblyScript developers instead of Solidity.

- BitDiamond: Nearly the same as for Ethereum, EVM compatible.

- Klayr Sidechain: Maintenance costs are moderate. Initial setup and configuration require input from a JavaScript developer, but ongoing involvement is only necessary if you plan to introduce new blockchain features. The infrastructure also requires node deployment, though costs remain low thanks to the dPoS consensus mechanism.

- ADAMANT Business: Nearly the same as for Klayr

5. Transaction Fees

- Ethereum: May be high and volatile. Gas spikes make micropayments or frequent use impractical.

- BSC: Low. Great for cost-sensitive operations, though at decentralization’s expense.

- Solana: Extremely low fees. Near-zero cost per transaction.

- Bitcoin Fork: From Low to extremely high. Fees depend on chain usage, but are still higher than modern alternatives.

- TON: Low fees. But pricing structure can be opaque to external devs.

- Massa: Has a low and predictable fee model

- BitDiamond: Offers low transaction fees, enabled by its consensus efficiency

- Klayr Sidechain: Low, and adjustable. Suitable for different types of apps.

- ADAMANT Business: Costs can be extremely low or even zero. Fees are flexible and can be customized based on transaction type — you can also set intentionally high fees for specific cases. There’s no need to pay external validators or miners.

6. Customizability

- Ethereum: Limited token-level customizability — you can’t modify parameters like tx fees, block time or consensus mechanism. However, it offers high flexibility in usage. Smart contracts can implement nearly any logic, though complexity and high execution costs can be limiting factors.

- BSC: Nearly the same as Ethereum

- Solana: Nearly the same as Ethereum

- Bitcoin Fork: Very limited. You can adjust protocol rules, but can’t add blockchain logic easily. You can control the chain and parameters, but are limited in features.

- TON: Nearly the same as Ethereum. Requires working with the TVM and Telegram ecosystem.

- Massa: Nearly the same as Ethereum. Smart contracts are Turing-complete and can trigger themselves via self-wake functionality.

- BitDiamond: As an EVM-compatible chain, DMD supports full deployment of custom smart contracts. Developers can port existing Ethereum or Polygon contracts with minimal changes.

- Klayr Sidechain: Highly customizable, especially for apps with Lisk/JS background. Tailored for independent projects; sidechains can be customized and maintained. But Klayr lacks smart contract functionality.

- ADAMANT Business: Extremely customizable — any blockchain parameters can be adjusted, including block times, transaction fees, and initial delegate/validator structure. However, it does not support smart contract functionality.

7. Transaction Types

- Ethereum: Standard transactions, NFTs, and any smart contract calls

- BSC: Nearly Same as Ethereum

- Solana: Complex system of transaction accounts and smart contracts. Supports SPL tokens and NFTs.

- Bitcoin Fork: Plain transfers. Limited support for more complex scripting.

- TON: Transfers, contracts, and dApps within Telegram’s scope

- Massa: Nearly Same as Ethereum, and autonomous smart contracts

- BitDiamond: Supports all standard Ethereum-compatible transactions

- Klayr Sidechain: Supports token creation, voting, asset tracking out-of-the box, but requires blockchain development for introducing new types of transactions

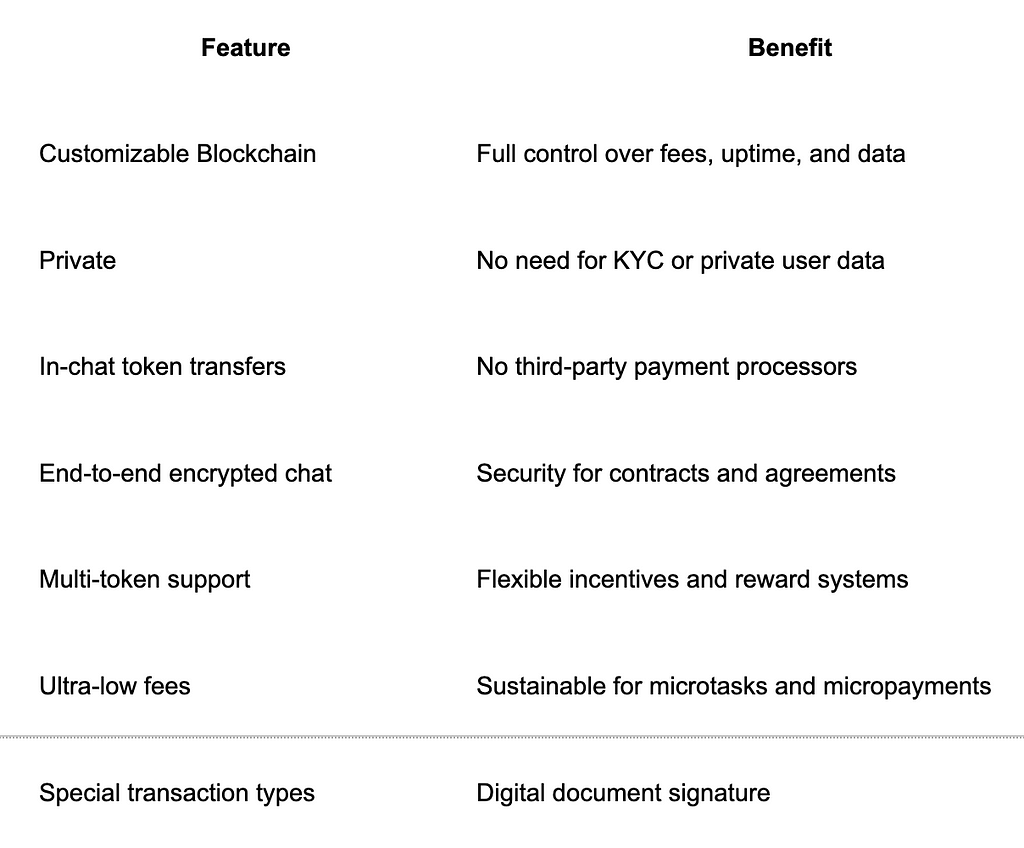

- ADAMANT Business: Transfers, messaging, data storage, signal, in-chat payments, delegate registration and voting are supported out-of-the box. Requires blockchain updates for introducing new types of transactions.

8. Ecosystem, Wallets

- Ethereum: Massive ecosystem. Thousands of tools, wallets, dApps (MetaMask, Uniswap, etc.).

- BSC: Strong ecosystem. Compatible with most Ethereum tools.

- Solana: Rapidly growing ecosystem. Wallets like Phantom and Solflare support SPL tokens.

- Bitcoin Fork: Limited wallets. Often requires self-hosted or custom solutions.

- TON: Growing ecosystem, but much behind Ethereum. Wallet integration is growing.

- Massa: Rapidly growing ecosystem, still in early-stage. SDKs and dev tools are available, and integrations are increasing gradually. Wallet, DEX, NFT marketplace are ready.

- BitDiamond: No ecosystem yet, as DMD v4 mainnet is not available yet. DMD can be used via popular Ethereum-compatible wallets like MetaMask.

- Klayr Sidechain: Klayr blockchain and ecosystem are in transition state, not available currently. Not EVM-compatible and can’t use its broad possibilities.

- ADAMANT Business: Not EVM-compatible and can’t use its broad possibilities, but provides different assets for their users: explorer, forging pool software, API libraries, IPFS node software, wallet and messaging applications for different platforms, message push service, airdrop software, CLI tool, currencyinfo service, exchange bot, AI bot, and other bots. Built-in crypto BTC, ETH, DOGE, KLY, DASH and ERC20 token wallets — all tokens can be transferred in-chat. Native interoperability for messaging and assets.

9. Blockchain interoperability

Ethereum: Mature, well-integrated, and a central hub for blockchain interoperability.

- Widely integrated with Layer 2 solutions (e.g., Arbitrum, Optimism) and sidechains (e.g., Polygon).

- Cross-chain bridges like Wormhole, LayerZero, and Axelar connect Ethereum to dozens of blockchains.

- ERC-20 token standardization makes asset transfers easy across chains.

- Smart contracts can integrate oracles (e.g., Chainlink) for external data interoperability.

BSC: Interoperability is robust, particularly within EVM ecosystems.

- Native bridging with Ethereum and other EVM-compatible chains

- Support for cross-chain swaps and wrapped tokens via BNB Bridge and Anyswap/Multichain

- EVM compatibility allows easy contract and dApp porting from Ethereum

- Supported by popular bridges and wallets (e.g., MetaMask)

Solana: Interoperability exists but relies heavily on third-party bridges and wrappers.

- Connected via bridges like Wormhole, which support token and NFT transfers

- Non-EVM architecture limits direct smart contract compatibility with Ethereum

- Bridges have suffered from security exploits, highlighting trust assumptions

- Ongoing development on native cross-chain standards (e.g., xNFTs, Solana x Chainlink CCIP).

Bitcoin Fork: Minimal interoperability; mainly reliant on custodial or bridge-based wrapping.

TON: Promising but early-stage. Interoperability is still maturing.

- Has an in-protocol bridging mechanism in development to connect with Ethereum and BSC

- Uses a shardchain architecture, enabling internal cross-shard communication

- Smart contracts are Turing-complete, but the ecosystem is isolated

- Some integration efforts are underway for Telegram-based crypto apps and payment systems

Massa: Not interoperable yet, but technically positioned for future integrations.

- Smart contracts operate fully on-chain, including autonomous execution and wake-up features

- Current support for Ethereum and BSC bridges

- Future upgrades could enable interoperability via smart contracts and secure storage models

BitDiamond: Fully compatible with Ethereum, using Open Ethereum addressing systems and foundations, and running EVM apps according to the protocol standards.

Klayr Sidechain: Strong internal interoperability; external integration is still limited.

- Formerly Lisk, it uses the Lisk Interoperability Protocol for connecting independent sidechains

- Each sidechain can be customized but still communicates securely with the L1

- Native messaging and token standards are designed for cross-chain compatibility within the ecosystem

- No support for external chains like Ethereum or BSC

ADAMANT Business: Intentionally isolated; prioritizes privacy and security over interoperability.

- Does not support external blockchain interoperability by design

- No wrapped ADM versions or bridges at this time, but could be implemented in future

- All ADAMANT Business chains share the same passphrases and address derivation (with different prefixes), allowing users to access all business wallets using a single passphrase. This unified identity structure enables seamless onboarding and easy airdrops to the existing ADAMANT user base.

- Business chains share the same addresses (but with different prefixes) and passphrases. It allows a user to enter all business wallets with the only passphrase, and projects can run airdrops to existing ADAMANT user base easily.

- Future upgrades may introduce cross-chain functionality between business chains or with external networks if privacy and security is preserved

10. Open Source Status

- Ethereum: Fully open source

- BSC: Partially open. Validator structure is not fully transparent.

- Solana: Mostly open source, but some infrastructure components are less documented.

- Bitcoin Fork: Fully open.

- TON: Not fully open. Controlled roadmap and access.

- Massa: Fully open-source, available on GitHub under the MIT license

- BitDiamond: Open-source, with its full codebase and whitepaper available on GitHub

- Klayr Sidechain: Open source and community-driven.

- ADAMANT Business: 100% open source. Transparent, auditable, and community-first.

11. Cost of Ownership

- Ethereum: Costs vary depending on your approach. Launching a standard token is low-cost, but developing custom-featured tokens or dApps is expensive. Additional costs may include smart contract audits, running nodes, and gas fees.

- BSC: Nearly the same as Ethereum, but lower blockchain fees

- Solana: Nearly the same as Ethereum, but lower blockchain fees. Developers and contract audits may cost higher.

- Bitcoin Fork: High. Forking is relatively easy, but tooling and updates are expensive to maintain. Also, high costs for initial infrastructure.

- TON: Nearly the same as Ethereum. Tied to Telegram’s ecosystem. Requires advanced knowledge. Developers and contract audits may cost higher.

- Massa: Nearly the same as Ethereum, but lower blockchain fees. Developers and contract audits may cost higher.

- BitDiamond: Nearly the same as Ethereum, but lower blockchain fees

- Klayr Sidechain: Costs also depend on your approach. You’ll need to maintain infrastructure, though it remains accessible. Developing features and applications requires JavaScript developers.

- ADAMANT Business: Similar to Klayr in terms of setup and development, but significantly more cost-effective when leveraging the already built Ecosystem (see above).

For any blockchain project, you’ll need to allocate funds for listing on exchanges, liquidity provision, market-making, marketing, legal support, and community management — these costs can vary widely.

12. Documentation

- Ethereum: Extensive but fragmented. Requires technical literacy in Solidity.

- BSC: Good documentation, mostly compatible with Ethereum.

- Solana: Improving. Still technical and Rust-based.

- Bitcoin Fork: Sparse. Not ideal for newcomers.

- TON: Underdeveloped public documentation

- Massa: Comprehensive and accessible documentation

- BitDiamond: Developer documentation is not yet fully available

- Klayr Sidechain: Reasonable. Good JS/TS support.

- ADAMANT Business: Practical and easy to understand — designed for general IT staff, not just blockchain engineers. Includes API guides, setup instructions, and real-world examples. However, some tools and software are still lacking comprehensive documentation.

13. Messaging/Interoperability Possibilities

- Ethereum/BSC/Solana/Bitcoin/TON/Massa/BitDiamond/Klayr: ❌ Messaging not natively supported. Requires separate apps and custom smart contracts. No native chat features.

- ADAMANT Business: ✅ Built-in communication platform. Blockchain-based, secure, anonymous. Chat with end-to-end encryption, transfer tokens in messages, build bots, send signals and notifications. Comprehensive blockchain API for communication apps. Messaging is not a plugin — it’s a core blockchain function with its own transaction type.

14. Listing on Exchanges

Ethereum: Near-universal. Supported by virtually all CEXs and DEXs.

- Token Standard: ERC-20 is the industry standard

- DEX Listing: Simple (e.g., Uniswap, SushiSwap)

- CEX Listing: Most CEXs support ERC-20 tokens out-of-the-box

- Wallet integration costs: Low

- Best for: Projects seeking broad liquidity and DeFi exposure

BSC: Supported by most CEXs and DEXs

- Token Standard: BEP-20 (widely recognized)

- DEX Listing: Simple (e.g., PancakeSwap)

- CEX Listing: Most exchanges handle BEP-20 similarly to ERC-20

- Wallet integration costs: Low

- Best for: Projects looking for fast listing and lower trading fees

Solana: Growing, but not universal. Some exchanges require extra infrastructure.

- Token Standard: SPL tokens

- DEX Listing: Simple on Solana-native DEXs (e.g., Raydium, Orca)

- CEX Listing: Possible

- Wallet integration costs: Moderate

- Best for: Projects targeting Solana-native communities and dApps

Bitcoin Fork: High support for native Bitcoin; but very limited for forks

- Token Standard: Lacks token-layer standard; use-case limited to native Bitcoin

- DEX Listing: Not supported

- CEX Listing: Requires listing the coin directly, but some exchanges offers lower integration fees comparing to custom blockchains

- Wallet integration costs: Moderate

- Best for: Projects using the blockchain for payments, not tokens

TON: Moderate and increasing support, especially via Telegram-affiliated platforms

- Token Standard: Jetton standard (requires custom handling)

- DEX Listing: Available via TON DEXs (e.g., STON.fi), but not widespread

- CEX Listing: Often requires specific integrations and is not plug-and-play

- Wallet integration costs: Moderate

- Best for: Projects targeting Telegram audience, willing to wait for broader support

Massa: Limited support; still early stage

- Token Standard: Native support for tokens, but not yet integrated into most CEXs or DEXs

- DEX Listing: Dusa and EagleFi

- CEX Listing: Mostly custom integrations needed. Only Bitget and MEXC listed MAS.

- Wallet integration costs: From Moderate to High

- Best for: Long-term, tech-savvy projects willing to grow with the ecosystem

BitDiamond: Not yet supported

- Token Standard: Not yet introduced, EVM-compatible

- DEX Listing: Possible

- CEX Listing: Requires integration

- Wallet integration costs: From Moderate to High

- Best for: Long-term, tech-savvy projects willing to grow with the ecosystem

Klayr Sidechain: Requires custom integrations

- Token Standard: No ERC-20/BEP-20 compatibility; custom token architecture

- DEX Listing: Not supported

- CEX Listing: Sidechain tokens are not natively supported by CEXs — requires integration. Only Probit, CoinEx and Bitrue listed KLY.

- Wallet integration costs: From Moderate to High

- Best for: Long-term projects wanting full control over tokenomics

ADAMANT Business: Not supported by default. Custom chain = no built-in listing path.

- Token Standard: Native ADAMANT token format; not compatible with ERC-20/BEP-20

- DEX Listing: Not available without custom bridging

- CEX Listing: Would require technical integration by the exchange (wallet support, API). The following exchanges already listed ADM, and it’s easy to list ADM Business chain for them: Biconomy, Coinstore, Tapbit, NonKyc, Azbit, DigiFinex, Hotcoin, KoinBX, FameEX, bitcastle, BigONE, XeggeX, StakeCube.

- Wallet integration costs: From Moderate to High

- Best for: Long-term projects wanting full control over tokenomics and architecture

Summary table about listing possibilities:

15. Market-making

Market-making is critical for ensuring token liquidity, minimizing slippage, and maintaining healthy exchange activity.

Speaking about market-making on CEXs, it doesn’t matter which platform runs a token, as mm software works with an exchange API directly. Widely trusted MarketMaking.app provides support for all exchanges, including Binance, OKX, Bybit, Coinbase, MEXC, BingX, HTX, KuCoin, Gate.

MarketMaking.app software possibilities for a reference:

- Self-hosted & self-controlled (don’t share API keys)

- Dynamic order book building

- Maintaining healthy exchange activity

- Spread & liquidity/depth maintenance

- Price range setting

- Arbitrage token price

- No monthly fees or subscriptions

- There is an open-source version

DEX market-making is not a common thing, Ethereum and BSC blockchain platforms are better supported by automated mm tools, while others require custom solutions.

Conclusion

Launching your own utility token can ensure monetization, supercharge user engagement, reduce operational costs, and give you ownership over your software ecosystem. But your success depends heavily on choosing the right blockchain platform.

Each blockchain platform offers unique strengths tailored to specific use cases. Whether you’re launching a game, securing private communication, or tokenizing your service offering, selecting the right platform depends on your goals in scalability, customization, decentralization, and ecosystem reach.

Let’s summarize:

Ethereum

The most established smart contract platform, Ethereum is ideal for complex, decentralized ecosystems with broad interoperability needs. It suits companies that want to build on a battle-tested platform with the deepest developer tools and liquidity.

Best for: Companies like financial services and banks, real estate, derivatives platforms, and tokenized art businesses

Examples: A real estate platform issuing tokenized property shares, an NFT gaming hub, or a carbon credit trading marketplace.

Binance Smart Chain (BSC)

BSC provides high throughput and low fees with full EVM compatibility. It’s ideal for projects looking for quick deployment and low-cost transactions, albeit with less decentralization.

Best for: Projects like VPN services, microtransaction services, mobile game publishers, and freelance work platforms

Examples: A VPN provider tokenizing bandwidth, a mobile game developer launching in-game currency, or a freelance gig marketplace with tokenized escrow.

Solana

Solana’s high performance and ultra-low fees make it ideal for real-time, data-heavy applications. It’s favored by apps that demand speed, such as trading tools.

Best for: High-frequency trading apps, games, NFT, stock trading startups, or real-time auction platforms

Examples: A digital ad exchange, a large-scale metaverse platform.

Bitcoin Fork

Bitcoin-based forks are best used for simple, secure transactions. These chains are reliable but limited in programmability.

Best for: Retail payment gateways, cross-border remittances, store-of-value models

Examples: An online store accepting crypto, a travel agency offering discounts via token, or a gift card service.

TON (The Open Network)

TON, deeply integrated with Telegram, is perfect for user-friendly consumer apps and Telegram-native experiences. Its mobile-first design suits startups targeting massive adoption quickly.

Best for: In-chat wallets, microtask platforms, social games, Telegram communities, social media influencers, or subscription-based services

Examples: A newsletter service with token tipping, a group chat NFT minting bot, or a mini-game studio inside Telegram.

Massa

Massa’s architecture enables scalable dApps with on-chain web hosting, built for developers who want to push Web3’s boundaries. Its design supports privacy, autonomy, and possible future multi-chain linking while ensuring security and reliability.

Best for: Web3-native projects, decentralized hosting, experimental startups, independent developer collectives, privacy-focused browsers, or DAO-run services.

Examples: A decentralized web hosting provider, an encrypted blog platform, or a social DAO app.

BitDiamond

Robust, decentralized, and developer-friendly EVM-compatible blockchain platform with strong performance, interoperability, and governance features — ideal for projects migrating from Ethereum or looking for a low-cost alternative with superior resilience and DAO-driven direction.

Best for: Microtransaction services, mobile game publishers, or DAO-run services.

Examples: A mobile game developer launching in-game currency, a metaverse platform.

Klayr (formerly Lisk L1)

Klayr enables companies to create their own sidechain with JavaScript-based tooling, making it ideal for custom business logic and enterprise blockchain solutions.

Best for: Enterprise applications, custom permissioned chains, JavaScript developers, supply chain logistics, property registries, or HR platforms.

Examples: A real estate company with tokenized titles, a food supply chain with traceability tokens, or an HR firm issuing performance-based rewards.

ADAMANT Business

ADAMANT Business chains provide secure messaging and payments with multi-tenant isolation and shared access via a single passphrase. It combines decentralized infrastructure with a built-in secure messenger, making it a unique choice for private communication and internal economies with custom transaction fees — ideal for software monetization, rewards & incentives, accessing premium features, internal settlements, no-KYC auth, and accountability.

Best for: Web3 social networks, communities, NSFW providers, decentralized dating platforms, privacy-first businesses, internal token economies, internal B2B ecosystems, industrial cooperatives, crypto exchanges.

Examples: A VPN business distributing tokens for bandwidth, a private investment club, a privacy-first metaverse platform, or an internal messaging platform for a multinational company.

Bonus: Freelance Marketplace use-case

Let’s review a use case of a freelance marketplace planning to tokenize its business with the following goals:

- Build or enhance a platform where clients and freelancers can collaborate, make payments, and resolve disputes securely

- Monetize the service by offering additional features for both clients and freelancers

Key challenges in freelance marketplaces:

- Need for reliable escrow between anonymous or semi-anonymous users

- High payment processing fees

- KYC requirements for payments between clients and freelancers

- Lack of secure, real-time communication

- Complex or costly dispute resolution mechanisms without exposing private data

- High operational costs on centralized infrastructure

- Dependency on centralized servers for messaging and payment flows

- No trusted or verified reputation and portfolio system

The company does not want a fully trustless escrow system, where no arbiter exists — because this could result in funds being permanently locked. Instead, it prefers to continue reviewing disputes manually but wants to reduce processing costs and improve reliability.

The objective is not to decentralize everything but to start with payments, communication, and a reputation system. The company is also looking for ways to ensure long-term monetization through optional services and to boost user engagement.

Each blockchain platform offers unique strengths tailored to specific use cases. Let’s assess the most suitable blockchains for a freelance marketplace:

- Ethereum: Offers the largest ecosystem and DeFi integration, but high fees and technical complexity may pose barriers for end-users. Best suited if a company plans to deeply integrate with DeFi or NFTs for advanced monetization models.

Not recommended due to high costs

- Binance Smart Chain: Lower costs and fast transaction speed make BSC more approachable than Ethereum. Also suited if a company plans to use DeFi possibilities.

Possible, but lacks native tools for secure messaging and internal ops

- Solana: High throughput and a growing user base are attractive, but entry cost will be probably expensive. High technical demands make it less ideal for lightweight apps.

Similar drawbacks to Binance Smart Chain

- Bitcoin Fork: These are good for basic tipping, payments, or in-app donations, but not more.

Not suitable

- TON: Integrated into the Telegram ecosystem, TON may offer exposure to a large privacy-oriented user base. However, limited tooling and ecosystem maturity could restrict innovation compared to alternative Ethereum and BSC platforms. Best for apps heavily dependent on Telegram or mobile-first strategies.

Limited: promising, but lacks core privacy and independence

- Massa: A promising Layer-1 with strong decentralization and parallel execution. While still emerging, it could offer a solid base for privacy apps that require scalability. Good for future-proofing, but current ecosystem support is limited.

May be an option, but development and maintenance costs may be high; no built-it messaging

- BitDiamond: EVM-compatible and offer low-fees, which make it very good for micro-transactions

Not yet available; In development

- Klayr: Easy to build with JavaScript and run a sidechain tailored to specific use cases.

Not reliable at this stage — Platform is in transition

- ADAMANT Business: Pragmatic and privacy-aligned choice. It’s free, self-hosted, lightweight, and comes with built-in messaging and coin transfers. This is a good option if a company wants full control while maintaining low costs. Especially suitable for custom reward systems and user identity layers.

Fits all project requirements

Final options for freelance marketplace tokenization:

- Binance Smart Chain BSC-20 token

- Solana’s SPL token

- Jetton on TON

- Token on Massa blockchain

- ADAMANT Business

How ADAMANT Business solves a Freelance marketplace challenges:

Tokenized escrow system & In-chat crypto transfers

- Issue a native token (e.g., GIG, WORK, or CRED) on your ADAMANT Business chain

- Freelancers request payment in GIG or other crypto-currency directly in-chat

- No separate interface needed — crypto can be sent directly within chat

- Freelancers can send invoices, and clients can pay with one click, non-custodially

- Supports GIG, BTC, ETH, DOGE, DASH, ADM, and ERC-20 tokens

Monetization opportunities

- Offer premium services for freelancers (e.g., portfolio, boost visibility)

- Charge clients for arbitration or project promotion

- Collect service fees in native token

- Extra-low fees

- No KYC, no reliance on external processors

Private messaging with end-to-end encryption

- Built-in secure messenger with no phone numbers or emails

- ADAMANT encrypts all messages (Curve25519 + Salsa20 + Poly1305)

- Ideal for protecting NDAs, contracts, or negotiation discussions

Reputation and rewards

- Freelancers earn tokens that represent completed tasks or reputation

- Create tiered reward systems or referral programs

- Clients can be rewarded for early payments or feedback via bonus tokens

No dependency on external APIs

- Fully customizable decentralized infrastructure

- The entire platform can run on self-hosted nodes

- Maintenance cost are low

- Transactions, user messages, bot activity — all happen on-chain or locally

Final words

While platforms like Ethereum or Solana offer public exposure, they often come with uncontrollable costs, complex maintenance, and security risks. In contrast, ADAMANT Business empowers you with privacy, speed, low costs, and native messaging capabilities — making it a perfect fit for software creators aiming to modernize without friction.

If your company needs a cost-effective, customizable, easy-to-maintain blockchain platform with built-in messaging, crypto wallets, and seamless internal utility token support, ADAMANT Business offers a uniquely powerful foundation.

“Ordinary IT specialists can deploy ADAMANT Business, totally customized and full-featured. No need for expensive consultants.” — Alch, community member of ADAMANT

“Spotlight on ADAMANT Business, a uniquely integrated blockchain and messenger platform for businesses” — Cherving, CEO of a software development company.

Your coin. Your data. Your rules.

Get started with ADAMANT Business today.

Learn more:

📱 Try ADAMANT Messenger apps: Web / iOS / Android / Tor / Desktop

🚀 Contacts

Building a utility token for your software product: Why, How, and what Blockchain Platform to… was originally published in ADAMANT on Medium, where people are continuing the conversation by highlighting and responding to this story.

0

0

Управляйте всей своей криптовалютой, NFT и DeFi из одного места

Управляйте всей своей криптовалютой, NFT и DeFi из одного местаБезопасно подключите используемый вами портфель для начала.