Ethereum Supply Crunch Deepens as Bulls Eye $2,200 Breakout

0

0

NAIROBI (CoinChapter.com) — Ethereum (ETH) continues to face selling pressure after falling below $2,000 for the first time in over a year. But mounting on-chain signals suggest the trend may be shifting.

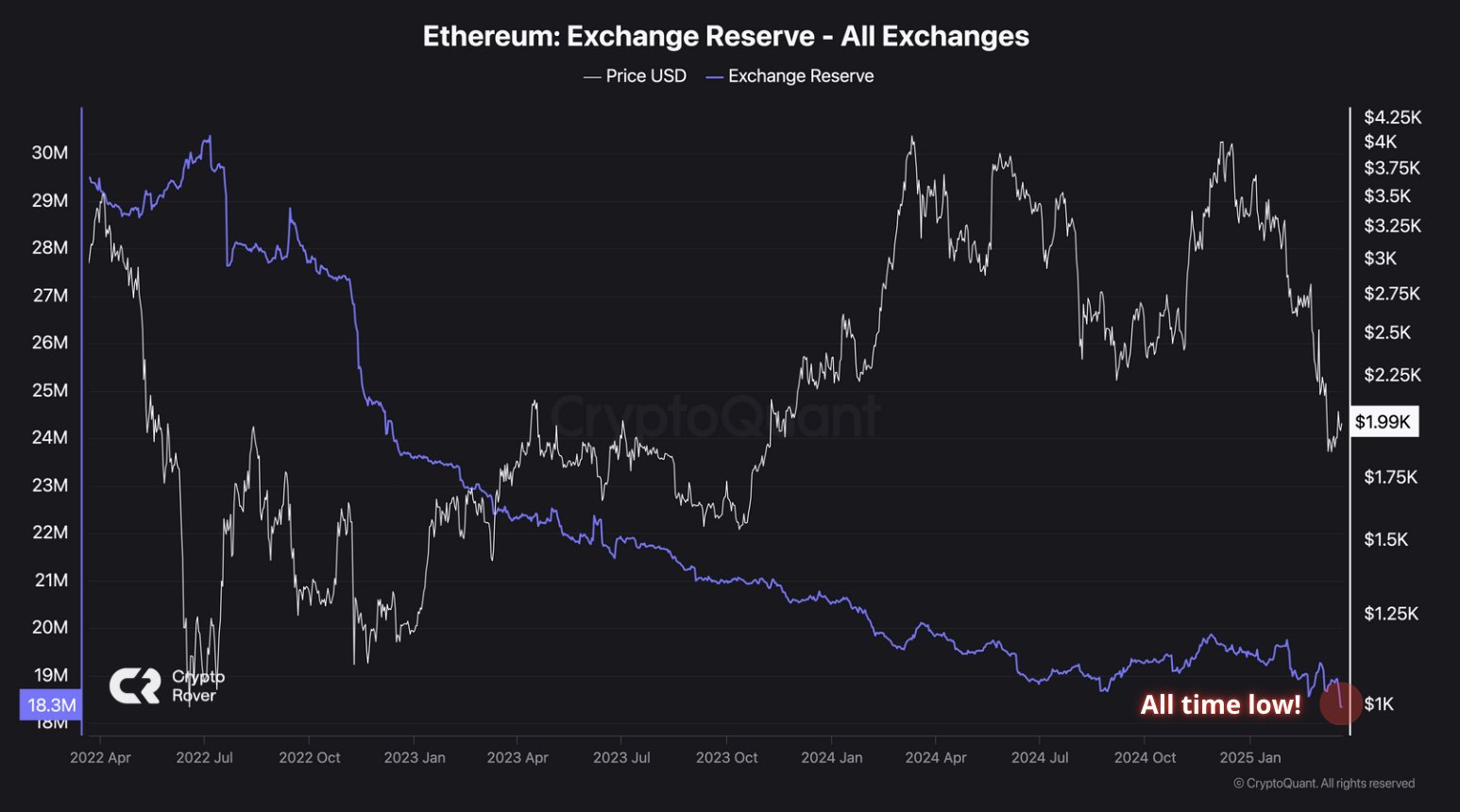

Record Low Exchange Supply Fuels Rebound Narrative

ETH’s total supply on centralized exchanges has dropped to levels last seen in Nov. 2015, according to CryptoRank and Santiment. As of March 23, reserves stand at just 8.97 million tokens. That marks the lowest tally in over nine years.

Crypto Rover posted that Ethereum’s exchange reserves recently fell to an all-time low of 18.3 million, signaling rising investor confidence. The drop points to more ETH being moved to cold storage, a behavior typically linked to long-term holding.

“Investors continue moving ETH to cold storage, reducing available liquidity,” CryptoRank wrote in a recent post. The same trend in Bitcoin in Jan. was followed by a sharp rally from $90K to $109K.

Merlijn The Trader echoed similar sentiment, writing,

“THE $ETH SUPPLY CRUNCH IS REAL! Ethereum reserves on exchanges just hit their LOWEST LEVEL EVER!”

ETH Whales Accumulate as Retail Dumps

Despite ETH dropping more than 51% from its Dec. 16 high of $4,100, whales appear to be unfazed.

Santiment data shows wallets holding between 1,000,000 and 10,000,000 ETH purchased over 120,000 tokens in 72 hours. Meanwhile, Glassnode data reveals the number of wallets holding $100,000 or more in ETH rose from 70,000 on March 10 to 75,000 by March 22.

ETH: Number of Addresses with Balance ≥ $100k. Year-to-date chart. Source: Glassnode

The uptick in large wallet activity aligns with a broader sentiment shift. Ether’s open interest hit an all-time high on March 21, pushing investor hopes toward a potential breakout.

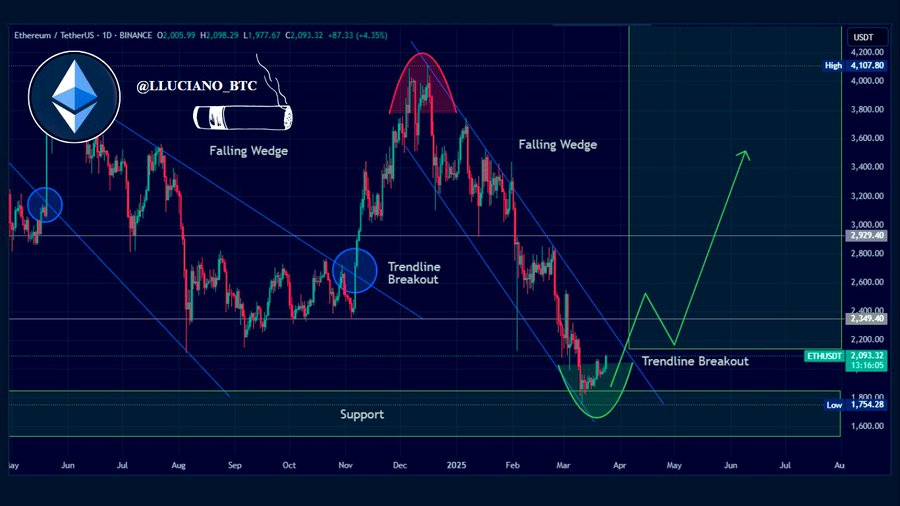

Analysts Say $2,200 Must Break

Rekt Capital emphasized $2,200 as the critical price to watch. In a March 19 post, the analyst said ETH must reclaim the $2,196–$3,900 macro range to resume its uptrend.

Crypto trader Jelle added, “$ETH is bouncing, and trying to get back above the key support level. If this pushes back above $2200 – we’ll have a monster deviation on our hands.”

Lucky also remains bullish. He called for a “crucial breakout,” predicting that both ETH and its on-chain gems will “fly harder in the coming 3 months.”

He added, “Historically, Q2 has been bullish for ETH, and I believe we will see this trend continue.”

ETH RSI Hits Historic Low as Bulls Plot $12K Path

Crypto Patel pointed to ETH’s Relative Strength Index (RSI), which has dropped to levels seen only three times in history. “Accumulation: Every F** Dip Between $2000-$1300,” he posted, suggesting a roadmap to $12,000.

VanEck projects ETH could reach $6,000 by the end of this cycle, with Bitcoin possibly climbing to $180,000. But macro headwinds remain a drag. Trade tensions and tariff uncertainty continue to cloud market sentiment heading into April.

Above all, with whale accumulation, falling exchange reserves, and key technical levels in focus, ETH bulls may still be preparing for a reversal.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.