Hyperliquid’s $5.5B USDC Migration: Who Will Control USDH Stablecoin?

0

0

According to recent reports, Hyperliquid USDH stablecoin is at the center of a fierce competition among major crypto players. Hyperliquid has opened a proposal window for institutions to bid for issuance rights.

The validator vote on who will manage USDH will occur on September 14, 2025. This contest could reshape stablecoin issuance, revenues, and governance within the Hyperliquid network.

What’s at Stake

| Metric | Figure / Detail |

|---|---|

| USDC currently held by Hyperliquid | ~$5.5 billion |

| Proposal deadline | September 10, 2025 |

| Validator vote date | September 14, 2025 |

Major Players in the Running

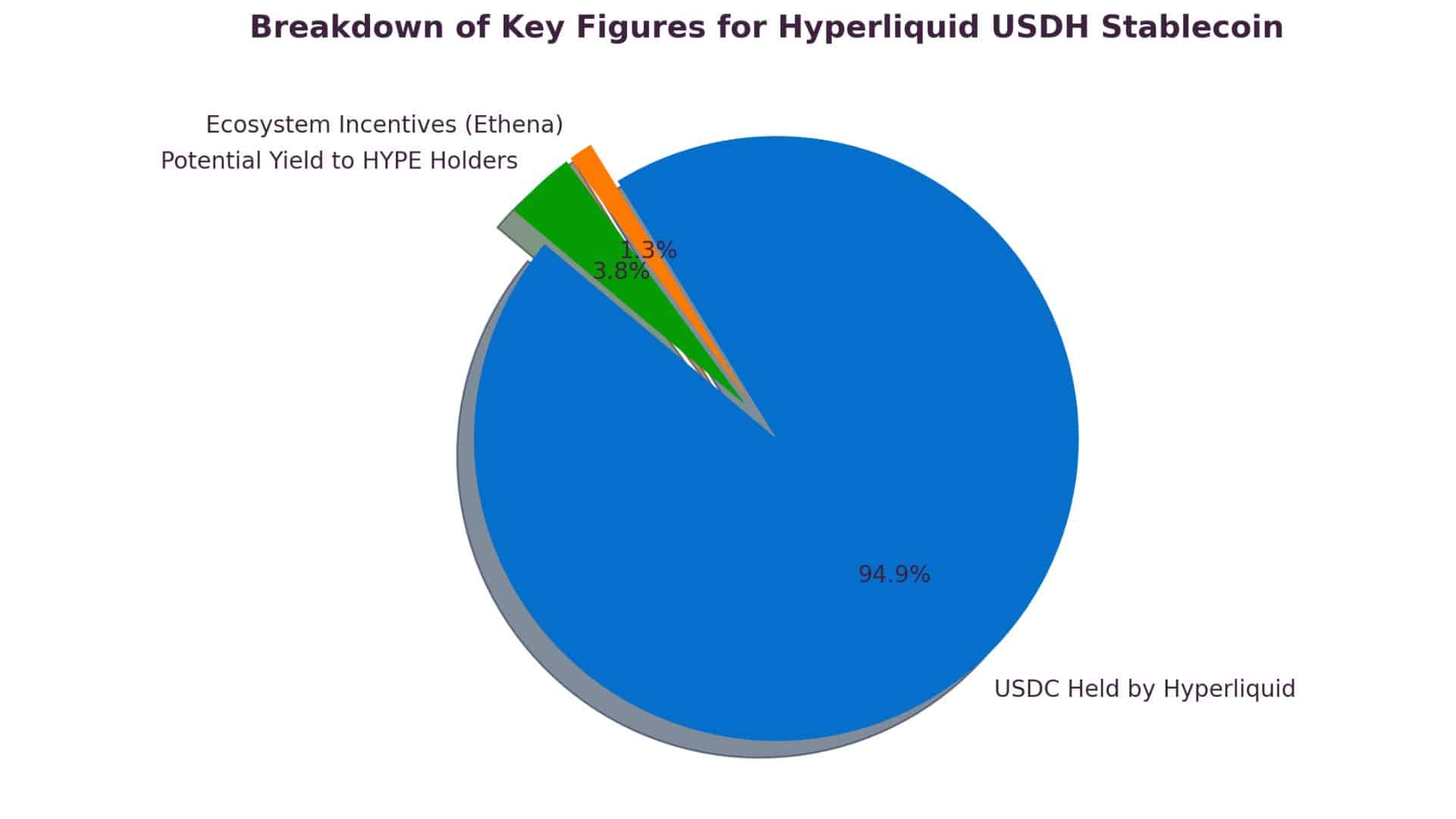

- Ethena Labs recently entered the bid with a plan to issue Hyperliquid USDH stablecoin backed by USDtb (linked to BlackRock’s BUIDL fund). It promises to return 95% of reserve revenue to the Hyperliquid community, set up a validator “guardian network,” and provide at least $75 million in ecosystem incentives.

- Other contenders include Paxos, Frax Finance, Agora, Native Markets, and Sky. Each brings its own model. Paxos leans on compliance. Frax highlights algorithmic backing. Sky has proposed offering nearly 4.85% annual yield, supported by its $8 billion balance sheet. These differences set up a high-stakes competition.

Also read: $1 Trillion Stablecoin Market by 2026? Why Experts Say It’s Within Reach

Community Concerns & Governance

Some proposals have sparked debate. One major point of contention is a bid linked to Stripe’s Bridge platform. Critics argue that giving control of USDH’s monetary layer to an entity with other overlapping interests could threaten decentralization.

Hyperliquid’s own Foundation has said it will “effectively abstain” from the vote to reduce bias. Validators will decide which proposal wins.

Market Reactions

- The native token HYPE climbed above $50.o8 in recent trading, with gains above 7% in 24 hours, as USDH proposals increased the community’s expectations.

- Analysts estimate that a full migration from USDC to USDH could redirect $200–$250 million in annualized yield to HYPE token holders.

Quotes and Insights

“Hyperliquid’s native stablecoin USDH has attracted proposals from Paxos and Frax Finance.”

“Ethena Labs proposed a version of USDH backed by USDtb … pledged to return 95% of reserve revenue to the Hyperliquid community.”

Conclusion

Based on the latest research, Hyperliquid USDH stablecoin could become a central pillar in Hyperliquid’s financial system if validators select the right issuer. Ethena, Paxos, Frax, Sky, and Agora each bring distinct visions for yield, governance, and compliance.

The vote on September 14 will decide who issues USDH. That choice could shift billions in holdings and hundreds of millions in projected annual yield. The decision will ripple through USDC markets, stablecoin users, and DeFi protocols watching closely.

Also read: Experts Crypto Price Prediction Today for XRP, Bonk and Hyperliquid

Summary

This article breaks down the contest over Hyperliquid USDH stablecoin issuance. With $5.5–$5.9 billion in USDC reserves and projected yield shifts up to $250 million, the validator vote on September 14 is set to reshape both Hyperliquid’s economy and the wider stablecoin market.

Glossary of Key Terms

Validator vote: On-chain process where designated validators decide among proposals.

Reserve backing: Assets held to support the value of a stablecoin.

USDH: Proposed native stablecoin for Hyperliquid.

USDC / USDe / USDtb: Existing stablecoins; USDC is by Circle, USDe by Ethena, USDtb tied to BlackRock’s BUIDL fund.

Guardian network: Validator group proposed by Ethena to oversee USDH operations.

FAQs for Hyperliquid’s USDH Stablecoin

Q: What is Hyperliquid’s USDH stablecoin?

A: It is a proposed native dollar-pegged stablecoin for Hyperliquid. Issuer rights are under competition, with validator vote due September 14, 2025.

Q: Who are the main contenders?

A: Ethena Labs, Paxos, Frax Finance, Agora, Native Markets, and Sky are bidding to issue USDH.

Q: What does Ethena propose?

A: Ethena’s plan includes backing USDH with USDtb, returning 95% of reserve revenue to community, offering $75 million+ in incentives, and setting up a guardian validator network.

Q: How could this affect USDC?

A: Hyperliquid holds about $5.5B in USDC. If USDH replaces or reduces USDC usage, that could redirect income and value toward HYPE token holders and reduce dependence on Circle’s USDC.

Read More: Hyperliquid’s $5.5B USDC Migration: Who Will Control USDH Stablecoin?">Hyperliquid’s $5.5B USDC Migration: Who Will Control USDH Stablecoin?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.