SolMate Buys $50M SOL at -15% Discount: Can Solana Recover Amid Tariff Tensions?

0

0

A discounted $50M Solana buy just collided with fresh tariff jitters, testing whether corporate demand can steady SOL in a risk-off week.

Abu Dhabi–based Solmate Infrastructure (Nasdaq: SLMT) said on Oct. 14 that it purchased $50M worth of SOL directly from the Solana Foundation at a 15% discount.

We bought the dip.

Solmate has acquired $50 million of $SOL from the @SolanaFndn at a 15% discount to the market price.

This purchase will be used to power our Solana infrastructure in the UAE. pic.twitter.com/JwBKCYBdvh— Solmate (@oursolmate) October 14, 2025

At the same time, ARK Invest revealed it holds about an 11.5% stake in Solmate. Both moves arrived as renewed US–China tariff tensions rattled global markets, keeping risk assets under pressure.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

JUST IN: Solana treasury company @oursolmate (NASDAQ: SLMT) has purchased $50M worth of $SOL from the Solana Foundation at a 15% discount, while Ark Invest has disclosed a new ~11.5% ownership stake in the company.

Solmate recently raised $300M to build its digital asset… pic.twitter.com/2eiERqx3sK

— SolanaFloor (@SolanaFloor) October 14, 2025

Over the past day, SOL traded between the high $190s and low $200s as traders reacted to shifting headlines.

Solmate described the purchase and ARK’s position in a company statement, presenting the tokens as fuel for its upcoming “bare-metal” Solana infrastructure project in the United Arab Emirates.

The initiative falls under the Foundation’s “Solana By Design” program, aimed at expanding regional infrastructure support.

Why Is Solana’s Price Holding Steady Around $200 Despite Market Pressure?

The agreement also gives the Solana Foundation the right to nominate up to two directors to Solmate’s board, deepening their strategic alignment.

“We bought the dip,” said CEO Marco Santori, noting that the move reflects confidence in Solana’s long-term fundamentals despite near-term volatility.

The purchase comes amid a turbulent macro backdrop.

New threats of tariffs and export controls, such as restrictions on rare-earth and shipbuilding, have been exchanged between Washington and Beijing, increasing supply-chain and inflation risks.

The expansion in the markets was curtailed as investors wanted to be safe.

On Tuesday, the IMF issued a statement that the probability of a chaotic correction in the market is rising under the condition of the survival of trade pressures, indicating that the following significant trend in crypto is likely to rely on the development of these tensions.

The network recorded a trading volume of $8-$14Bn, and the price action became choppy, after briefly falling below $200 on fresh trade-related anxiety.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in October2025

Solana Price Prediction: Could Solana’s Price Rally Toward $300 or Fall Back to $125?

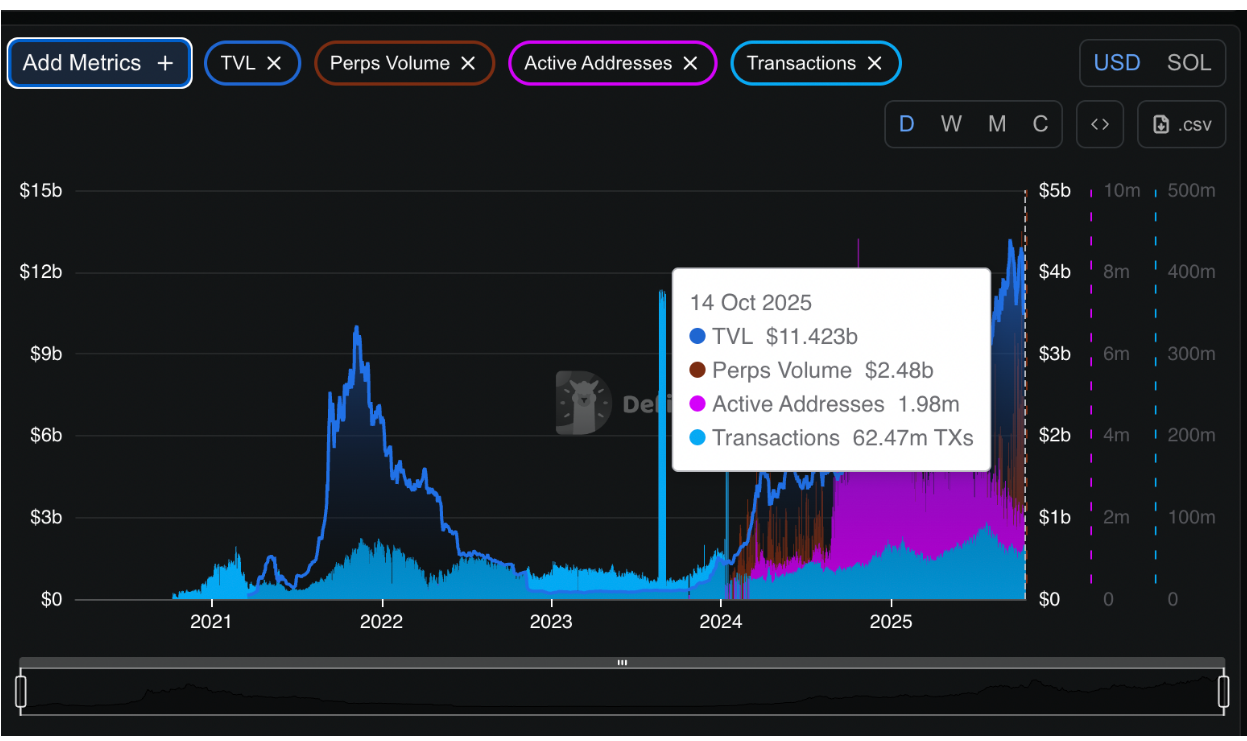

According to DeFiLlama, decentralized exchange (DEX) volume on Solana reached $5.15Bn, marking a 54% weekly rise.

The financial value of stablecoins in circulation on the network amounts to approximately $16.25Bn, of which USDC occupies approximately 74%.

The activity is high, the number of active addresses is about 1.9M, and there are 62.47M transactions within the last day.

The perpetual market run by Solana had completed about $2.48Bn in trades and earned $760,000 as fees and $150,000 as network revenue.

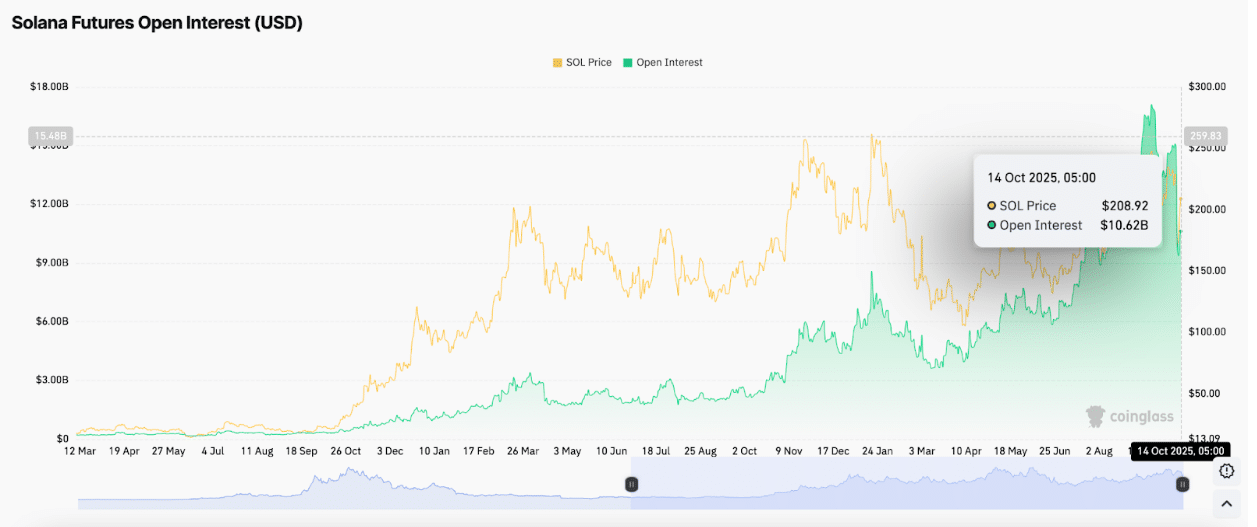

CoinGlass data indicate that the open interest in the derivatives market has been between $10.4Bn and $10.8Bn, with the futures volume 24 hours to run around $41-$43Bn, indicating that the traders are busy even though the price itself is not hot.

The spot trading was still stable at an average of $3.8-$3.9Bn in major exchanges. The level of venue-based funding was balanced, implying a relatively balanced market that is sensitive to key headlines.

Lark Davis, a prominent crypto analyst, posted the chart on X.

$SOL is tightening up between key levels.

If it breaks upwards, the Fib 1.618 points toward $300+

If it breaks down, the next possible support levels are at $169 → $125 → $95

One clean move from here decides the next major trend. pic.twitter.com/z7bDZYxirF

— Lark Davis (@TheCryptoLark) October 14, 2025

SOL was trading between $169 and $195 in a pattern of a symmetrical triangle, a pattern that is commonly observed before a huge breakout.

The upper resistance zone aligns near $195–$200, while key Fibonacci confluence levels sit just above.

If Solana breaks above the upper boundary, the next Fibonacci extension (1.618) projects a potential rally toward the $300 region, aligning with Davis’ analysis.

However, a breakdown below $169 could trigger a deeper correction toward the next support levels at $125 and $95, areas that coincide with previous accumulation zones and psychological demand levels.

Momentum indicators such as RSI appear neutral, reflecting indecision as traders await confirmation of direction.

Trading volume has thinned, reinforcing the likelihood of a breakout soon.

Overall, Solana’s structure suggests an inflection point. A single, decisive move could define whether it resumes its bullish leg or enters a corrective phase.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post SolMate Buys $50M SOL at -15% Discount: Can Solana Recover Amid Tariff Tensions? appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.