3 Big Reasons Bitcoin Isn’t Rising Despite $12B ETF Inflows

0

0

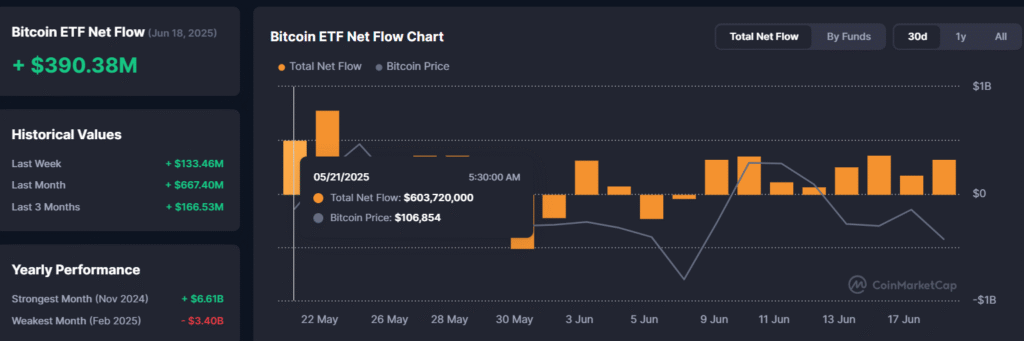

Bitcoin is experiencing record amounts of capital ETF inflows, especially through U.S. spot ETFs. Over $12 billion of capital has entered such investment products since the middle of April 2025 — one of the strongest adoption waves the asset has ever seen. But catch this: Bitcoin’s price stays relatively unchanged.

On June 18 alone, U.S. spot Bitcoin ETF inflows of $389 million, according to SoSoValue data. BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the charge. Nevertheless, Bitcoin still trades sideways, stuck between $103,000 and $105,500.

At the time of writing, Bitcoin trades at approximately $104,920, after a 24-hour fall of approximately 1.5%. On paper, this amount of inflow and interest should be sufficient to drive prices into new highs. So why is Bitcoin not reacting?

Big ETF Inflows but No Big Bitcoin Move

In the past cycles, this kind of enormous buying pressure would have led to Bitcoin surging quickly. Inflows are usually bullish signs because they suggest demand. But in this scenario, they are being countered by similarly powerful although less obvious selling pressure.

10X Research analysts think the market is too engrossed in surface-level positives while overlooking what’s going on below.

There is an ongoing bias towards the emphasis on positive developments particularly inflows and purchases while mostly excluding selling pressure, which is equally relevant,” the firm said in a recent note.

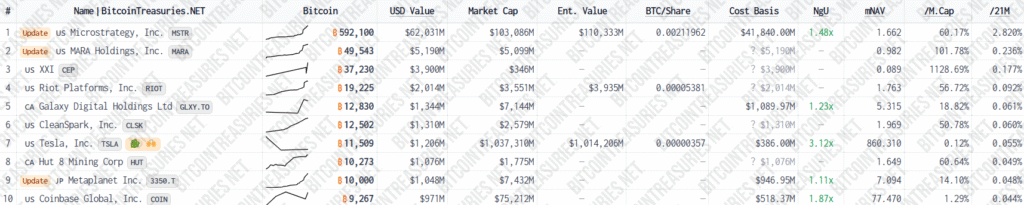

The big holders such as the miners, the early adopters, and the OTC desks seem to be employing the ETF inflows driven demand to quietly distribute their holdings, taming the price. Quiet distribution avoids the price reacting as aggressively as it did during previous bull runs.

Institutional Adoption: Stronger Than Ever

Not just ETF inflows institutional adoption of Bitcoin is stronger than ever. From traditional finance titans such as BlackRock and Fidelity to pension funds, endowments, and asset managers, Bitcoin is being seen more and more as a viable store of value and portfolio diversifier.

Donald Trump’s newfound pro-crypto tone has also been a bullish factor. The former President of the United States has committed to supporting American Bitcoin mining and friendly regulations, consistent with increasing acceptance on Capitol Hill.

Despite this institutional push, the market still misses a vital element, that is, retail fervor.

Earlier bull cycles were fueled not only by institutions but by tidal waves of retail participants. Today, retail involvement is subdued.

On-chain data verifies that transactions below $10,000 have declined, and Google Trends indicates a minimal spike in searches for Bitcoin ETF inflows. Without smaller investors piling in what most refer to as “FOMO buying” price has limited room to blow up.

Liquidity Conditions Put More Pressure

Another reason for the price action is the wider macro backdrop. Geopolitical tensions (such as the Israel-Iran conflict), Fed uncertainty, and tight U.S. dollar liquidity are all shaping a risk-averse environment.

Since March 2025, USD liquidity has remained flat to slightly negative, though ETF inflows are high, unlike the loose monetary conditions that fueled past rallies. Bitcoin thrives in high-liquidity, low-rate environments. That’s not the setup we’re in now.

The market’s low volatility is also noteworthy. Volatility compression often signals that a big move is coming, but whether it’s up or down remains uncertain.

Current liquidations of more than $1.2 billion in leveraged positions imposed short-term downward pressure. In addition, activity from long-silent wallets has made it difficult to determine whether early buyers are positioning themselves to sell.

Bitcoin Price Prediction Table – 2025

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| June | $102,500 | $105,000 | $109,000 | +3.8% |

| July | $104,000 | $108,500 | $115,000 | +9.5% |

| August | $107,000 | $112,000 | $120,000 | +14.5% |

| September | $110,000 | $116,500 | $125,000 | +19.2% |

| October | $113,000 | $119,000 | $130,000 | +23.8% |

| November | $115,500 | $122,000 | $135,000 | +28.5% |

| December | $118,000 | $125,500 | $140,000 | +33.3% |

Last Thoughts: Inflows ≠ Breakout

Even with an explosion of ETF inflows and record institutional onboarding, Bitcoin is stuck in a tight range. The institutionals’ fever is genuine so, too, is the stealth selling. Retail investors, who usually power the frothy legs of bull markets, are sitting out in large numbers.

Until the general surroundings change either through macro relief, retail re-entry, or clean technical breakout, Bitcoin could remain stuck in limbo.

FAQs

- Why isn’t Bitcoin rising with all this money flowing in?

Quiet selling from big players counteracts ETF buying. - What is a Bitcoin spot ETF Inflows?

It allows individuals to invest in Bitcoin using the stock market without actually possessing the coins. - Where are the individual investors?

Retail demand is low today. Fewer individuals are looking for or trading Bitcoin than previously.

Glossary

- ETF: An investment that allows you to invest in things such as Bitcoin on the stock exchange.

- Retail Investor: Regular individuals who sell and buy investments.

- On-Chain Data: Data from the blockchain that indicates how individuals are using Bitcoin.

- FOMO: Fear of missing out — when individuals scramble to buy as prices are increasing.

- Volatility : The amount and speed with which the price varies.

Sources

Read More: 3 Big Reasons Bitcoin Isn’t Rising Despite $12B ETF Inflows">3 Big Reasons Bitcoin Isn’t Rising Despite $12B ETF Inflows

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.