Fed Ends Crypto Oversight Program as Treasury Rules Out New Bitcoin Buys

0

0

The Federal Reserve announced Friday it has officially ended its Novel Activities Supervision Program, a framework established in 2023 to enhance oversight of banks engaged in emerging technology sectors like cryptocurrency, distributed ledger technology (DLT), and complex fintech partnerships.

Oversight of such activities will now be integrated into the Fed’s regular supervisory processes, which the central bank says can adequately identify and mitigate risks.

According to the official press release, the Fed hinted that it has gained sufficient understanding of these novel activities and how banks manage their exposure.

The now-discontinued program was initially designed to cover activities such as stablecoin issuance, tokenized securities, API-driven banking partnerships with non-banks, and services to crypto-related clients. Fed officials had leveraged academic and industry expertise to ensure supervision struck the right balance between innovation and stability.

According to the Fed, the move reflects growing confidence in traditional supervision methods to handle risks without stifling beneficial technological innovation in banking.

Treasury Rules Out New Bitcoin Acquisitions for Strategic Reserve

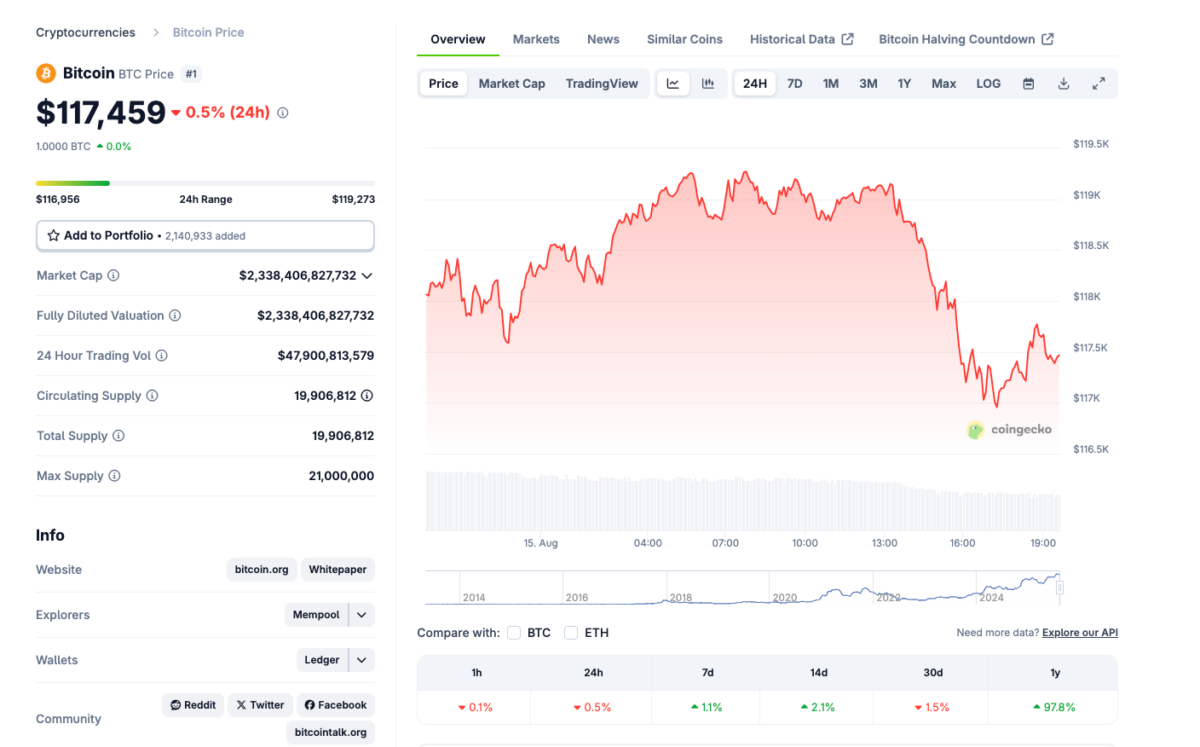

The Fed’s announcement came a day after US Treasury Secretary Scott Bessent said the government will not purchase new Bitcoin BTC $117 069 24h volatility: 1.0% Market cap: $2.33 T Vol. 24h: $47.37 B for its planned strategic reserve.

Speaking in a Fox News interview, Bessent confirmed the reserve will be built solely from confiscated Bitcoin assets, currently valued between $15 billion and $20 billion. He also reaffirmed plans to halt future sales of these holdings.

Bitcoin (BTC) Price Action | Source: CoinGecko

Bessent framed the decision as part of a broader “store of value” strategy, noting that while gold holdings won’t be revalued, Bitcoin is being positioned as a modern complement to US reserves.

Following the remarks, Bitcoin prices briefly tumbled as low as $116,856 on Friday, before stabilizing near $117,500, according to CoinMarketCap data. With the US Fed now relaxing regulatory restrictions on banks, the rapid wave of corporate BTC adoption is expected to accelerate as the second half of August 2025 unfolds.

Maxi Doge Presale Pumps Amid Friendly US Regulatory Stance

As crypto markets absorb the Fed’s oversight rollback and Treasury’s Bitcoin reserve stance, prospective investors are also paying attention to Maxi Doge ($MAXI). The Maxi Doge meme token offers staking incentives, gamified ROI contests, and partner integrations on futures platforms, positioning it as a viable option for traders rotating profits to newly launched crypto assets.

Maxi Doge Presale

Maxi Doge is trading on 1000x leverage with zero stop loss, attracting short-term speculative traders seeking high-risk and high-reward trading opportunities.

Priced at $0.000252, the presale has already raised $1,015,360.41 out of its $1,083,483.84 target. With just hours left before the next price hike, visit the official Maxi Doge website to get in early.

The post Fed Ends Crypto Oversight Program as Treasury Rules Out New Bitcoin Buys appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.