Solana Long-Term Holders Bet on a Breakout Despite Sideways Price Action

0

0

Since the beginning of June, Solana has traded sideways, consolidating within a narrow range. The altcoin has faced strong resistance at $158.80 and found support at $141.97, making several unsuccessful attempts to break out in either direction.

However, this period of price stagnation has presented a buying opportunity for long-term holders (LTHs), who are taking full advantage.

Solana Long-Term Holders Shrug Off Weak Price Action

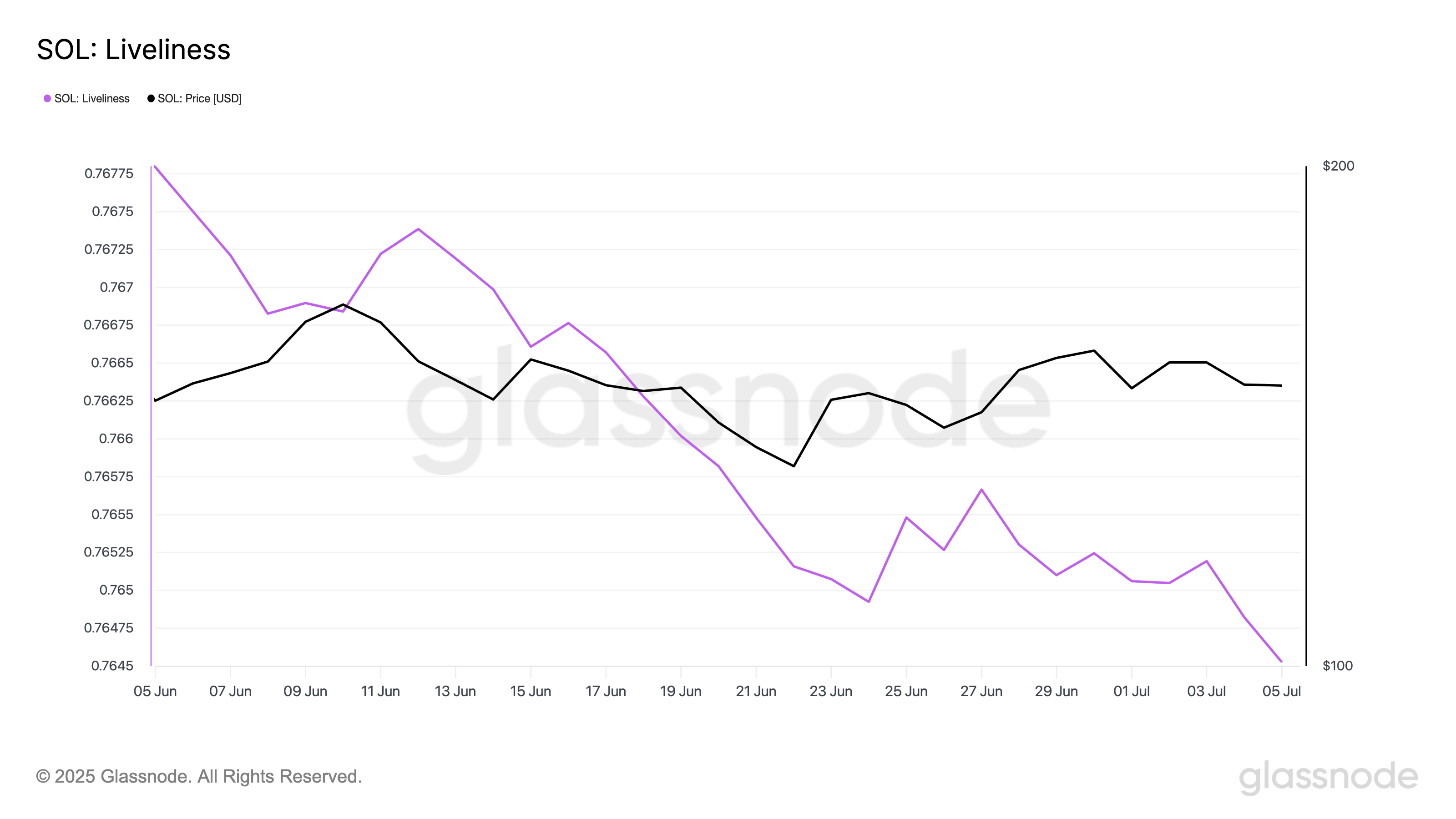

Glassnode’s data shows that SOL’s Liveliness has trended downward since climbing to a 90-day high on June 4. This metric, which tracks the movement of previously dormant tokens, fell to a 30-day low of 0.764 yesterday, indicating a notable decline in sell-offs among SOL’s LTHs.

SOL Liveliness. Source: Glassnode

SOL Liveliness. Source: Glassnode

Liveliness measures the movement of long-held tokens by calculating the ratio of coin days destroyed to the total coin days accumulated. When it climbs, it suggests that more dormant tokens are being moved or sold, often signaling profit-taking by long-term holders.

Converesly, when Liveliness declines, it indicates that LTHs are moving their assets off exchanges and opting to hold.

For SOL, this trend suggests that long-term holders remain confident in the prospect of a near-term rally and show little concern over the coin’s current lackluster performance.

Continued accumulation from these investors could build the foundation for a bullish breakout once market sentiment shifts in a more favorable direction.

Solana Holders Remain “Hopeful”

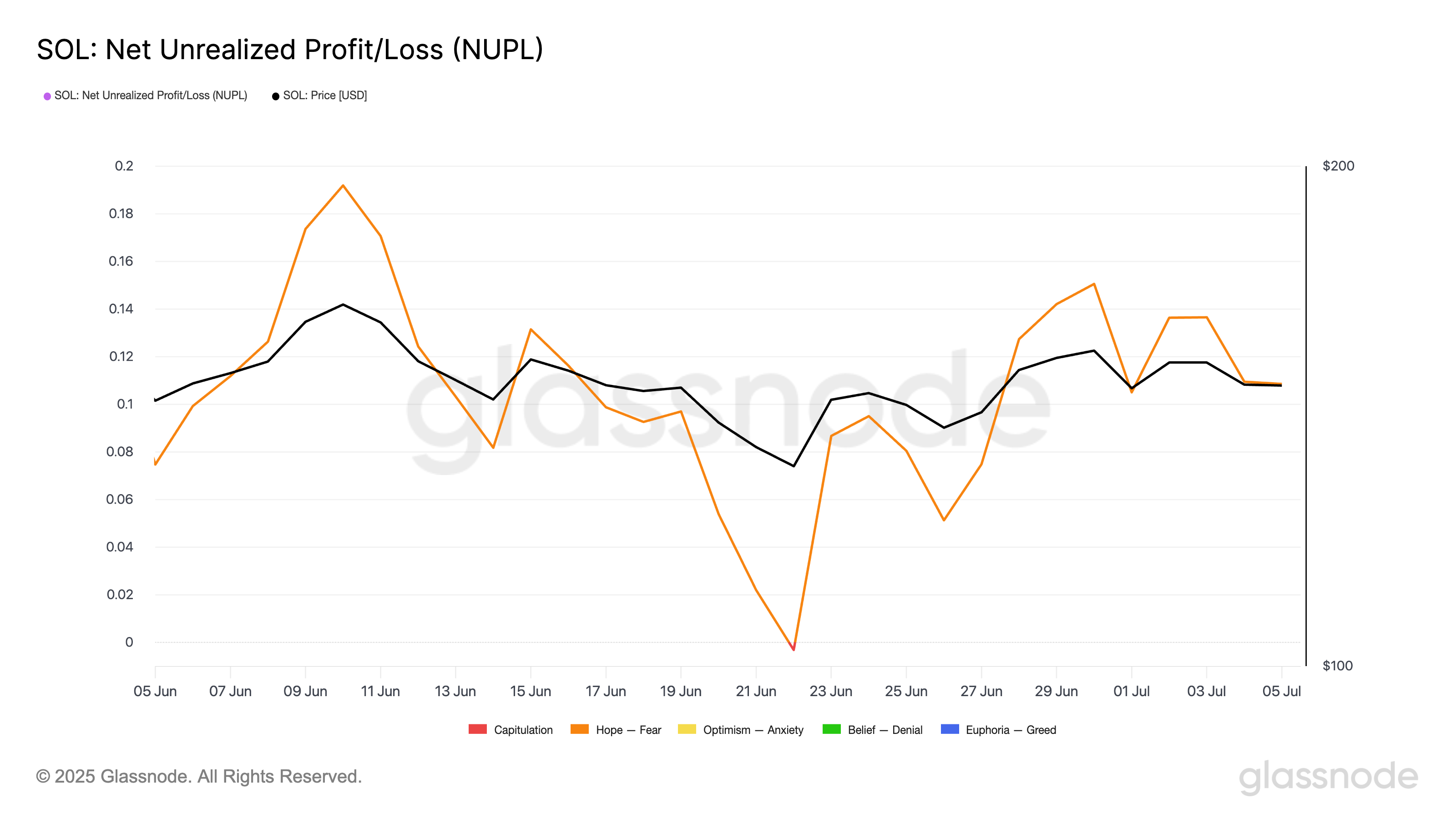

Moreover, readings from SOL’s Net Unrealized Profit/Loss (NUPL) confirm the likelihood of a bullish breakout. According to Glassnode, the metric has remained within the “hope” zone over the past 30 days. At press time, it is at 0.108.

SOL NUPL. Source: Glassnode

SOL NUPL. Source: Glassnode

The NUPL tracks the difference between the total unrealized gains and losses of investors based on the price at which coins were last moved. It indicates whether holders are, on average, in profit or loss and how likely they are to sell.

The “Hope” zone suggests that while many investors are back in profit, they have not yet begun taking profits aggressively. Instead, they are holding with the expectation of further upward momentum.

This trend signals cautious optimism among SOL coin holders and often marks the early stages of a potential bullish trend.

SOL Bulls Eye $170 as Long-Term Holders Tighten Their Grip

At press time, SOL trades at $148.06. If the coin’s LTHs double down on their accumulation and historical patterns hold, this could propel SOL’s price above the resistance at $158.80.

A succesful breach of this long-term resistance zone could lay the groundwork for a rally toward $170.

SOL Price Analysis. Source: TradingView

SOL Price Analysis. Source: TradingView

However, if selloffs strengthen, SOL eyes a break below the support floor at $141.97. In this case, its price could fall to $123.49.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.