Ripple (XRP) Price Gains Ahead of Closed-Door Meeting With SEC

0

0

The price of Ripple’s XRP token has maintained an uptrend in the past 12 hours as anticipation builds for a closed-door meeting between the payment services provider and the Securities and Exchange Commission (SEC).

The meeting, rescheduled from an earlier date, will focus on resolving the legal battle between both entities.

Ripple Witnesses Surge in Buying Activity

XRP is currently trading at $0.60. In anticipation of Ripple’s upcoming meeting with regulators, the token’s price has surged and is trending within an ascending channel.

The altcoin’s price movements assessed on a 12-hour chart reveal an uptick in demand. Its Relative Strength Index (RSI) currently lies above its 50-neutral line at 59.02, suggesting that buying pressure outweighs selling activity among market participants.

An asset’s RSI measures its overbought and oversold market conditions. At 59.02 at press time, XRP’s RSI suggests that traders are accumulating the token in anticipation of a favorable outcome from the upcoming meeting.

Read More: How To Buy XRP and Everything You Need To Know

XRP 12-Hour Analysis. Source: TradingView

XRP 12-Hour Analysis. Source: TradingView

Beyond the growth seen in its spot market, XRP’s derivatives market has also experienced a significant surge. Over the past 24 hours, trading volume in XRP derivatives has reached $3.82 billion, marking a 65% increase.

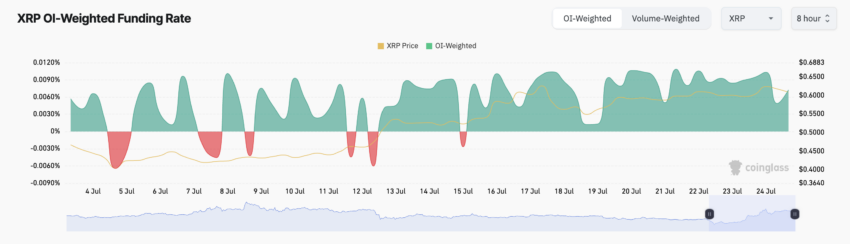

Further, its funding rate across cryptocurrency exchanges has remained positive. At press time, XRP’s funding rate is 0.0072%.

XRP Funding Rate. Source: Coinglass

XRP Funding Rate. Source: Coinglass

When an asset’s funding rate is positive, it indicates a hike in the demand for long positions. This suggests that more traders anticipate an uptick in the asset’s price compared to those buying it, hoping to sell at a lower price.

XRP Price Prediction: Price May Swing in Either Direction

When an asset sees an uptick in its derivatives trading volume, it indicates that its traders are actively speculating on its future price movements. This often leads to a spike in price volatility.

The widening gap between the upper and lower bands of XRP’s Bollinger Bands (BB) indicator confirms this volatility. This puts the token at risk of swinging in either direction.

If Ripple’s meeting with the SEC ends in the resolution of the different claims made by both parties, the positive sentiment may drive XRP’s price up to $0.61.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

XRP 12-Hour Analysis. Source: TradingView

XRP 12-Hour Analysis. Source: TradingView

However, if no such resolutions are reached or made, the token’s price may fall to $0.56.

0

0