VanEck’s Solana ETF Targets 6.65% Staking Yield in Zero-Fee Launch Window

0

0

This Article was first published on The Bit Journal.

The Solana ETF race just heated up. VanEck launched its VanEck Solana ETF (ticker VSOL) on November 17, 2025, offering investors regulated exposure to SOL plus staking rewards.

According to the company’s announcement, VanEck will waive its sponsor fee for the first $1 billion in assets or until February 17, 2026.

What Makes This Solana ETF Unique

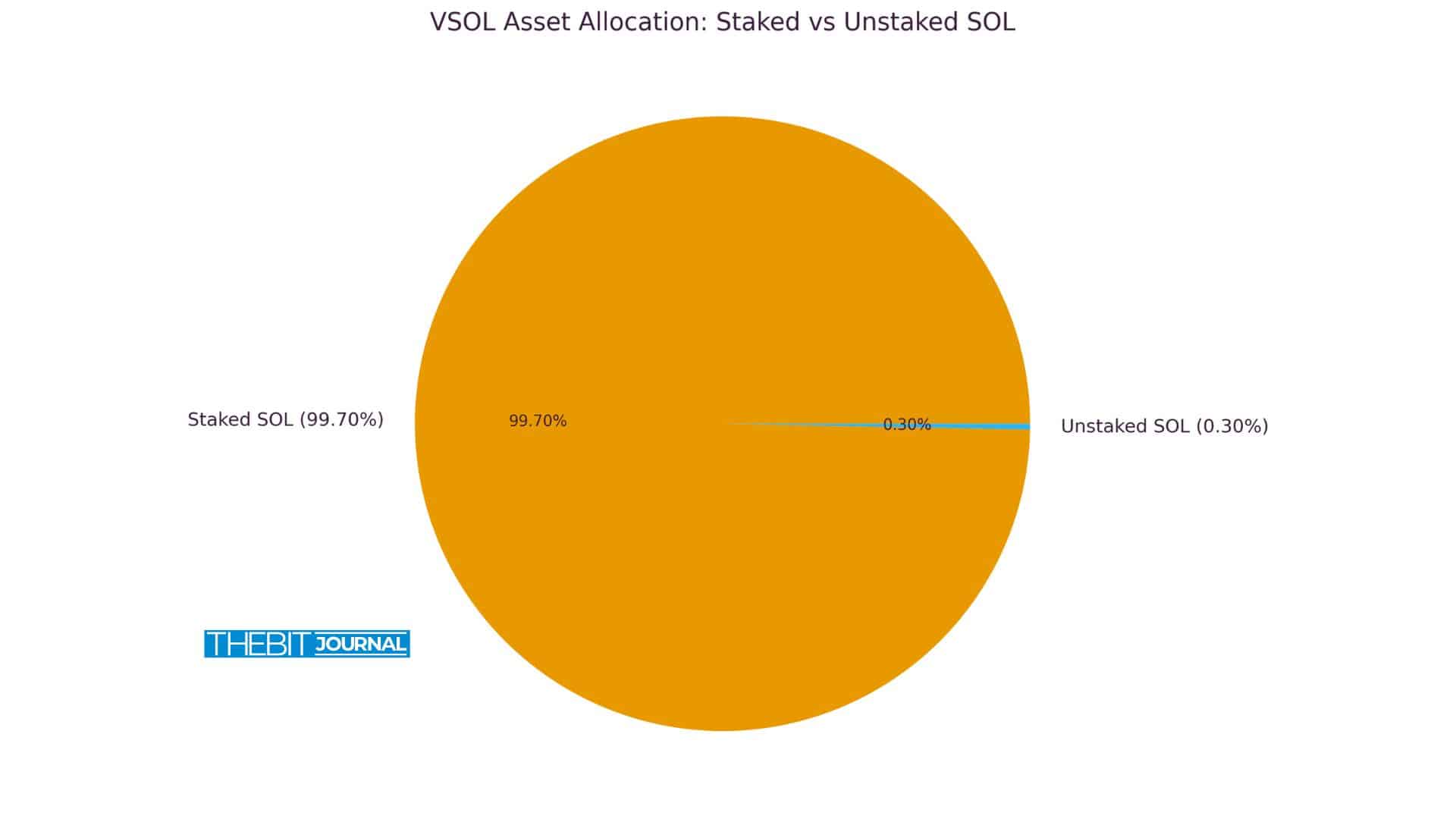

VanEck designed VSOL to reflect both SOL’s market price and the yield from staking. The trust delegates about 99.70% of its SOL to validators to earn staking rewards.

VanEck selected SOL Strategies (via its Orangefin validator) to handle staking. This partner runs high-performance validating infrastructure with ISO 27001 and SOC 2 certification. Custody of SOL is provided by Gemini Trust Company and Coinbase Custody, giving the ETF a solid institutional backbone.

Fees and Launch Incentive

VanEck is making a compelling offer for early adopters. For the first $1 billion in assets or until February 17, 2026, it waives the full sponsor fee. The staking provider fee (0.28%) is also waived during that window. After that period, VanEck will charge a 0.30% sponsor fee.

Early Numbers and Yield

As of November 14, 2025, VSOL’s Net Asset Value (NAV) was $18.29, with total net assets around $7.32 million. The ETF’s gross staking yield is reported at 6.65%, before any fees or tax. These rewards accrue to the trust and reflect in its NAV rather than being paid out separately.

Risks to Consider

Staking is not risk-free. According to VanEck’s documentation, activating or deactivating staked SOL requires network “epochs.” This means redemptions could be delayed. Validators might underperform, creating a drag on rewards.

While Solana currently does not enforce “slashing,” future protocol upgrades could introduce it, which could penalize misbehaving validators. Also, any earned staking rewards do not go directly to investors. Instead, they stay inside the ETF and influence the NAV.

There are also operational risks, including counterparty risk from the staking provider and custodians, and possible regulation or tax changes.

Why This Matters for Crypto Investors

This Solana ETF could be a big deal for many crypto investors. First, it offers a way to earn staking returns without running a validator or managing technical infrastructure. Second, institutions gain a regulated path into SOL — something that was harder to trust before.

By combining price exposure and staking, VanEck gives investors a two-pronged way to benefit. That could drive more stable capital into Solana, and help bridge DeFi yield and traditional finance.

Conclusion

VanEck’s Solana ETF offers a powerful mix: direct exposure to SOL, staking rewards, and a zero-fee launch window. With credible custody and validator partners, it stands out in the growing altcoin ETF space.

But staking does bring complexity and risk, including possible delays, validator issues, and regulatory shifts. For investors who understand that trade-off, VSOL could be an elegant bridge between decentralized yield and regulated investing.

Glossary of Key Terms

- Solana (SOL): A fast, scalable blockchain that uses Proof-of-Stake (PoS) and Proof-of-History (PoH).

- ETF (Exchange-Traded Fund): A fund that trades on exchanges and tracks an asset or index.

- Staking: Locking up cryptocurrency (e.g. SOL) to support blockchain operations and earn rewards.

- Validator: A node in a PoS network that helps validate transactions and earn staking rewards.

- NAV (Net Asset Value): The per-share value of an ETF’s underlying assets.

FAQs About Solana ETF

Q: How does the Solana ETF pay staking rewards?

A: The ETF stakes most of its SOL. Rewards go back into the trust and raise its NAV; they do not distribute as cash.

Q: When does VSOL start charging fees?

A: VanEck waives its fee until February 17, 2026, or for the first $1 billion in assets. After that, the fee is 0.30%.

Q: How long does it take to unstake SOL?

A: Deactivation takes one or more network epochs. That can delay redemptions.

Q: Is there a risk that validators could be penalized (“slashing”)?

A: Not currently for Solana, but future protocol upgrades could introduce slashing.

Q: Who holds the SOL for this Solana ETF?

A: Gemini Trust Company and Coinbase Custody store the SOL that backs VSOL.

References

ETF & UCITS Fund Manager | VanEck

Read More: VanEck’s Solana ETF Targets 6.65% Staking Yield in Zero-Fee Launch Window">VanEck’s Solana ETF Targets 6.65% Staking Yield in Zero-Fee Launch Window

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.