Ethereum’s Bulls Run Reignites: All Eyes on the $2,850 Breakout Zone

0

0

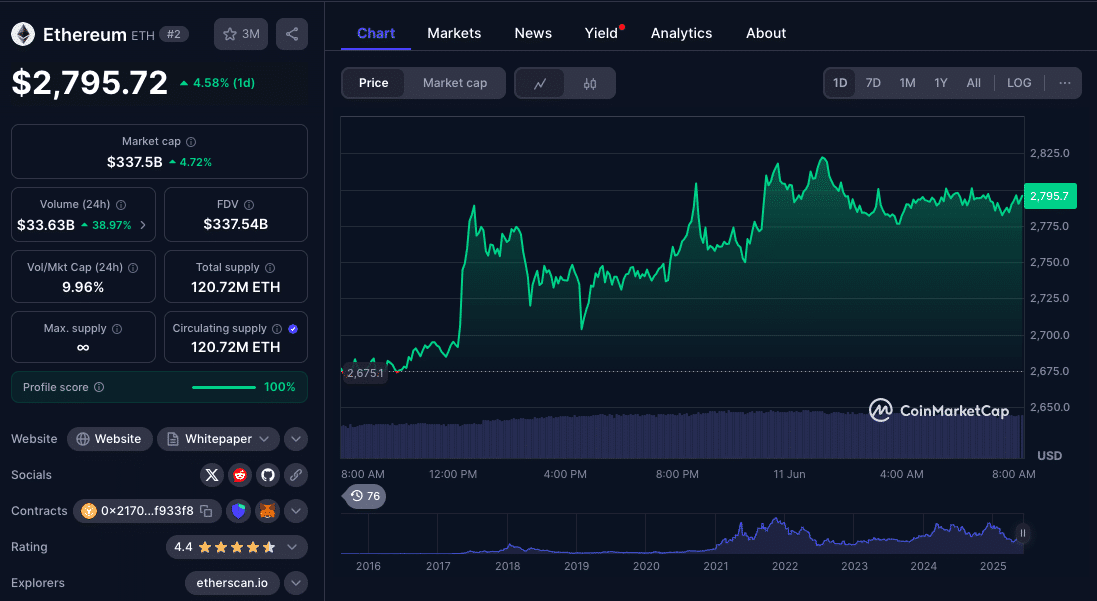

Ethereum is back in bullish mode after reclaiming $2,790 and making higher highs above $2,800. As buyers come back, ETH is now looking to break above $2,850, a big resistance zone that could lead to $3,000. But while momentum is building, there are potential traps ahead. Is Ethereum setting up for a continuation or getting overheated?

Ethereum Price Takes Off from $2,500 Lows as Bulls Dominate Short-Term Structure

After falling to $2,500 in early June, Ethereum bounced big surging above $2,650 and $2,750. This new rally has been supported by strong hourly charts and macro buyers returning to altcoins as volatility subsides.

At the moment, ETH is trading at $2,795.72 and holding above the 100-hourly Simple Moving Average, going above $2,750, a level that has been support for the last week. A bullish trend line is also forming on the hourly chart with higher lows, so the short-term structure is intact.

Momentum picked up after Ethereum broke $2,750 and even hit $2,832. Now it’s consolidating but as long as $2,750 and $2,700 hold, the structure is bullish. Hourly MACD is bullish and RSI is above 50, so it’s set up for a break above $2,850 if buyers stay active.

Why $2,850 Could be the Key Level for Ethereum

Traders are looking at $2,850 as the big inflection point for Ethereum. This level has been a rejection point several times in the last month. A break above it would not only change market structure but could also trigger a wave of buy orders and short squeezes, sending ETH higher quickly. Fib levels show $2,850–$2,880 is the same resistance zone from late Q1 and a break through this area would open up $2,920, Ethereum’s high before the May correction.

Above $2,920 is $3,000. This is not just a round number target, this is also where Ethereum consolidated in March and early April, so it’s a strong attractor for both traders and liquidity.

However, if $2,850 doesn’t clear convincingly, some traders may take profits. Then Ethereum price will be back to immediate support levels and testing the bullish thesis.

Support Zones: Why $2,750 and $2,650 Now Matter More Than Ever

The immediate support for ETH is at $2,750, a level that is supported by the bullish trend line and the hourly 100 SMA. This area has been a launchpad for this rally. A break below it won’t necessarily mean the trend is invalid but could trigger a short term correction.

Below $2,750, the next major support is at $2,650 which is also the 50% Fibonacci retracement of the recent swing from $2,483 to $2,832. This confluence of levels makes $2,650 a battleground for bulls and bears. If broken, ETH could go to $2,600 or even retest the $2,550-$2,500 support range which was the early June lows.

The hourly MACD is still bullish but early signs of flattening could mean any cooling in momentum could send ETH into a minor correction. For now, bulls are in control but they need to defend $2,750 to keep the trend intact.

Ethereum Price outlook: Bullish Bias but Cautious at $3K

Ethereum’s approach to $3,000 is psychological, traders remember this level as a supply zone where previous rallies died and some may look to exit early.

On-chain data shows that ETH exchange netflows have stabilized after a short spike earlier this month and long term holders are not yet selling. Meanwhile ETH staking deposits are growing and adding to the supply reduction. As of June 10th, over 32 million ETH are staked, over 26% of total supply, tightening the available float and making the price more responsive.

But the real test is how Ethereum handles the $2,850-$2,880 zone. If broken with conviction, $3,000 becomes more than a headline, it becomes a launchpad for another leg higher potentially to $3,120.

Conclusion: Ethereum Price Needs Proof, Not Potential

Ethereum’s move above $2,750 has rekindled bullish sentiment and injected life into a market that was stuck sideways. But price alone isn’t enough. ETH needs to prove it can break $2,850 with volume backed momentum to unlock more upside. Otherwise it could be just another lower high in a mid-year range.

With clear support at $2,750 and $2,650 and a visible resistance wall ahead, the next 24-48 hours will define the short term trend. Traders should be watching not just price but the underlying signals. Ethereum price is bullish but the breakout isn’t guaranteed.

FAQ

What resistance levels should Ethereum bulls be watching right now?

Ethereum has immediate resistance at $2,850, then $2,880 and $2,920. A break above $2,920 could open up $3,000.

What if Ethereum fails to break $2,850?

A failure at $2,850 could lead to a retrace to $2,750 or $2,650. Below those levels ETH could revisit $2,500.

How important is the $3,000 level for Ethereum?

$3,000 is a psychological and technical level. Breaking it could reestablish strong bullish momentum in the altcoin market.

Are staking and supply dynamics affecting Ethereum’s price?

With over 32 million ETH staked, available supply is reduced and price moves will be amplified during periods of high demand.

Glossary

Ethereum (ETH): A blockchain platform for smart contracts. ETH is the native coin.

SMA: Simple Moving Average

MACD: Moving Average Convergence Divergence

RSI: Relative Strength Index

Fib: Fibonacci Retracement

Sources

Read More: Ethereum’s Bulls Run Reignites: All Eyes on the $2,850 Breakout Zone">Ethereum’s Bulls Run Reignites: All Eyes on the $2,850 Breakout Zone

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.