Bitcoin Dips Below $90k As Crypto Markets Lose $1 Trillion In Value 📉

0

0

👋 Welcome to the CoinStats Scoop, your weekly newsletter bringing you the most groundbreaking Web3 innovations and market-moving headlines in the crypto space.

Stay in the loop with all the key market moves, emerging trends, and exciting developments from the past week 📈.

This week, cryptocurrency markets suffered a significant decline, as investor sentiment plummeted to “Extreme Fear” despite positive political developments.

President Donald Trump finally signed a key funding bill passed by the full House, ending the longest-ever 43-day US government shutdown on November 12.

Bitcoin and Ether extended their declines, falling under key accumulation levels that triggered concerns over the end of the current bull market cycle.

The silver lining? Big players with over 1,000 BTC continue stacking Bitcoin, despite record levels of retail fear 🐋.

In this week’s CoinStats Scoop, you’ll find:

🌐 Crypto market analysis and the most important news in Web3

📉 Bitcoin dips below $90k, as ETFs bleed $3 billion in November

⏳ Mt. Gox moves $950 million Bitcoin after delaying creditor payments another year.

💰 Republic Technologies raises $100M for Ethereum investment, despite market downturn

🐋 Bitcoin whales buy the dip as investor sentiment hits “extreme fear”

🔍 Analysis and key events that will shape the crypto market next week

Bitcoin Dips Below $90k, as ETFs Bleed $3 Billion in November 📉

Bitcoin continued its decline for the fourth consecutive week, losing multiple key psychological levels amid the lack of treasury buying and Bitcoin exchange-traded fund (ETF) demand.

Bitcoin fell over 10% this week, bottoming at a weekly low of $89,460 on Nov. 18, falling below the key $90,000 mark for the first time since the end of April 2025, CoinStats data shows 🔻.

Bitcoin’s downtrend is extending despite the end of the 43-day US government shutdown, a much-awaited development that failed to reignite institutional buying ⚠️.

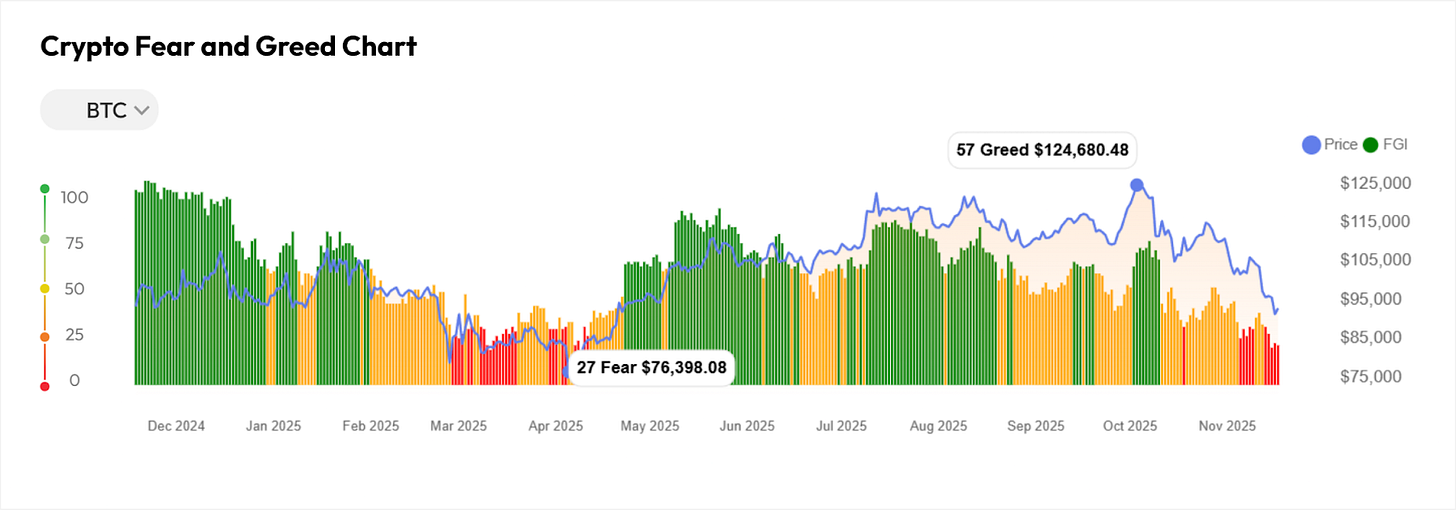

Bitcoin price and investor sentiment last sank to current levels after President Trump’s reciprocal tariff threat hit global markets, causing a record $5 trillion loss to the S&P 500 within a couple of days in April.

Adding to the sell pressure, US spot Bitcoin ETFs continued their losing streak, selling at least $250 million daily since Nov. 12.

During November, the spot Bitcoin ETFs sold a cumulative $3 billion worth of Bitcoin, which already marks their second-worst month since launch, with another week and a half left for more potential sales.

Bitcoin ETFs were the most important institutional demand driver for Bitcoin, along with Michael Saylor’s Strategy 📊.

However, the latest $835 million Bitcoin investment from Strategy was not enough to counteract the billions sold by Bitcoin ETFs this month, leading to more downside until ETFs stop the sell-off ⚠️.

Mt. Gox Moves $950 Million Bitcoin After Delaying Creditor Payments Another Year ⏳

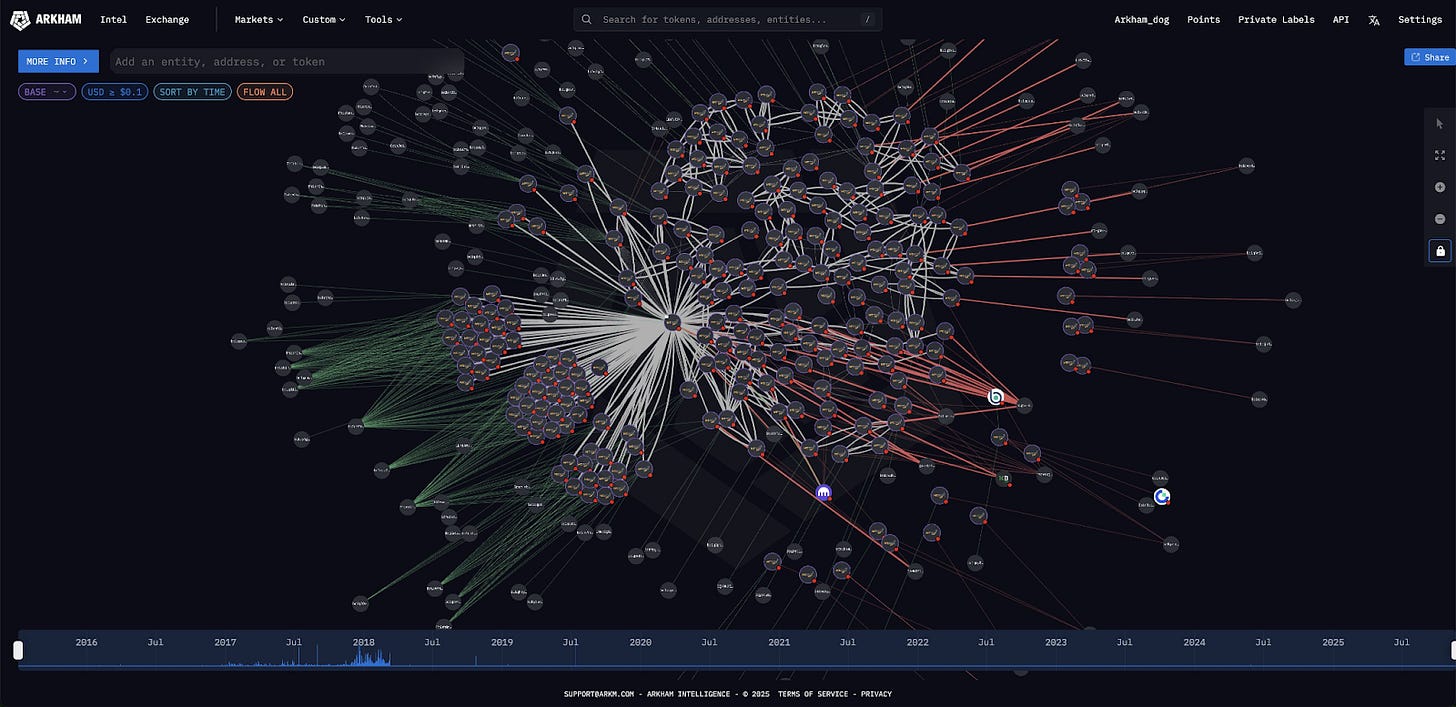

Bankrupt cryptocurrency exchange Mt. Gox moved nearly $1 billion worth of Bitcoin earlier this week, but not for its creditor repayments 💰.

The Mt. Gox cold wallet transferred 10,600 Bitcoin worth $950 million on Nov. 18, marking the first big wallet movement from the exchange in 8 months.

Following the first transfer, Mt. Gox moved another $16.8 million in Bitcoin to cryptocurrency exchange Kraken, signaling that the defunct exchange may be selling some of its holdings.

“Mt Gox just transferred 185 BTC ($16.8M) to Kraken after a test transaction. $936M of change BTC has been moved to another Mt. Gox wallet,” wrote Arkham on Nov. 18 📝.

The transfer came as a shock for crypto investors, as Mt. Gox has delayed its next repayment by another year, until October 2026. The exchange still owes approximately $4 billion to its creditors ⚠️.

Some industry insiders saw this as a sign of incoming sales from the bankrupt exchange, including analyst and SwanDesk CEO Jacob King, who wrote:

“Mt. Gox has just moved over $900M in bitcoin, likely preparing to dump it on the market. No surprise insiders have been selling aggressively for weeks. They clearly saw this coming.”

Republic Technologies Raises $100M for Ethereum Investment, Despite Market Downturn 💼

Republic Technologies, a publicly listed technology and Ethereum treasury company, raised $100 million for Ether investments despite the harsh market conditions 💰.

The UK-based company secured $100 million in funding from a convertible note offering closed at an unusual term, offering 0% interest rate and no ongoing interest payments.

The $100 million will be used to buy more Ether for the company’s corporate reserve. The company currently holds $3.5 million worth of Ether bought at an average price of $2,153 per ETH, according to the Republic’s homepage.

The company will also expand its Ethereum validator infrastructure, which provides Republic with passive income in the form of staking rewards.

The zero-interest convertible note facility means that the company does not have to spend cash to service its debt and can’t default on interest payments, which is a risk among crypto treasuries 🔐.

Bitcoin Whales Buy the Dip as Investor Sentiment Hits “Extreme Fear” 🐋

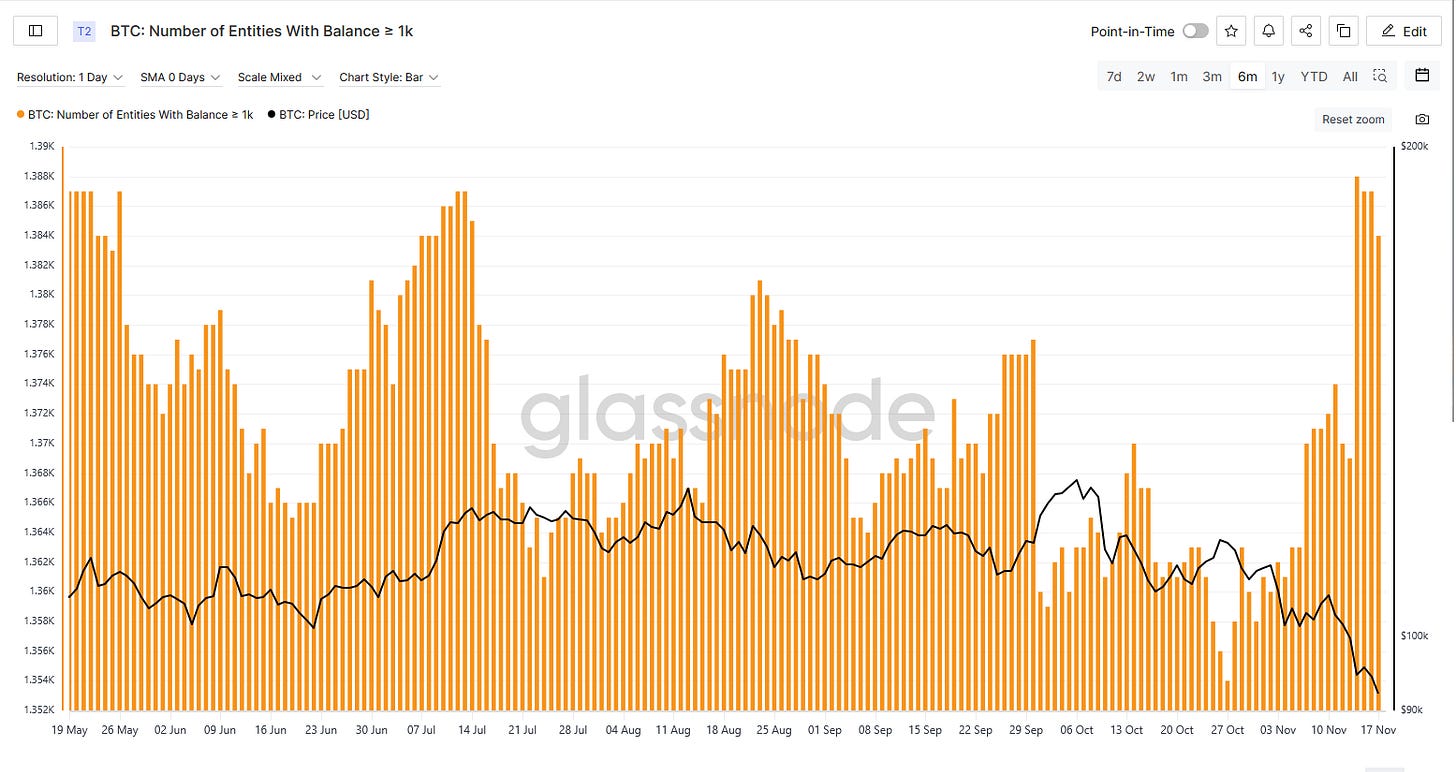

Despite the record $20 billion crypto market crash, the number of whales, or large investors with at least 1,000 BTC, has been on a steady rise.

Whale wallet addresses with over 1,000 BTC rose to a four-month high of 1,384 on Nov. 18, marking a significant recovery among the largest investors after the market crash lows, according to Glassnode 📈.

Large whale movements are crucial for Bitcoin’s price trend, as the significant capital held by this cohort can dictate short-term momentum ⚡.

The growing whale wallets come during a period of peak retail investor panic, as crypto investor sentiment sank to 15, meaning “Extreme Fear,” marking its lowest point year-to-date in 2025, according to the CoinStats Fear & Greed index.

The whale acquisitions are signaling a stark contrast to smaller wallets, which continue selling Bitcoin holdings, often at a financial loss.

The growing accumulation signals that whales are still expecting more upside for Bitcoin, despite the dip to $89,000 earlier this week 📈.

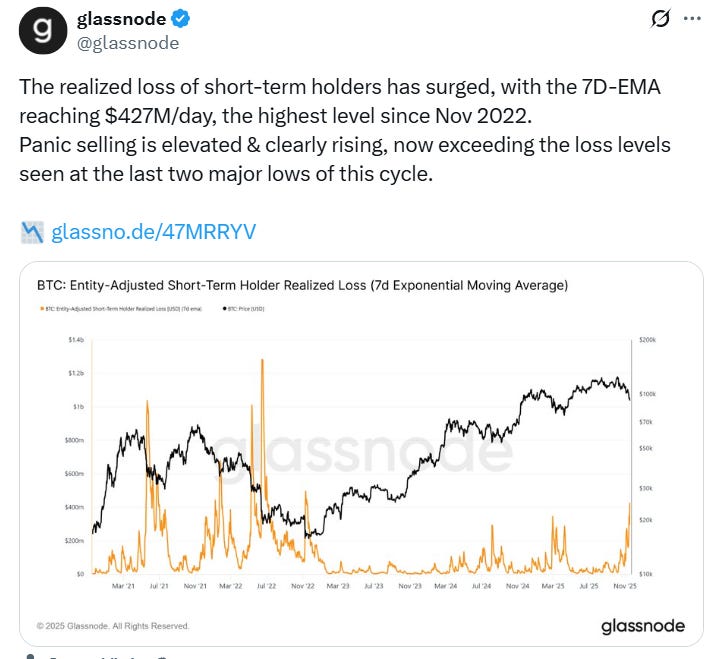

“Short-term #Bitcoin holders are already in extreme pain, comparable to previous corrections in April 2025 (‘tariff shock’) or August 2024 (‘Yen Carry Trade Unwind’),” wrote Bitwise’s head of research, André Dragosch.

Market Overview: Crypto Market Sheds $1 Trillion, Triggering “Structural” Bear Market Calls Ahead of Bottom 📉

Crypto markets extended last week’s decline, leading to a $1.1 trillion loss in market capitalization over the past 41 days.

Raising questions among analysts, crypto prices continued to decline despite positive developments, including President Trump announcing his plans to make America “number one in crypto,” paired with the end of the 43-day government shutdown.

However, the downturn may be a structural or mechanical correction, according to the Kobeissi Letter.

“Excessive levels of leverage have resulted in a seemingly hypersensitive market,” wrote the Kobeissi Letter, explaining:

“Over the last 16 days alone, we have seen 3 days with liquidations exceeding $1 billion. Daily liquidations of $500+ million have become a normal occurrence. Particularly in periods of thin volume, this results in violent crypto swings. And, it goes in both directions.” ⚡

While crypto appears to be in a “structural” bear market, the bottom is most likely near before the recovery, according to the market analysis publication.

Analysts now look ahead at the emerging interest rate cut expectations for the Federal Open Market Committee (FOMC) meeting on December 10, along with a potential resurgence in structural ETF inflows to sustain Bitcoin’s recovery 📈.

Tweets & Memes

Bitcoin short-term holders are near max pain, but things may just be temporary… ⚡

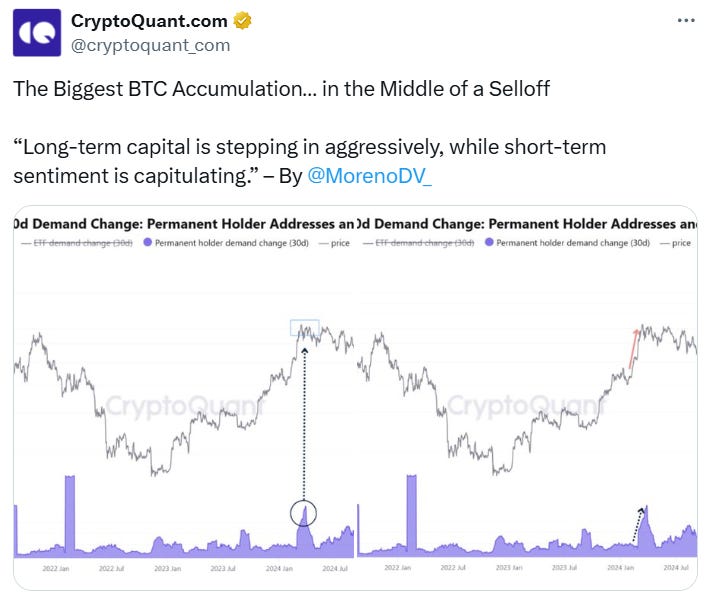

Long-term capital is stepping in instead of short-term buyers, but is there enough buying pressure for a cycle extension? 🐋

Panic selling is near FTX levels, as retail paper hands sell at a loss 😟.

But the Bitcoin correction remains in accordance with previous bull market cycles 🔄.

Thank you for reading the weekly CoinStats Scoop Newsletter.

CoinStats will continue to guide you through the world of crypto and DeFi. We’ll see you next week for another edition of CoinStats Scoop!😎

0

0

Gerencie todo seu criptograma, NFT e DeFi de um só lugar

Gerencie todo seu criptograma, NFT e DeFi de um só lugarConecte com segurança o portfólio que você está usando para começar.