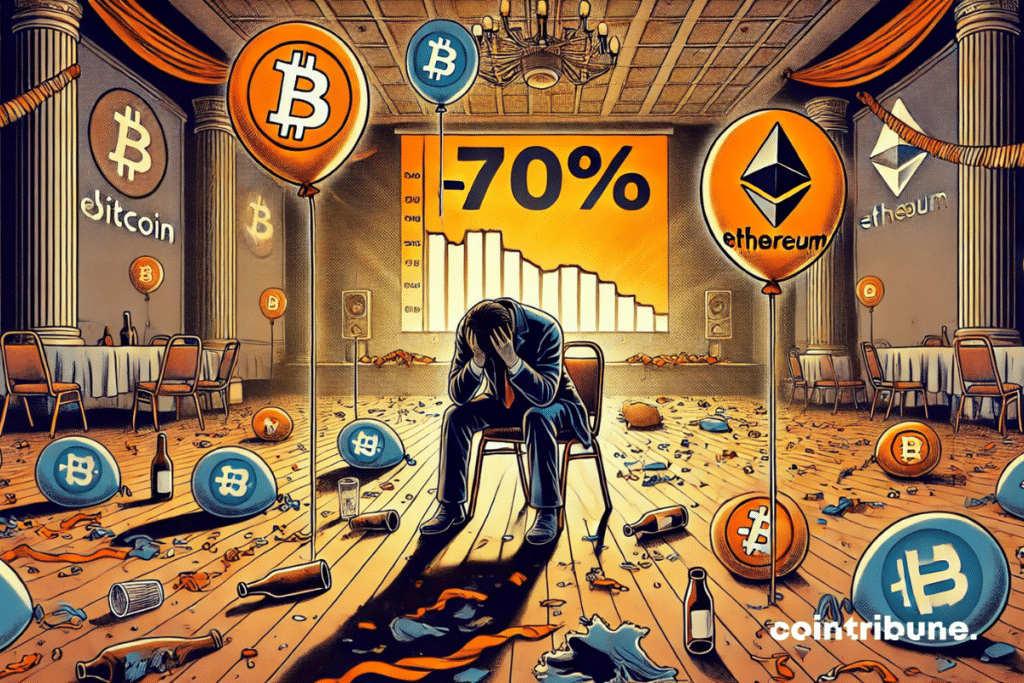

Crypto: Trading Volumes Drop By 70%, Post-election Euphoria Has Quickly Turned

0

0

It is hard to ignore the gravity of the moment. The crypto market is experiencing a period of silent eroding. Billions of dollars are evaporating. Not only do assets like Bitcoin, Ethereum, or altcoins falter, but trading volumes are plunging. Even the optimists are starting to revise their certainties. The post-election bull market gives way to a glacial calm, almost suspicious.

A brutal collapse of crypto trading volumes

While it peaked at 126 billion dollars after the U.S. presidential election, the crypto trading volume has now dropped to 35 billion. A 70% drop, signaling a clear exhaustion. Investors are fading away. The noise is fading. Activity is contracting.

A recent tweet summarizes this disillusionment:

This is not a good sign. Crypto trading volume is down 70% since the post-election euphoria.

For the author, the reasons are clear: “Sanctions, global economic instability, and a return of traders to the sidelines.“

This withdrawal marks a break. No more euphoric beats. Just a heavy waiting. And as often in crypto, silence makes more noise than excitement.

The crypto market, so quick to ignite, seems today overwhelmed by doubt. Analysts struggle to read the upcoming movements. Volatility has faded. Hope too, perhaps.

So, are we facing a pause before a revival or a deeper turning point in the cycle?

Bitcoin, Ethereum, and altcoins: losses accumulating after the electoral peak

It is not just a story of volumes. It is a general bloodbath. The crypto market has lost 659 billion dollars since its peak in 2025. No asset is spared. Bitcoin, leading the way, is down. Ethereum follows. And the altcoins? They are looking grim, trapped in a creeping bear market.

Yet, just after the election, the picture was bright. A tweet from January 29 illustrates this:

The U.S. crypto market has increased by 1.15 trillion dollars (+38%) since the election! $BTC +41.8%, $ETH +13.1%, $XRP +505%.

America imagined itself the global capital of crypto.

But since then, the dynamics have reversed. The uplifting breath has turned. Prices are falling. Buying signals are becoming scarce. Even the most convinced are looking elsewhere in search of stability.

- 70% drop in trading volumes.

- 659 billion dollars lost on major assets.

- Bitcoin and Ethereum in turmoil.

- Altcoins in prolonged retreat.

- Electoral enthusiasm evaporated in a few weeks.

And if crypto is no longer a market to read with yesterday’s glasses?

Faced with this situation, the founder of Polygon does not mince his words: the crypto market no longer follows its classic cycles. The Bitcoin halving, once a catalyst for bull markets, seems today to have no clear effect. The rules are changing. Uncertainty becomes the only constant.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.