Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go?

0

0

The post Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go? appeared first on Coinpedia Fintech News

Story Highlights

- Bitcoin is currently trading at: $ 118,617.80498998

- Predictions suggest BTC could reach $175K in 2025.

- Long-term forecasts estimate BTC prices could hit $900K by 2030.

The Bitcoin price prediction for 2025 is becoming aggressively bullish as in the year’s second half, July, a new ATH has been marked, smashing previous all-time highs of $112K.

As a wave of bullish momentum sweeps into the market, investors and traders are intrigued by its next stop, as it has entered a price discovery mode.

This optimism has been directly fueled by massive inflows into spot Bitcoin ETFs, skyrocketing institutional adoption, much clearer regulations, and unwavering political support from figures like President Trump.

It’s now seen as “a hedge against inflation” more than ever, and the cryptocurrency is capturing global attention. Major players like MicroStrategy, Metaplanet, Trump Media and several other entities are boldly adding BTC to their balance sheets, signaling unshakable adoption and confidence in its future.

With the Federal Reserve hinting at future rate cuts and market enthusiasm at a fever pitch, investors are buzzing with questions: “Can Bitcoin sustain its meteoric rise?” and “Will it redefine the financial landscape in the next five years?” This Bitcoin price prediction dives deep into the trends driving this historic rally. Read on for the full scoop.

The BTC price may range between $107,296.38 and $109,142.23 today.

Bitcoin Price Today

| Cryptocurrency | Bitcoin |

| Token | BTC |

| Price | $ 118,617.80498998  6.75% 6.75% |

| Market cap | $ 2,359,401,849,316.72 |

| Circulating Supply | 19,890,790.00 |

| Trading Volume | $ 121,107,900,809.05 |

| All-time high | $109,114.88 on 20th January 2025 |

| All-time low | $0.04865 on 15th July 2010 |

CoinPedia’s Bitcoin (BTC) Price Prediction

Firstly, at CoinPedia, we feel optimistic about Bitcoin’s price increase. Hence, we expect the BTC price to create a 2025 high of ~$168,000.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $71,827.81 | $119,713.02 | $167,598.22 |

Bitcoin Price Prediction 2025 (H1 2025)

Bitcoin’s performance during the first half of 2025 was mixed, reflecting a combination of macroeconomic and geopolitical volatility.

In Q1, the price action remained subdued, primarily due to lingering concerns around U.S. tariff implementations and heightened tensions between Russia and Ukraine. These global issues weighed heavily on market sentiment, keeping BTC in a consolidation phase.

However, Q2 brought a notable turnaround. By April and May, easing geopolitical tensions and improved macro signals helped Bitcoin stage a strong rally. By the third week of May, BTC surged to $112,000, marking a significant recovery from earlier lows.

Then the price retraced from its May peak, even positive factors like a positive U.S. jobs report on June 6 and resumed U.S.-China trade talks back in June were overshadowed when rising geopolitical concerns between Israel and Iran tensions worsened, triggering renewed selling pressure.

On June 17, the situation escalated even sharply when U.S. President Donald Trump issued a warning to Iran’s Supreme Leader. Iran’s defiant response and subsequent U.S. attacks on Iranian nuclear sites over the third weekend of June sent BTC sliding to $98,000.

Bitcoin Price Prediction July 2025

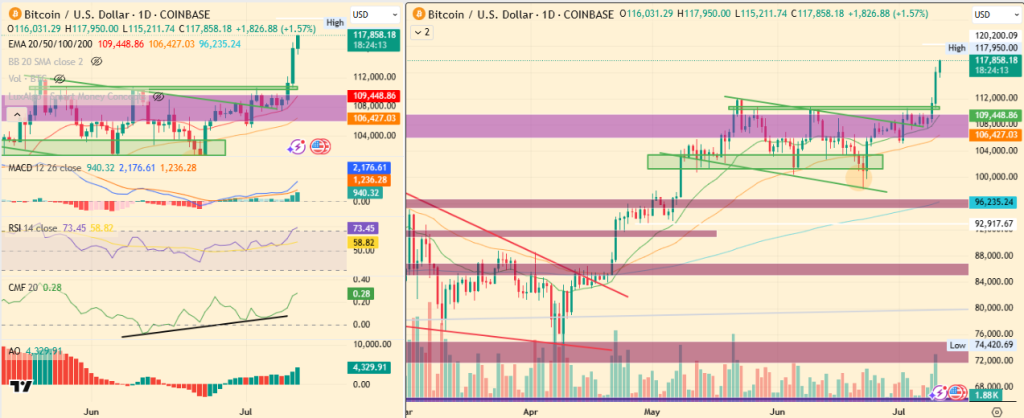

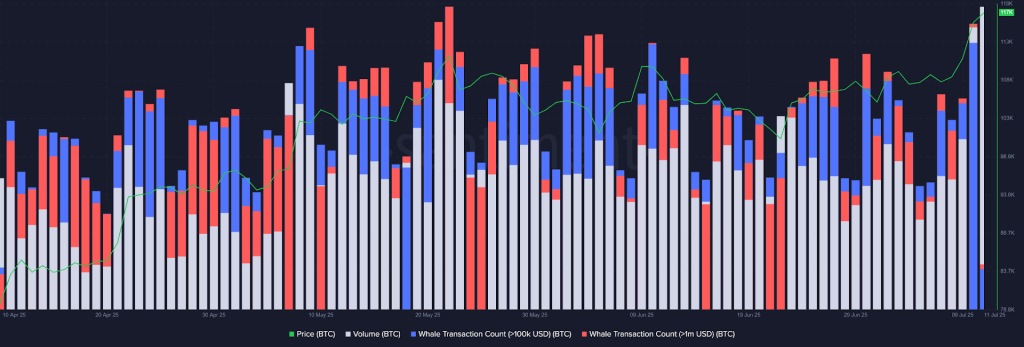

The Bitcoin price performance in July 2025 has been nothing short of impressive. Since the final week of June, Bitcoin has broken free from its consolidation zone, fueled by a combination of whale accumulation, increased spot trading volume, and a confirmed technical breakout from a bullish flag pattern.

On-chain data reveals a sharp increase in whale transactions especially in the $100K+ and $1M+ brackets. Spot volume also hit a 3-month high, indicating heightened market participation.

These catalysts combined helped the BTC price to break above the $110,000 resistance, enter price discovery, and establish a new all-time high at $118,340.

However, following a ceasefire announcement on June 23, Bitcoin rebounded quickly, signaling strong buy-the-dip behavior among investors, and now its course has once again aimed north.

Also, dormant wallets coming back online also suggest broader ecosystem confidence. These older addresses that were left untouched for years HAVE recently reactivated during the current rally, pointing toward stronger belief in long-term price potential.

From a technical perspective, BTC now eyes the psychological milestone of $120,000. Should the price maintain upward momentum, this level may be tested before the end of the month.

However, any short-term pullback would make $110,000 a crucial support to hold. A drop below this level may validate a false breakout, potentially dragging BTC back to the $101,000 swing low support zone and final defense line stays near the $95,000 mark.

| Year | Potential Low | Potential Average | Potential High |

| July 2025 | $95,000 | $103,500 – $108,000 | $120,000 |

Bitcoin Price Prediction 2025

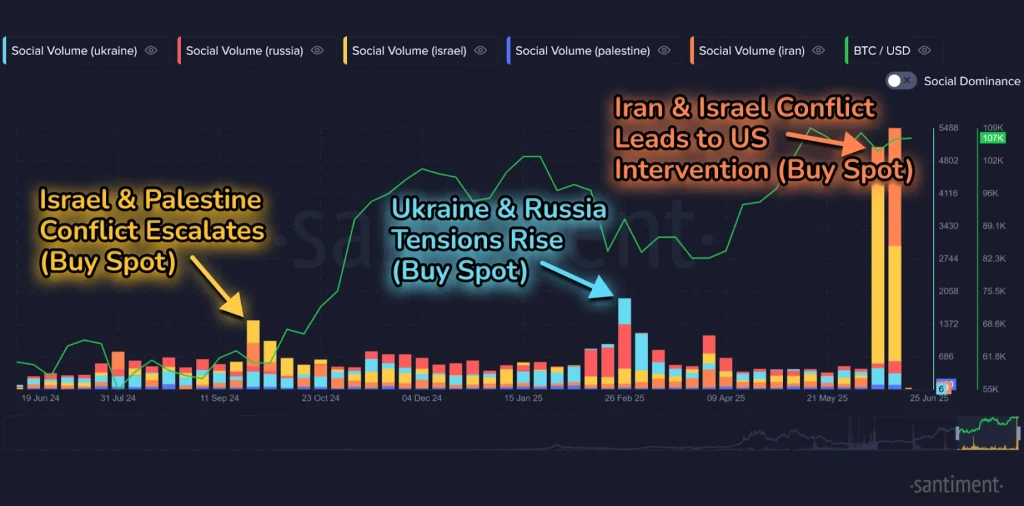

Recent insights from Santiment highlight that the Israel-Palestine conflict in H2 2024 caused a spike in social volume. Initially, crypto prices dropped, but the market rebounded, leaving panic sellers behind.

A similar trend occurred in Q2 2025 when rising Ukraine-Russia tensions led to increased social activity. After a price dip, Bitcoin surged to a new all-time high of $112,000.

Now, the ongoing Israel-Iran conflict has prompted U.S. intervention, resulting in another surge in social volume. Bitcoin’s price dipped to $98,000, but analysts expect a strong rally in H2 2025. Despite geopolitical challenges in Q1 and Q2, the overall outlook for Bitcoin remains bullish.

Looking ahead, advancements in financial products, especially ETF flows, could sustain Bitcoin’s bullish momentum. Market sentiment is optimistic, suggesting Bitcoin may reach new highs.

Moreover, the speculation is growing that the Federal Reserve might cut interest rates in the U.S., further supporting Bitcoin’s upward movement. Also, pata data is evident of its relationship with global liquidity, as global M2 increases, Bitcoin often experiences price surges.

Similarly, the CryptoQuant data also indicates rising accumulation, with exchange reserves declining to 2.4 million BTC, down from 3.1 million BTC a year ago.

Ultimately, Bitcoin’s future market potential will depend on buying demand, geopolitical developments, regulatory changes, and investor sentiment regarding long-term holdings.

Talking about Bitcoin Price Prediction, if things turn bullish, BTC is expected to create a high of $175K. If things go south, we can expect a low of $70K.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $70K | $120K | $175K |

Also Read: What is Bitcoin? An In-Depth Guide To The King Of Digital Currencies

Bitcoin Crypto Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| BTC Price Forecast 2026 | 150K | 200K | 230K |

| BTC Price Prediction 2027 | 170K | 250K | 330K |

| Bitcoin Predictions 2028 | 200K | 350K | 450K |

| BTC Price 2029 | 275K | 500K | 640K |

| Bitcoin Price Prediction 2030 | 380K | 750K | 900K |

BTC Price Forecast 2026

The BTC price range in 2026 is expected to be between $150K and $230K.

BTC Price Prediction 2027

Subsequently, the Bitcoin price range can be between $170K to $330K during the year 2027.

Bitcoin Predictions 2028

With the next Bitcoin halving, the price will see another bullish spark in 2028. Specifically, as per our Bitcoin Price Prediction, the potential BTC price range in 2028 is $200K to $450K.

BTC Price 2029

Thereafter, the BTC price for the year 2029 could range between $275K and $640K.

Bitcoin Price Prediction 2030

Finally, in 2030, the price of Bitcoin is predicted to maintain a positive trend. Indeed, the BTC price is expected to reach a new all-time high, ranging between $380K and $900K.

Bitcoin Price Prediction 2031, 2032, 2033, 2040, 2050

Based on the historic market sentiments and trend analysis of the largest cryptocurrency by market capitalization, here are the possible Bitcoin price targets for the longer time frames.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | $540,830.43 | $901,383.47 | $1,261,936.86 |

| 2032 | $757,162.60 | $1,261,936.86 | $1,766,711.60 |

| 2033 | $1,059,945.80 | $1,766,711.60 | $2,473,477.75 |

| 2040 | $5,799,454.28 | $9,665,757.13 | $13,532,059.98 |

| 2050 | $161,978,188.65 | $269,963,647.74 | $377,949,106.84 |

Bitcoin Prediction: Analysts and Influencer’s BTC Price Target

| Firm Name | 2025 |

| Standard Chartered | $200K |

| VanECk | $180K |

| 10x Reserach | $122K |

| Fundstrat | $250K |

| Blackrock | $700K |

- As per the Bitcoin price forecast by Blockware Solutions, the price of 1 BTC could hit $400,000

- Cathie Wood predicts the price of BTC to achieve the $3.8 million mark by 2030.

- Michael Saylor-led MicroStrategy expects Bitcoin to soar beyond $13 million by 2045.

- ARK Invest has increased its bullish BTC price target to $2.4 million by 2030.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

At the time of writing, 1 Bitcoin Price USD is $108,783.81.

If the sentiments remain bullish, the star crypto may continue gaining value tomorrow.

Hoping for positive market sentiments, the BTC token may test its $102k mark.

With a potential surge, the Bitcoin (BTC) price may close the month with a high of $110,000.

As per Coinpedia’s BTC price prediction, the Bitcoin price could peak at $168k this year if the bullish sentiment sustains.

With increased adoption, the price of Bitcoin could reach a height of $901,383.47 in 2030.

As per our latest BTC price analysis, Bitcoin could reach a maximum price of $13,532,059.98

By 2050, a single BTC price could go as high as $377,949,106.84

Bitcoin first hit $1 on February 9th, 2011. This historic milestone was achieved on the now-defunct Mt. Gox exchange.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.