Massive Crypto Crash Triggers $1.12B in Liquidations

0

0

The market has seen turbulence before, but this week’s crypto crash left a sting that many won’t forget. In just 24 hours, more than $1.12 billion worth of long and short positions were liquidated, shaking the confidence of traders worldwide.

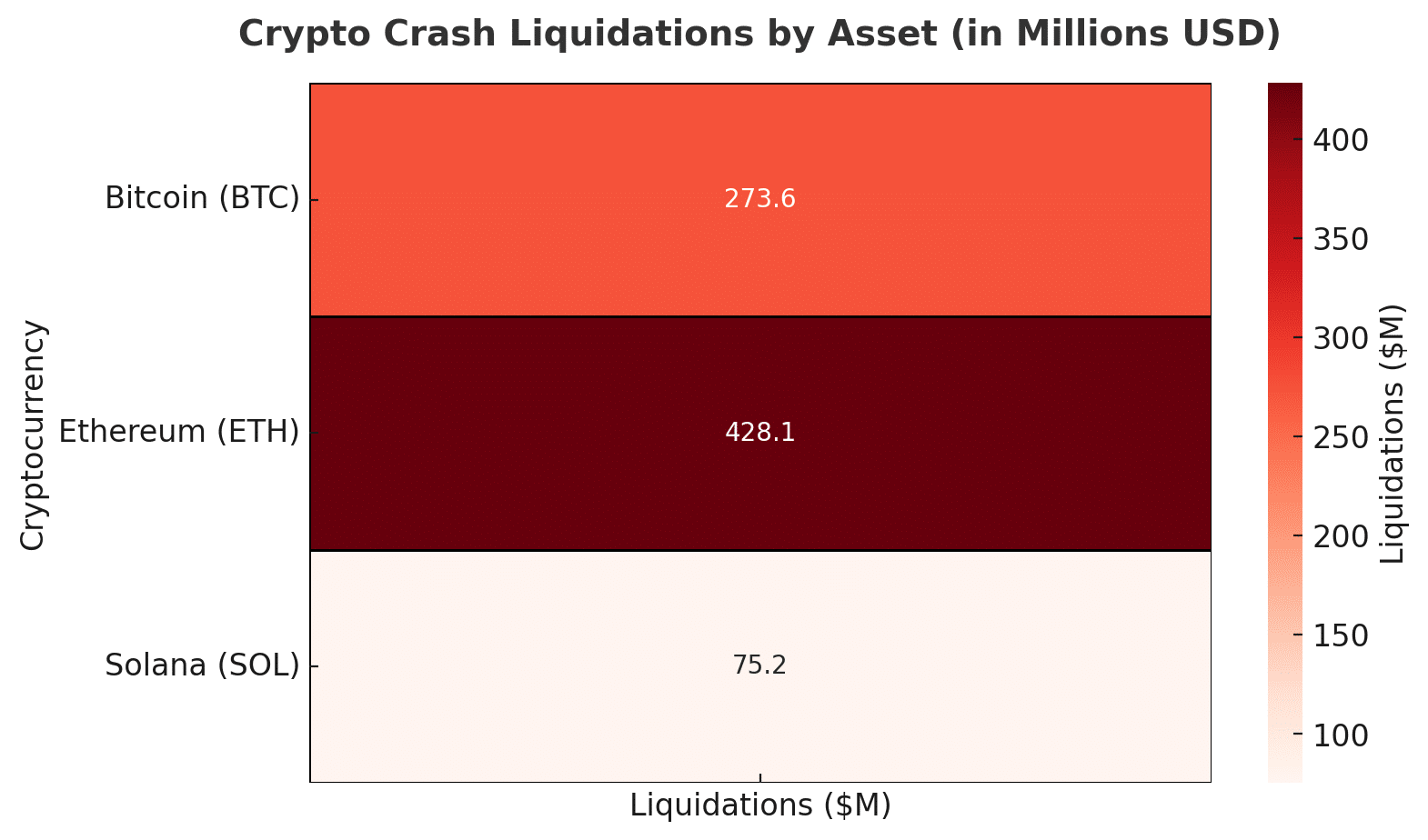

Bitcoin, Ethereum, and Solana bore the brunt of the sell-off as leveraged bets were wiped clean.

Data showed more than 252,000 traders were hit by liquidations, with long positions accounting for most of the damage. Ethereum alone saw over $428 million erased, followed by Bitcoin with nearly $274 million and Solana with $75 million.

The top single liquidation order, tied to Ethereum, reportedly came in at more than $29 million on Hyperliquid.

Ethereum Leads Losses in the Crypto Crash

Ethereum’s sharp slide underscored just how fragile leveraged positions have become. The second-largest digital asset fell to around $3,924, down from recent highs near $4,273.

Traders who were betting big on ETH’s upside found themselves on the wrong end of cascading sell orders.

A trader on X remarked, “This isn’t just a dip; it’s a full reset of overleveraged longs,” pointing to charts showing sudden outflows from major exchanges.

The crypto crash reminded investors that while ETH remains central to DeFi and NFTs, its price can tumble quickly when macro conditions shift.

Bitcoin Dips, Solana Struggles

Bitcoin, the bellwether of the market, was not spared. It fell from highs above $113,000 to around $109,700 in less than a day. For many, this dip served as a wake-up call that even the most established digital asset is not immune to a crypto crash triggered by leveraged wipeouts.

Solana, often praised for speed and scalability, lost about $75 million in liquidations. Its network fundamentals remain strong, but sentiment can turn against even the most promising chains when risk appetite vanishes.

Market Cap and Wider Impact

The broader digital asset market shed nearly 4% in value, sliding to about $3.73 trillion. For context, that’s more than the GDP of several large economies wiped out in less than 24 hours. The scale of this crypto crash shows how much capital flows through digital markets on any given day.

Business dailies reported an even higher tally of $1.5 billion in liquidations when including smaller exchanges and derivative platforms. That discrepancy highlights how opaque and fragmented the trading landscape remains.

The lack of unified reporting standards makes it tough to get a precise read during moments of panic.

Sentiment and What Comes Next

Analysts noted that a surge of overleveraged longs set the stage for the crypto crash. When prices began slipping, automated liquidations cascaded across platforms, driving the market deeper into the red.

One market strategist wrote on X, “This was not a random sell-off. It was a leverage reset, and traders should brace for more volatility”.

While some argue that corrections like these are healthy, giving markets room to breathe, the psychological impact can’t be ignored. Seeing more than $1 billion vanish overnight shakes both retail and institutional confidence.

Recovery may come, but scars from such a swift crypto crash often linger.

Conclusion

This latest crypto crash is a stark reminder that digital assets, for all their promise, remain volatile and unforgiving. Ethereum’s outsized losses, Bitcoin’s dip, and Solana’s struggles all point to a market stretched too thin on leverage.

For disciplined traders, the wipeout may serve as a reset, a chance to re-enter at healthier levels. But for those who bet heavily without risk controls, the lesson has come at a steep price.

As the dust settles, one thing is clear: in crypto, fortunes can flip in the blink of an eye.

FAQs about the crypto crash

Q1: What caused the latest crypto crash?

Overleveraged positions triggered cascading liquidations across exchanges, leading to more than $1.12 billion in losses.

Q2: Which cryptocurrencies were hit hardest?

Ethereum saw the biggest liquidations, followed by Bitcoin and Solana.

Q3: How much value did the market lose overall?

The global market cap dropped by nearly 4%, to about $3.73 trillion.

Q4: Are more crashes expected soon?

Analysts warn that volatility may persist, especially if leverage builds up again without proper risk management.

Glossary

Liquidation: Forced closure of leveraged positions when collateral falls below required levels.

Leverage: Borrowing capital to amplify potential returns, but also increasing risk.

Market Cap: The total value of all cryptocurrencies combined.

Long Position: A trade betting that an asset’s price will rise.

Short Position: A trade betting that an asset’s price will fall.

Overleveraged: When traders take on too much borrowed exposure, making positions fragile.

Read More: Massive Crypto Crash Triggers $1.12B in Liquidations">Massive Crypto Crash Triggers $1.12B in Liquidations

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.