Bitcoin Whale Accumulation Heats Up After $16M Transfer: Breakout Incoming?

0

0

This article was first published on The Bit Journal.

Bitcoin whale accumulation drew fresh attention after a dormant wallet moved 171 BTC, worth about USD 15.8 million, off a central exchange. According to on-chain data, the wallet had remained inactive for a long stretch before suddenly resurfacing.

The timelines and magnitude of this pullback have fueled much chatter within the cryptosphere, as traders eagerly await earlier indications that momentum is beginning to tilt.

What The Whale Move Means

A previously quiet wallet recently withdrew 171 BTC from an exchange. Such withdrawals often reflect long-term holding intent rather than short-term trading. This move is a clear example of Bitcoin whale accumulation, as large investors increasingly favor private wallets over exposure to exchanges.

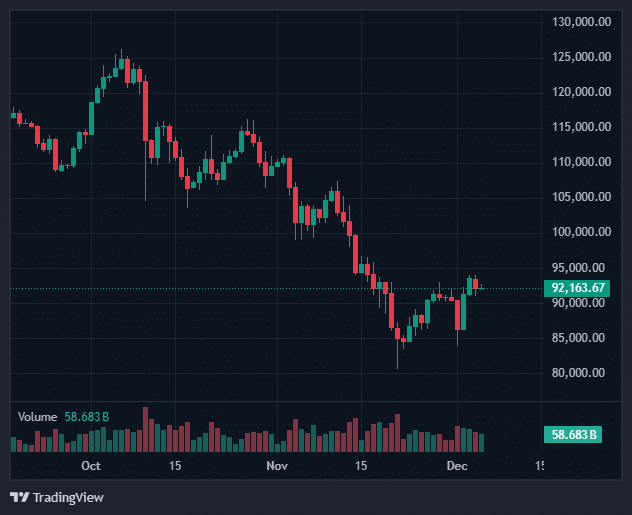

Reducing supply on exchanges tends to tighten availability. When supply shrinks, and demand holds or rises, markets get tighter. Right now, 1 BTC trades around USD 92,163 depending on the source.

That puts the entire 171 BTC withdrawal at just over USD 16 million at current rates.

Recent Price and Market Conditions

Current figures available indicate a 24-hour trading volume of about USD 65–70 billion and market capitalization around USD 1.84 trillion.

According to the analysts, while reading technical indicators, Bitcoin is experiencing resistance at around USD 90,000, and support areas for the cryptocurrency are at near USD 88,600-90,000.

Signs of Bitcoin whale accumulation, combined with quiet trading volume, suggest the market may be setting up for either a breakout or a renewed dip.

Potential Scenarios Ahead

| Scenario | What Might Happen | Why It Matters |

|---|---|---|

| Breakout | Price climbs toward USD 100,000 – 105,000 | Exchange-supply shrinks, whales hold BTC off-exchange |

| Range Bound | Price stays between USD 90,000 and USD 95,000 | Demand and supply remain roughly balanced |

| Pullback | Price dips below USD 90,000 | Some holders may take profit, supply returns to exchange |

Sustained withdrawal of large BTC amounts along with stable or rising demand could push the price higher. But a shift in demand or sudden sell-offs may reverse gains.

What Readers and Investors Should Watch

-

Exchange outflows: Normal Highwayville withdrawals which are usually when accumulation occurs.

-

Price action around significant levels: Resistance around USD 95,000; support around USD 88,600–90,000.

-

Market Volume: A market with rising volume and accumulation indicates strength and growing confidence in the market.

-

Macro sentiment and external news: forces from the outside, regulation, macroeconomic trends and institutional moves continue to dominate momentum and investor sentiment.

Conclusion

Bitcoin whale accumulation is a very interesting ingredient in the price storyline today. Supply pressure could ease as large amounts move off exchanges.

If demand picks up, Bitcoin could rally back toward six figures. The next few weeks may tell whether this is a fundamental shift in trend or simply another pause in the ebb and flow, which has been so volatile this year. For now, traders and investors must be mindful of on-chain activity and market sentiment to get a clearer picture.

Glossary of Key Terms

-

Whale: A wallet, or holder of large percentages of cryptocurrency Float.

-

Exchange outflow: Crypto moving from a public exchange to a private wallet, perceived as accumulation.

-

Supply scarcity: A supply scenario in which the available supply decreases while demand remains stable or increases.

-

Support / Resistance: Price levels at which buying is believed to take place (support), and price levels which selling is believed to be dominant resistance.

Frequently Asked Questions About Bitcoin Whale Accumulation

1: Does every significant withdrawal mean the price will rise?

No. Withdrawals may show longer-term holding, but price still depends on demand, volume, and market sentiment.

2: How many withdrawals signal a trend?

A clear pattern of consistent withdrawals, combined with rising demand or stable volume, is more meaningful than a single significant move.

3: Should retail investors follow whale moves?

Whale transactions are evidence but not determinative. Try to keep a balanced perspective and don’t get too caught up trying to catch the price moves.

4: Will Bitcoin still dump when whales load?

Yes. The price can drop even though buying is still ongoing, if demand weakens or macroeconomic or regulatory factors hit the market.

References

Read More: Bitcoin Whale Accumulation Heats Up After $16M Transfer: Breakout Incoming?">Bitcoin Whale Accumulation Heats Up After $16M Transfer: Breakout Incoming?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.