4 US Economic Indicators to Watch This Week As Bitcoin Reclaims $122,000

0

0

Bitcoin (BTC) price is attempting to reclaim its recent highs, foraying above the $122,000 threshold. However, whether the climb is sustained or breaks hinges on several US economic indicators that are due for announcement this week.

With Bitcoin now in the hands of institutions just as much as it is accessible to retail, US economic data points significantly influence the pioneer crypto.

US Economic Indicators That Could Derail Bitcoin’s Climb this Week

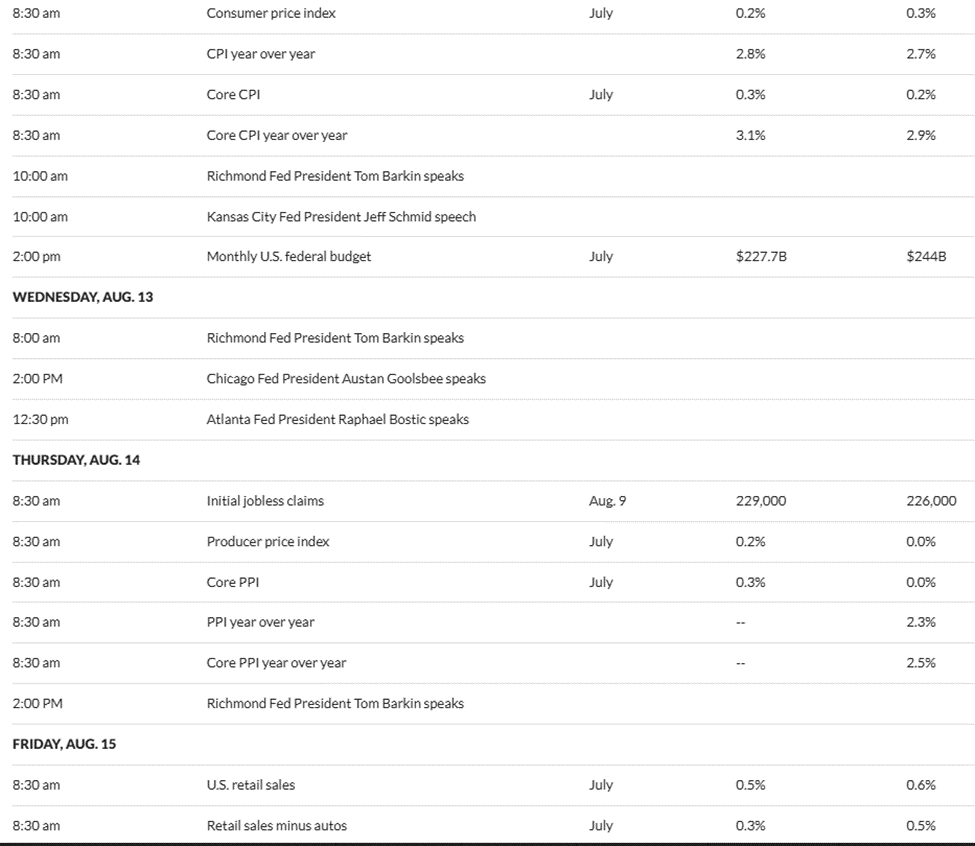

Data on MarketWatch shows several US economic signals are on the schedule this week, each with its respective influence and impact on the market.

US Economic Signals This Week. Source: MarketWatch

US Economic Signals This Week. Source: MarketWatch

CPI

The US CPI (Consumer Price Index) is arguably the most important US economic signal this week. It is due on Tuesday, August 12. This data point drives Federal Reserve (Fed) interest rate policy expectations.

According to the schedule data, economists project CPI to come in at 2.8%, which would indicate an inflation rise in July, year-over-year (YoY), compared to the 2.7% recorded in June. Goldman Sachs also projects the same outlook.

The expectation comes amid Trump’s Tariff woes, which went into effect on August 7 for yet another series.

“CPI Inflation data hits Tuesday! Economists’ consensus is that tariffs drove July’s CPI higher,” wrote Peter Tarr, a private investment manager.

A hotter-than-expected reading, which means anything above 2.8% would strengthen the dollar, putting downward pressure on the Bitcoin price.

However, if the US Department of Labor reveals a softer print, say below the 2.7% seen in June, it may spark a crypto rally.

“After recent unemployment data, the September rate cut probability is at 91%. If CPI comes in lower than expected, the September rate cut will be confirmed. This will help risk-on assets rally even more. In case CPI comes in higher than expected, rate cut probability will go down along with crypto prices. Given that the unemployment rate has been going up lately, CPI is expected to come lower, which will be good for the markets,” wrote analyst BitBull.

However, according to Tarr, it may not necessarily influence the market as investors progressively price in rising inflation in the US.

PPI

Another US economic signal this week is the PPI (Producer Price Index), scheduled for release on Thursday.

Notably, PPI is a leading inflation gauge, and persistent inflation in producer costs can push the Fed to keep policy tighter for longer, influencing liquidity-sensitive assets like crypto. Like CPI, economists also project that PPI will increase after the 2.3% recorded in June.

“The NFP bid in bonds is in the process of unwinding as we head into a week where core CPI and PPI are expected to come in HIGHER than the last prints Why is this important? Because the market and Fed are going to begin to realize that inflation risk is a GREATER risk than recession risk,” said Capital Flows in a post.

Indeed, and like any surprise in CPI would affect the Fed rate cuts, any uptick in US PPI could fuel inflation fears.

Retail Sales

Elsewhere, retail sales are also a key watch among US economic signals this week, with weak data expected to amplify recession fears. The US Census Bureau is due to release the data point on Friday, August 15, reflecting consumer spending, which drives about 70% of the US economy and influences market sentiment.

After a 0.6% reading in June, economists’ polls reported by MarketWatch predict a 0.5% reading in July 2025. Such an outcome would indicate that US consumer spending remained strong but cooled slightly.

Notably, readings near 0.5% are historically solid, suggesting the US economy is still running hot enough to avoid a spending slowdown. While the dip from 0.6% to 0.5% would hint at mild cooling, it is not enough to signal a major demand drop.

Retail sales beating the 0.5% projection would reinforce the strong economy narrative, which could push yields and the dollar higher, but serve as a short-term headwind for Bitcoin.

Conversely, retail sales missing expectations would suggest the Fed could lean more dovish, which is potentially bullish for Bitcoin and risk assets.

Initial Jobless Claims

Meanwhile, with the growing influence of the labor market on Bitcoin and the crypto market in general, initial jobless claims will also be a critical watch this week.

This economic signal measures the number of US citizens who filed for unemployment insurance for the first time last week. Initial jobless claims reported were 226,000 for the week ending August 2.

In the same week, recurring applications for unemployment benefits surged to the highest since November 2021, as continuing claims rose by 38,000 to 1.97 million in the week ended July 26.

However, for last week, data in MarketWatch shows economists predict a slight increase to 229,000. Meanwhile, market watchers say this US economic indicator has stabilized over the last few weeks.

A stable but slightly rising jobless claims figure suggests a cooling labor market, potentially boosting Fed rate-cut bets and supporting Bitcoin’s upward momentum.

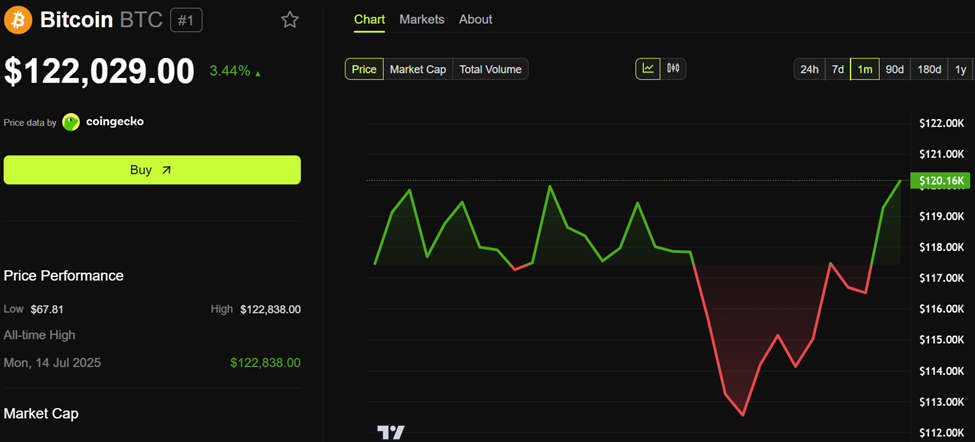

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto

As of this writing, BTC was trading for $122,029, up by 3.44% in the last 24 hours.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.