Crypto Options Rollover Signals Bullish Tilt Toward $100K Bitcoin Breakout | US Crypto News

0

0

Welcome to the US Morning Crypto News Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see what data says about the Bitcoin (BTC) price outlook, alongside insights into the current sentiment in the options market. Remember, this being the last Friday of April, monthly options expired today at 8:00 UTC on Deribit.

Strong Market Expectations of Bitcoin Reaching $100,000

During the early hours of the Asian session, over $8 billion worth of Bitcoin and Ethereum options expired. Out of these, BTC options contracts accounted for over $7 billion in notional value.

Interestingly, Bitcoin traded well above its max pain or strike price of $86,000. Ordinarily, as options near expiration, an asset’s price would tend to gravitate toward its max pain level. While Bitcoin traded for $93,471 minutes before the options expiry, it is now selling for $94,581.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto

BeInCrypto contacted Bitfinex analysts for insights into the current market outlook and their perspective on what lies ahead for the Bitcoin price in the short term. According to the analysts, Bitcoin’s price could record further upside after clearing option-based resistance.

“Post-expiry, the market is leaning cautiously bullish, and with the $90,000 strike cluster now cleared, there’s less option-based resistance overhead,” Bitfinex analysts told BeInCrypto.

Further, the analysts observed that many traders have rolled exposure to higher strikes, with $95,000 and $100,000 showing increased call open interest for end-April and May expiries.

While this reflects the expected continued upside, the analysts did not rule out a potential short-term chop.

This aligns with Deribit analysts’ statements that the highest open interest for BTC options was around the $100,000 strike price. This indicates strong market expectations of Bitcoin reaching this level.

As BeInCrypto reported, the analysts ascribed this to traders selling cash-secured put options on Bitcoin. These traders also use stablecoins to collect premiums while buying BTC at lower prices.

BeInCrypto also reported that the Cumulative delta (CD) across BTC and related ETF (exchange-traded fund) options on Deribit reached $9 billion. Bitfinex analysts agree, citing rising spot flows and ETF demand.

“Spot flows and ETF demand have picked up significantly for BTC over the past few days and will now continue to dictate if BTC can establish $90,000 as support,” the analysts added.

Meanwhile, these forecasts add to the list of growing bullish bets on Bitcoin’s price, credibly confirming a sentiment shared in the previous US Crypto News publication.

However, despite strong prospects for more Bitcoin price gains, some analysts urge investors to temper their optimism. One is Innokenty Isers, the Chief Executive Officer at Paybis Exchange.

“Current market outlook suggests that Bitcoin price may face more stiff resistance moving forward. In the last two months, the uncertainty around the tariff war triggered an unusual concern for investors as many decided to temporarily steer clear of more volatile assets like Bitcoin,” Isers told BeInCrypto.

Moreover, the Federal Reserve (Fed) has spotlighted the inflationary risks the tariff war may introduce. Nevertheless, Isers acknowledged clear indications of sustained accumulation of BTC by institutional investors and market whales.

Chart of the Day

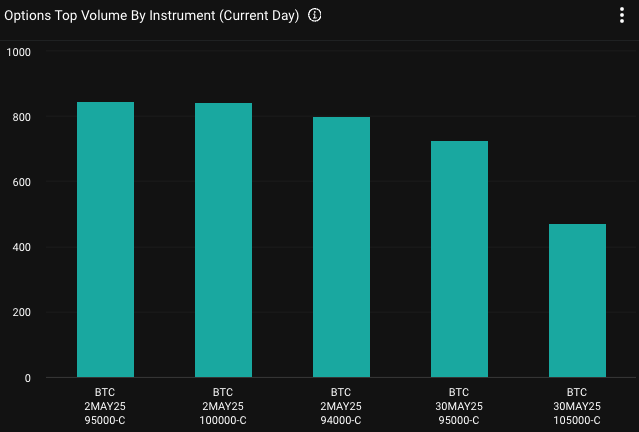

Options top volume by instrument. Source: Deribit

Options top volume by instrument. Source: Deribit

This chart shows that the top Bitcoin options by trading volume over the past 24 hours are call options with strike prices of $95,000 and $100,000, ahead of the May 2 expiry.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.