Bitcoin Hits $2.18 Trillion Market Cap But Why Analysts Warn

0

0

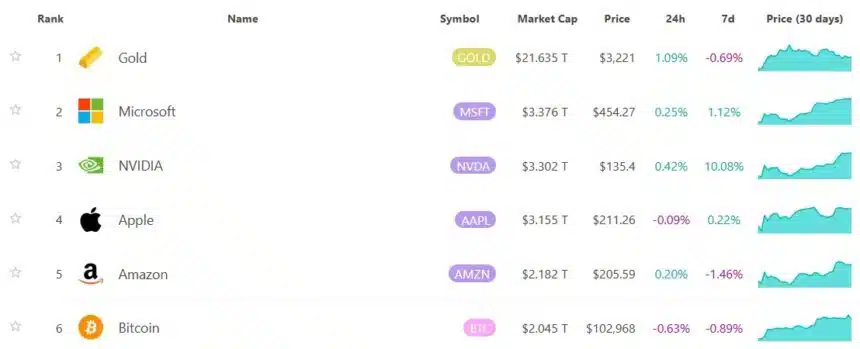

Bitcoin set another record by achieving a market capitalization of $2.18 trillion, making it the biggest achievement in the history of the cryptocurrency. It demonstrates how strong bullish feeling is in the crypto market and that investors are becoming increasingly confident about Bitcoin.

At the time of this breakthrough, Bitcoin was trading at an impressive $104,000 per coin. Both Binance and Coinbase had a daily trading volume of over $55 billion, suggesting the market is bustling with activity.

Such a large amount of trading implies that BTC is becoming a significant influence in the global finance sector. Greater investment from institutional investors has boosted liquidity in the market which benefits the crypto sector.

Bitcoin RSI and MACD Show Caution

Analysts are calling for people to be mindful despite the high returns. Bits of information from technical analysts indicate that BTC could be approaching a place where its price could fall. Currently, the RSI value is 72 and the MACD is in a bullish direction.

As these indicators indicate that the market is doing well, they also suggest that the market may be moving in the wrong direction, inviting a possible short-term correction.

According to Glassnode, investors are stocking up on Bitcoin. Wallets storing multiple Bitcoin surged by 15% from May 10 to May 18, a sign that many are now buying and holding BTC for the long term. While it was going on, BITO, a BTC Strategy ETF from ProShares, gained 5%, hitting $28.50, marking increased institutional interest in BTC products.

MicroStrategy and Coinbase Shares Climb

On May 17, shares in MicroStrategy (MSTR) rose 3.2% and Coinbase Global Inc. (COIN) rose 2.8%. The S&P 500 index saw its value rise by 0.5%, mirroring the increase in several digital currencies.

Not all changes in the market received praise from everyone. Prominent crypto analyst Crypto Rover issued a warning about a possible “Sunday Scam Pump,” referring to sudden, sharp gains in low-cap altcoins. Sometimes these tokens saw prices rise by hundreds of percent, causing people to worry about speculation in the more volatile segments of the market.

SUNDAY SCAM PUMP !!!! pic.twitter.com/KsAhQw5chL

— Crypto Rover (@rovercrc) May 18, 2025

Interest Rates and Stocks Impact Bitcoin

Since Bitcoin is experiencing growth, market experts highlight the need to pay attention to macro-level factors including interest rates and equity prices. This could greatly influence the future changes and trends in the cryptocurrency market.

Despite this historic moment for both BTC and digital assets, prudence is still the most important aspect of investing. Since the stock market is still volatile and many indicators warn of risks, investors should try to be positive without forgetting safety measures.

Conclusion

While bitcoin’s high today means a lot for digital assets, we should still exercise caution. With risks showing in the markets and various economic factors in play, investors should remain updated and sensible. As more institutions become interested in crypto, the market becomes more volatile, meaning it is essential to make smart and safe decisions at this time.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. Why did Bitcoin’s market cap hit $2.18T?

Strong demand, high trading volume, and institutional interest drove Bitcoin’s market cap past $2.18 trillion.

2. Is Bitcoin still a safe investment?

Experts urge caution as RSI and MACD suggest the market may be overbought.

3. What does a rise in BTC wallets mean?

More wallets holding 1+ BTC signals growing long-term investor confidence.

4. What is a Sunday Scam Pump?

It’s a sudden surge in low-cap altcoins, often seen as market manipulation.

Glossary Of Key Terms

Bitcoin (BTC)

The first and most valuable cryptocurrency.

Market Capitalization

Total value of a crypto asset (price × supply).

Liquidity

How easily an asset can be traded.

RSI

Momentum indicator: over 70 means overbought.

MACD

Trend tool showing buy/sell signals.

Glassnode

Blockchain analytics platform.

MicroStrategy (MSTR)

The company is known for large Bitcoin holdings.

Reference

Read More: Bitcoin Hits $2.18 Trillion Market Cap But Why Analysts Warn">Bitcoin Hits $2.18 Trillion Market Cap But Why Analysts Warn

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.